- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

U.S. Treasurys And Gold: Odd Couple In Relative Correlation

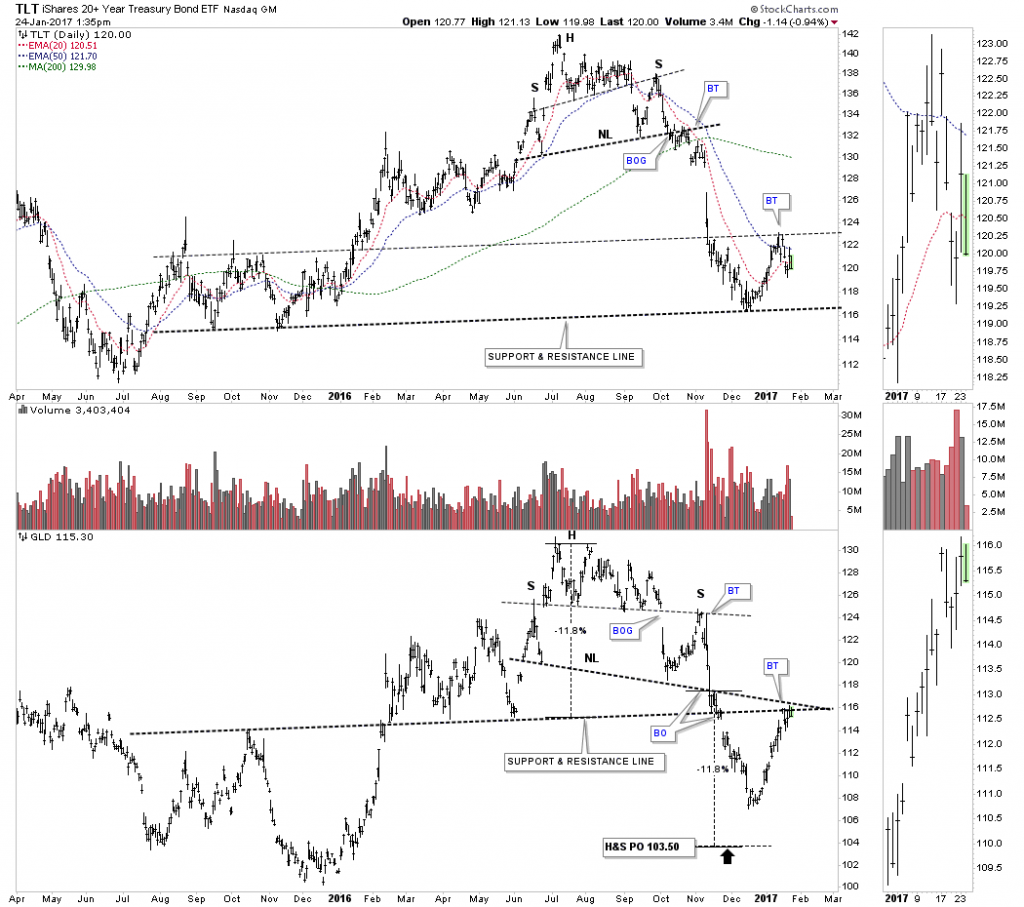

Lets start by looking at a weekly chart for iShares 20+ Year Treasury Bond Fund (NASDAQ:TLT), the 20 year bond ETF, which shows it built out a H&S top last summer. That H&S top is a reversal pattern that showed up at the end of its bull market which has been going on for many years.

There is a big brown shaded support and resistance zone that has been offering support.

This next chart is a 15-year monthly look at the TLT which shows it has built out a four year, 5-point bearish rising wedge which broke to the downside in November of last year. If there is a backtest it would come in around the 129.75 area.

Direxion Daily 20+ Year Treasury Bear 3X Shares Fund (NYSE:TMV) is a 3 X short of the TLT.

This last chart is a combo chart which has the TLT on top and SPDR Gold Shares (NYSE:GLD) on the bottom. It’s not a perfect correlation by any means, but these two have been moving together pretty consistently over the last year or so.

GLD is currently backtesting its neckline and a support and resistance line going back a year and a half or so. If GLD can trade back above the neckline and the S&R line, the bulls will be talking to us. To say this is a critical area for GLD is an understatement. Definitely an area to keep a close eye on.

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Pretty rough day out there—S&P 500 down about 1.8%, Nasdaq down around 2.2%, and small caps hit even harder, dropping 2.7%. However, the S&P 500 is approaching a crucial...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.