- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

This Week's Market Outlook And Overall Trends

SNB Shocked Markets, Focus Turns to ECB

The Swiss National Bank shocked the markets by removing the EUR/CHF 1.2 floor last week. The news triggered sharp surge in the Swiss franc with EUR/CHF hitting record low before settling below parity. The shock also hit a number of forex brokers, including the largest retail currency brokage in US, FXCM, which needed USD 300m cash infusion from Leucadio National Corp to maintain normal operation. There were also brokers out of business after the move and some expected more casualties to be announced ahead.

The announcement was just days after SNB officials reiterated the pledge to maintain the cap on the franc, and just two weeks after the central bank implemented negative rates in another surprise move. SNB president Thomas Jordan later defended the decision as he said it was backed by the entire governing board after "intensive discussion" and said that signaling the move ahead of the decision would have "opened the door to speculators".

Here are some additional reports on the SNB:

- SNB Abruptly Removed EURCHF Floor, Harm to Credibility and Economic Prospect

- SNB Shocker: EURCHF Peg Comes To An End

- Swiss Shocker 2.0: After The Dust Settles

- SNB Exits 1.20 Floor on EUR/CHF

- CHF Safe Haven Comeback: Why the SNB's Shocking Decision May Hurt the Buck

While it's still to be seen when the dusts caused by the SNB turmoil settle, markets will now turn the main focus to eurozone this week. Main attention would be on ECB and Greek election. Headline inflation just dropped to -0.2% yoy in December and inflation expectations continued to slide. It's now widely expected ECB would finally long-awaited sovereign bond buying program. There were various options for the bone purchase discussed in the markets. But Speigel magazine just reported that ECB would opt for the plan to have national central banks buying their respective countries' bonds, thus, keeping the risk within those countries.

Greece might be excluded from the program as its bond doesn't fulfill the criteria. EUR/USD was dragged down by EUR/CHF and hit an 11 year low against the greenback. The common currency will very likely stay under pressure this week. Here are some reports regarding ECB:

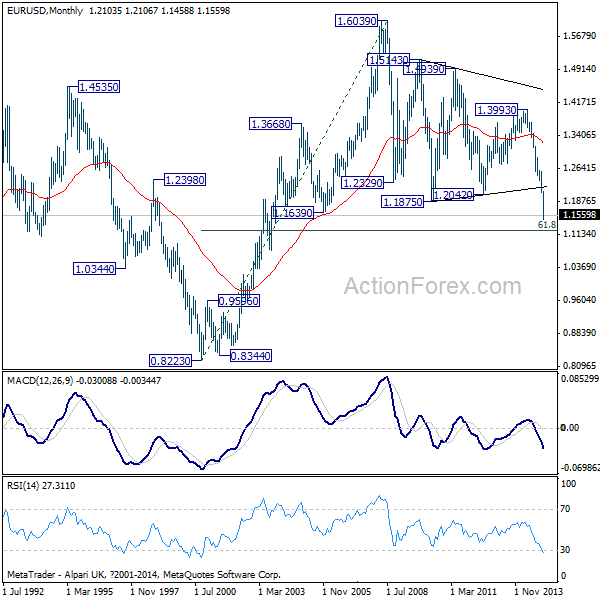

Just ahead of ECB's meeting, let's have a look at some of the euro pairs. EUR/USD is now on the third leg of the correction pattern from 1.6039 (2008 high) and should be targeting 61.8% retracement of 0.8223 to 1.6039 at 1.1209. Near term outlook will stay bearish as long as 1.1754 resistance holds.

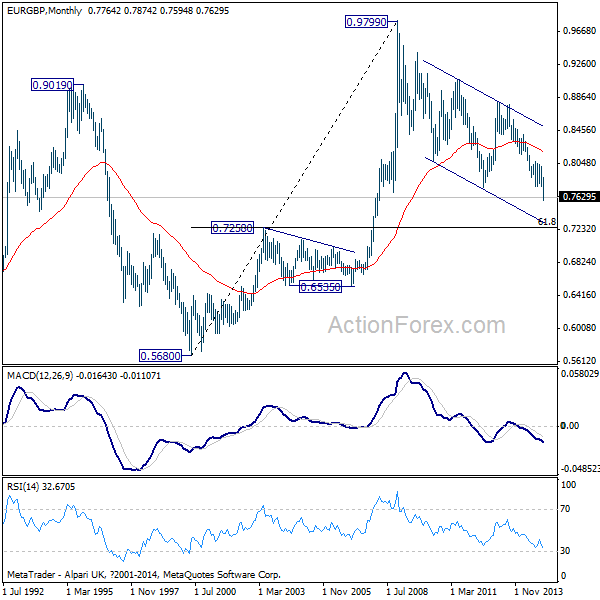

EUR/GBP took out a key support level around 0.7755 last week, which carries medium term bearish implications. The down trend from 0.9799 (2007 high) is now expected to continue to the next key support level at 0.7250 (61.8% retracement of 0.5680 to 0.9799 at 0.7253. Near term outlook will stay bearish as long as 0.7744 resistance holds.

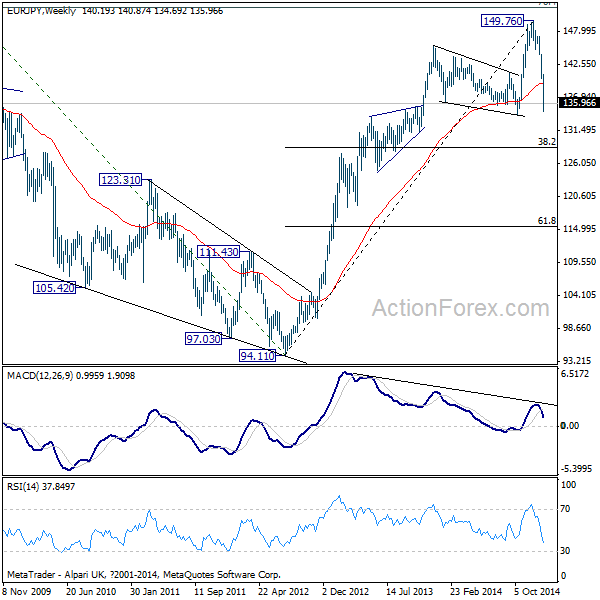

EUR/JPY is still holding above 134.13 key near term support. But it's increasing likely that 149.76 is a medium term top. We'd anticipate deeper decline through 134.13 to 38.2% retracement of 94.11 to 149.76 at 128.50 ahead. And near term outlook will stay bearish as long as 138.78 resistance holds.

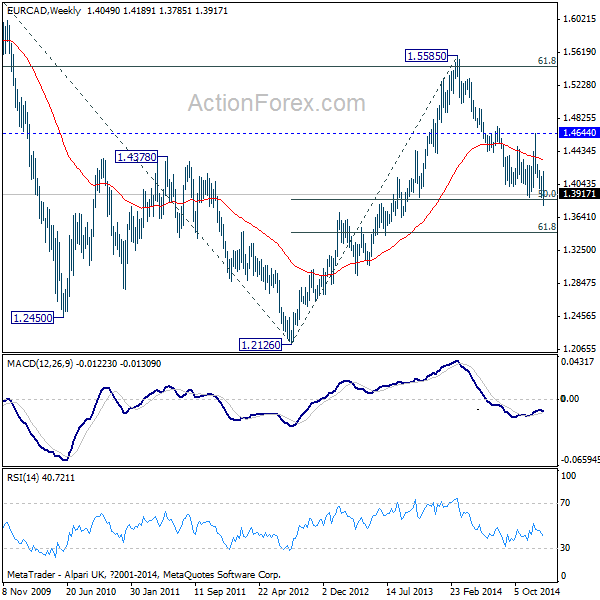

EUR/CAD breached 1.3884 last week to extend the down trend from 1.5585 but loss was so far limited due to weakness in the Canadian dollar itself. Such move is viewed as a correction and thus, while deeper decline is expected, we might see some support from 61.8% retracement of 1.2126 to 1.5585 at 1.3447 to contain downside.

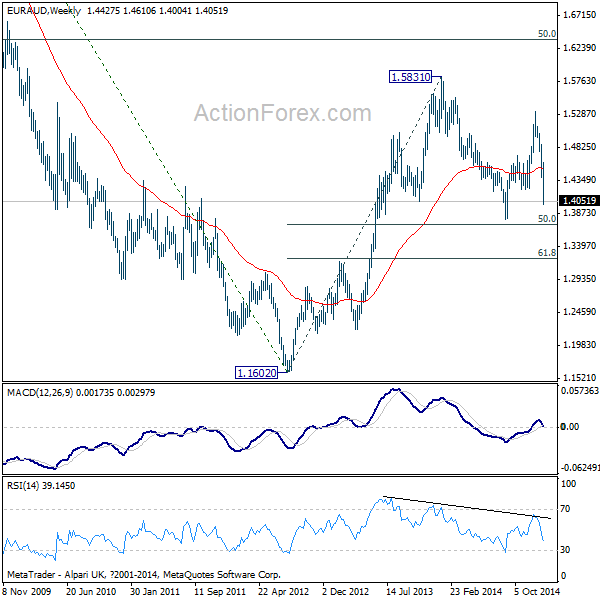

Development in EUR/AUD suggested that it's in a third leg of the medium term correction pattern from 1.5831. And deeper fall should be seen through 1.3792 support. However, as it's still viewed as a correction, there might be strong support around 61.8% retracement of 1.1602 to 1.5831 at 1.3217.

The above views are admittedly medium to long term. But they do provide a sense of the overall trend that could aid short term trading. At least, there is room for the euro to decline further before getting some solid support. Meanwhile, it should be noted that the dollar was the relatively strong one compared to the others.

Outlook in GBP/USD and AUD/USD stay bearish in spite of recent near term consolidations. USD/CAD's up trend continued. The trickier one is USD/JPY but it's still holding above 115.55 near term support and thus, favoring an eventual upside break out from it's recent range of 115.55/121.84. So, selling euro against dollar is the desirable choice. Nonetheless, we'd prefer to hold our hands off and refrain from chasing the EUR/USD decline for the moment.

Related Articles

At age 94, Warren Buffett can still formulate a shareholder letter like no other. His humility, candor, and wisdom is special. I always make it a point to read these because you...

The EU’s most costly budgets, bitcoin’s market swings, and rising US bankruptcies. Each week, the Syz investment team takes you through the last seven days in seven charts. 1. The...

The central bank’s job is never easier, but in the current climate, it’s unusually tricky. In addition to the usual challenges that complicate real-time monetary policy decisions,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.