Here are four stocks with Zacks Rank #1 (Strong Buy) and strong income characteristics for investors to consider today, June 16th:

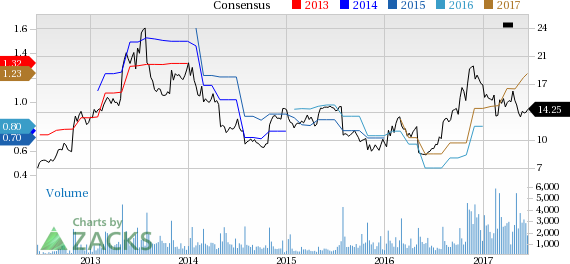

Big 5 Sporting Goods Corporation (BGFV) : This sporting goods retailer has witnessed the Zacks Consensus Estimate for its current year earnings jumping 8.7% over the last 60 days.

This company has a dividend yield of 4.21%, compared with the industry average of 0%. Its five-year average dividend yield is 12.09%.

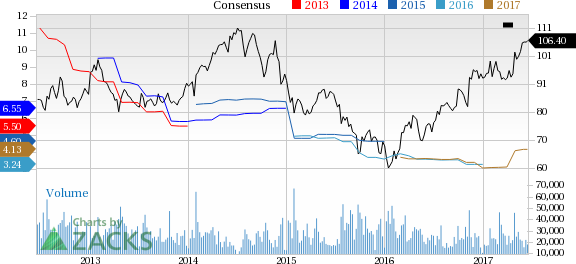

Caterpillar Inc (NYSE:CAT). (CAT) : This manufacturer of construction and mining equipment has witnessed the Zacks Consensus Estimate for its current year earnings advancing 32.6% over the last 60 days.

This company has a dividend yield of 2.89%, compared with the industry average of 0.75%. Its five-year average dividend yield is 11.76%.

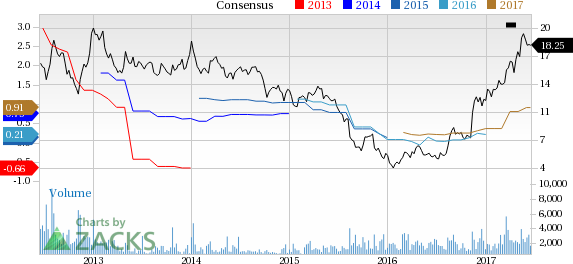

Kronos Worldwide, Inc. (KRO) : This global producer and marketer of titanium dioxide pigments has witnessed the Zacks Consensus Estimate for its current year earnings jumping more than 100% over the last 60 days.

This company has a dividend yield of 3.29%, compared with the industry average of 0.76%. Its five-year average dividend yield is 5.31%.

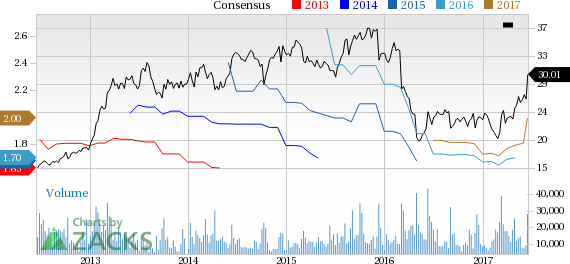

H&R Block (NYSE:HRB), Inc. (HRB) : This tax preparation services provider has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.3% over the last 60 days.

This company has a dividend yield of 2.93%, compared with the industry average of 0%. Its five-year average dividend yield is 5.31%.

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens

More Stock News: 8 Companies Verge on Apple-Like Run

Did you miss Apple (NASDAQ:AAPL)'s 9X stock explosion after they launched their iPhone in 2007? Now 2017 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade, which could in turn save $200 billion in U.S. healthcare costs.

A bonus Zacks Special Report names this breakthrough and the 8 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains. Click to see them right now >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

H&R Block, Inc. (HRB): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Big 5 Sporting Goods Corporation (BGFV): Free Stock Analysis Report

Original post

Zacks Investment Research