The EU’s most costly budgets, bitcoin’s market swings, and rising US bankruptcies. Each week, the Syz investment team takes you through the last seven days in seven charts.

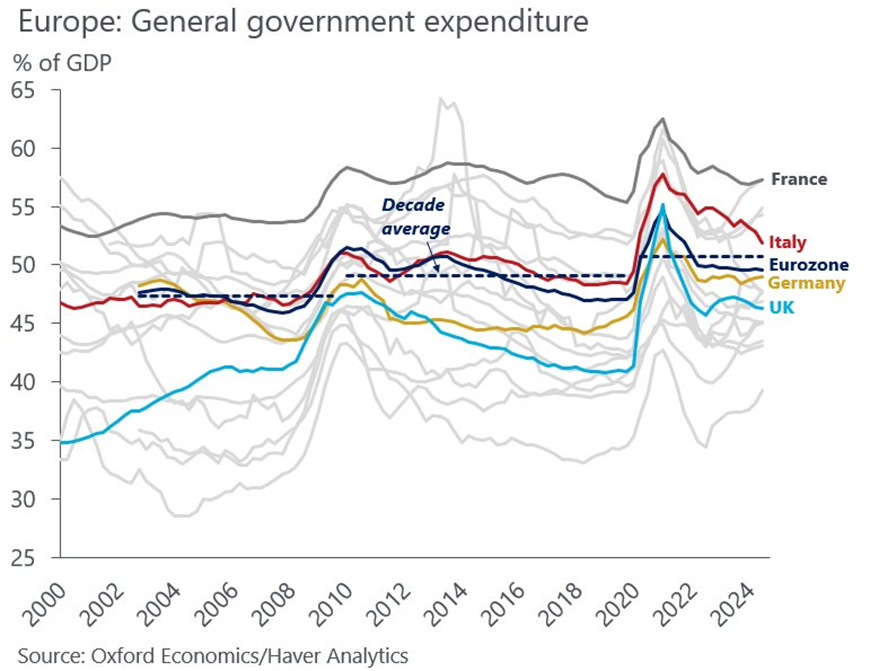

1. The EU Countries With the Highest General Government Expenditure as a % Of GDP

With its overblown government expenditure, it’s not surprising that France is running a fiscal deficit of more than 6% even in good times. What will happen when the next recession hits?

Source: Michel A.Arouet

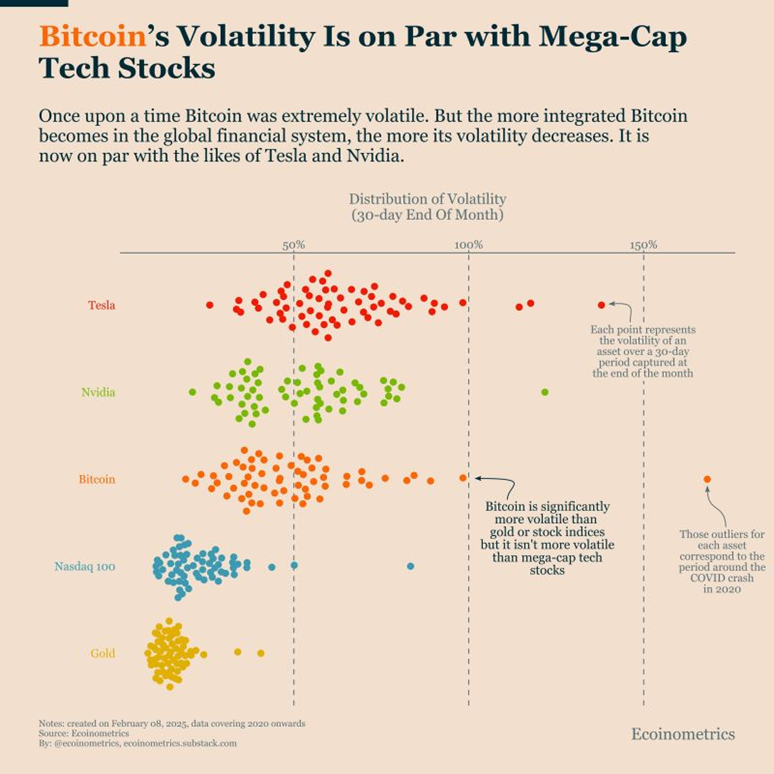

2. Bitcoin’s Volatility Is on Par With Mega-Cap Tech Stocks

Once upon a time, Bitcoin was extremely volatile, but the more integrated Bitcoin becomes in the global financial system, the more its volatility decreases. It is now on par with the likes of Tesla (NASDAQ:TSLA) and Nvidia (NASDAQ:NVDA).

Source: Documenting Bitcoin

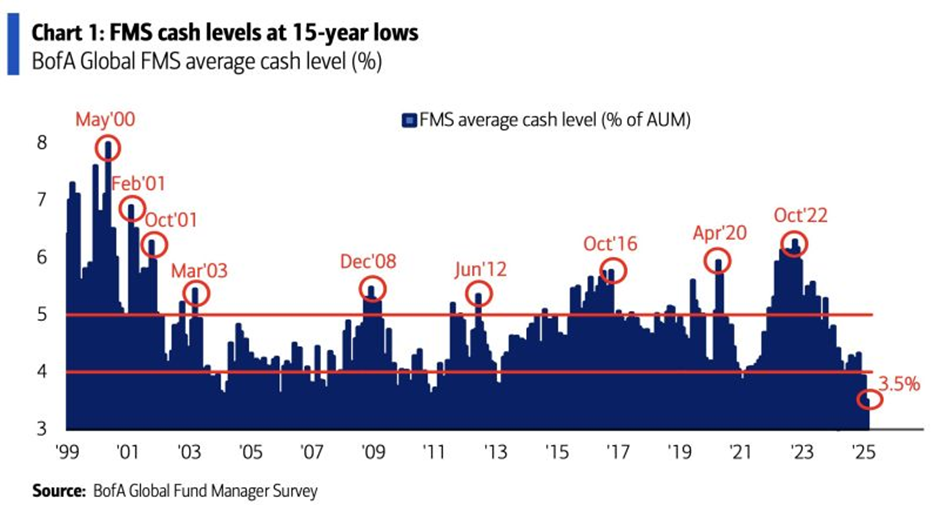

3. Are Investors Too Complacent?

Investors are extremely bullish—heavily invested in stocks while betting against everything else. Cash levels have dropped to just 3.5%, the lowest since 2010, according to the BofA Fund Manager Survey.

Source: BofA

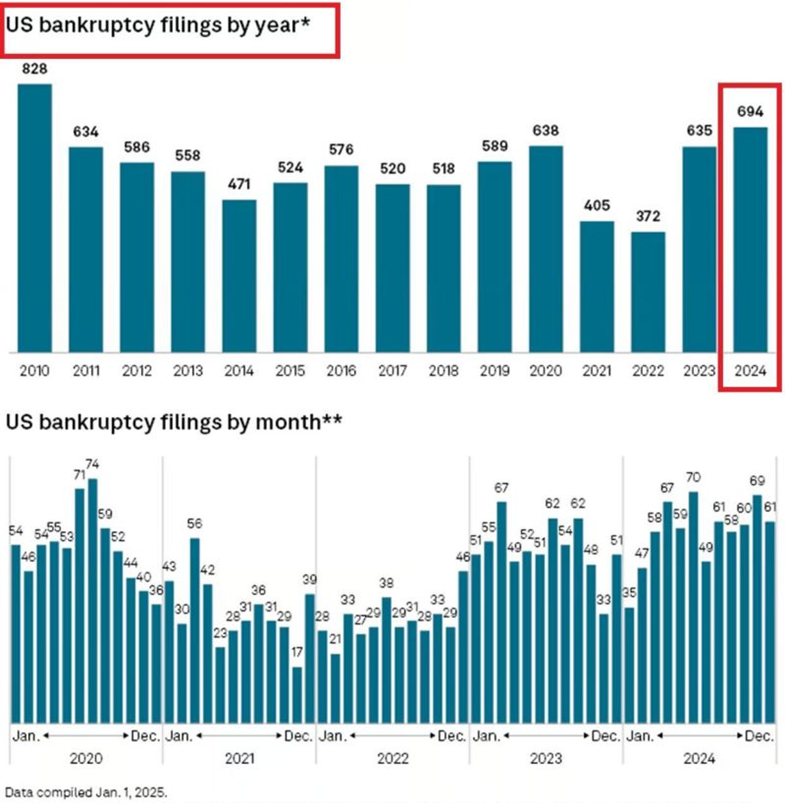

4. US Bankruptcies Are Accelerating

There were 70 US bankruptcy filings in January, in line with the largest monthly number since the 2020 crisis.

This comes after bankruptcies hit 694 in 2024, the most in 14 years.

Source: S&P Global

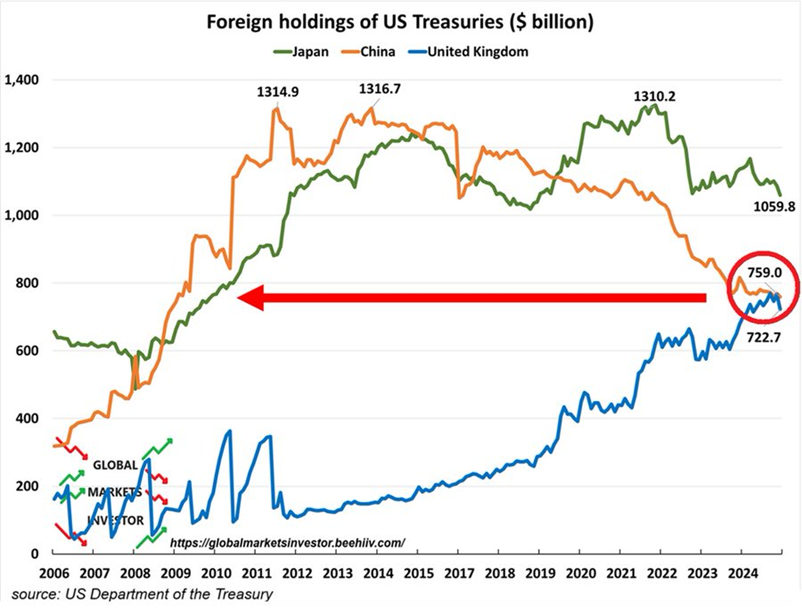

5. China and Japan Continue Dumping US Treasuries

China’s holdings fell by $77 billion in 2024 to $759 billion, the lowest in 15 years.

Japan sold $57.3 billion, down to $1.06 trillion, the lowest since 2018.

Japan and China are the world’s largest foreign holders of US public debt.

Source: Global Markets Investor

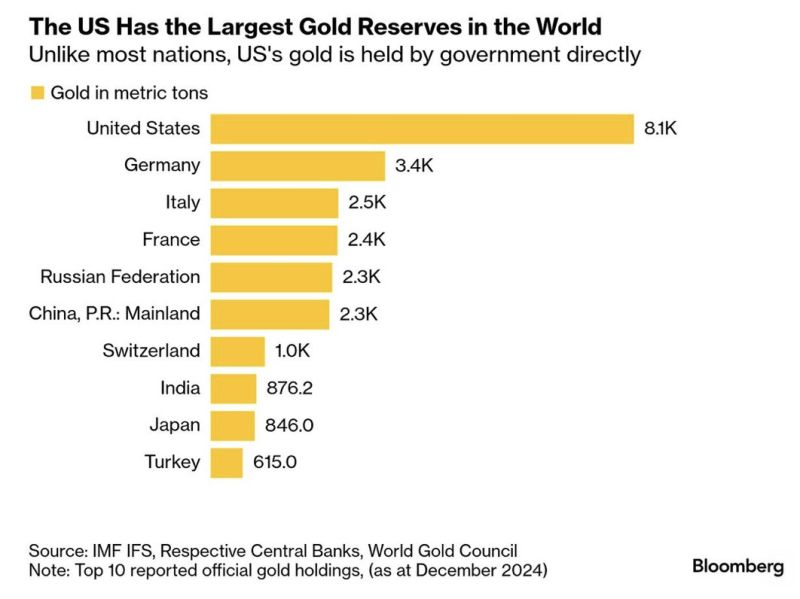

6. The US Has the Largest Gold Reserves in the World

The US has the largest gold reserves in the world by far; in fact, it has more than Russia, China, Switzerland, India, and Japan combined.

Source: Bloomberg

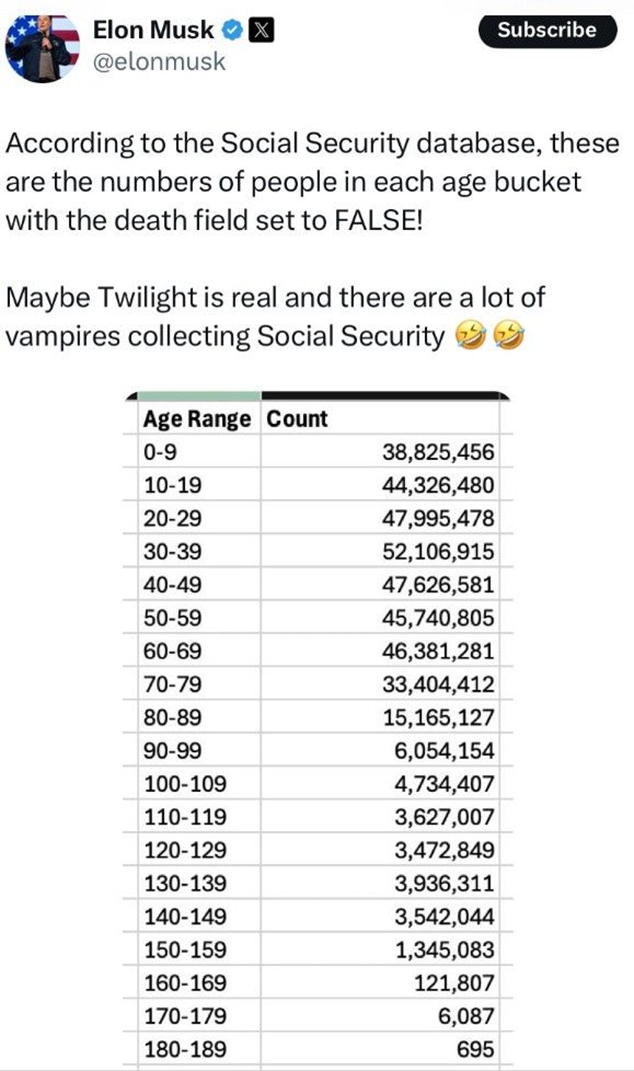

7. Are Vampires Collecting Social Security Benefits in the US?

Elon Musk says millions of people over 140 years old are receiving Social Security benefits.

Source: WinSmart

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.