The release of the first estimate for Q4 2012 GDP growth was definitely the biggest surprise of the week, since January the ISM and labour market reports came in line with our expectations and the Fed announced no change in its monetary policy.

Expect for one component of growth that had a great negative impact on the overall rate of growth, the Q4 2012 GDP report was in line with our expectations: final private domestic demand rebounded sharply (households and business spending accelerated from respectively +2% to +2.6% and from -1.8% to +8.4%.), while both the inventory change and net exports brought negative contributions (of respectively 1.2 percentage points and 0.3 pp.). In short, and excluding spending from the government, GDP grew by an annualised 1.4% in the final quarter of 2012 (we were forecasting 1.3%).

What was highly unexpected was the violent cut in government spending: -6.6%. After a surprise increase in defence consumption in Q3 (15.1%), a correction was to be expected, but not of that magnitude, since those spending dropped by 25.1%, cutting the overall rate of growth by 1.2 pp. To be honest, we do not have a clear explanation, despite extended research. The component that explains the bulk of the decrease is “services”, which covers spending on research and development, support (installation, weapons, personnel), transportation of material and travel of persons. In short, these are spending related to military operations. The problem is that the US have not been pulling out of Iraq and Afghanistan in the final quarter of 2012, but before that.

Whatever the explanation, this drop is a foretaste of the automatic spending cuts to be implemented form March 1st. Adepts of the conspiracy theory claim that the Department of Defense lied to the Bureau of Economic Analysis about its spending in Q4 to scare of Congressmen so that they would decide on cancelling sequestrations. Since Fox Mulder is not available for an in depth investigation, we will never be sure (that’s the problem with the conspiracy theory, easy to understand, difficult to prove wrong).

All in all, GDP contracted in Q4 2012 (-0.1% on a quarterly annualised basis) for the first time since exiting the 2008-09 recession. However, the components of the decline (and the very likely upward revisions to come) led financial markets to ignore that reading. FOMC members did not do otherwise, simply noting in their statement that “growth in economic activity paused in recent months, in large part because of weather-related disruptions and other transitory factors”. A highly expected, the Fed did not alter its monetary policy. Indeed, next news from the Fed is likely to be about enhancing its communication, which involves more explanation than just a paragraph in a statement. Next meeting, scheduled on March 19th and 20th will be followed by the release of the updated set of forecasts from FOMC members as well as a press conference by Chairman Bernanke.

This could be the occasion to clarify what would make the Fed slow and eventually end QE3, which currently goes on following the rules set in December (monthly purchases of MBS and long-dated Treasuries of USD 40 bn and USD 45 bn, respectively).

An increase in the Fed Fund Target is, since the December meeting, data-dependent: FOMC members will not decide to raise it as long as the unemployment rate remains above 6.5%, unless inflation (as measured by the PCE deflator) is foreseen as increasing faster than 2.5% y/y within a 1 to 2 year horizon. It is not unlikely that the Fed could soon announce something similar about the pace of security purchases. Employment is key, and QE3 could become dependent not on the level of the unemployment rate but on the pace of job creation. As noted in the statement, “if the outlook for the labor market does not improve substantially, the Committee will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools”. They could definitely become more specific…

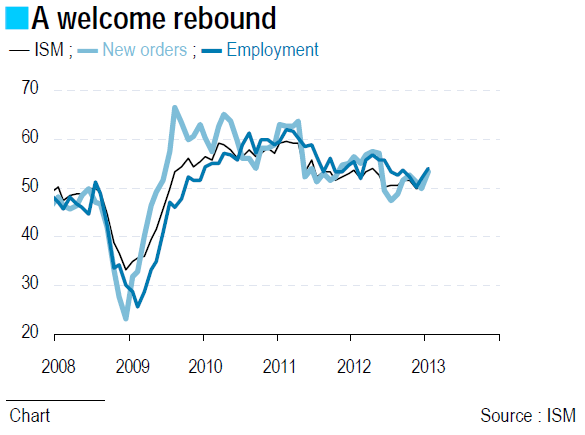

As for employment, news was mixed, as non-farm payrolls grew by 157k in January, substantially below the average of the previous months (201k a month in Q4 2012 and 177k in H2 2012), but those numbers were actually revised upwards. Additionally, the unemployment rate came up a notch (to 7.9%). But on a more positive note, hourly earnings kept the somewhat stronger pace of December (+2.1% y/y versus 1.9% in 2012). However, the release of the manufacturing survey helped soften the disappointment from labour data, as it jumped to 53.1 in January (from 50.2 in December), with all five subcomponents bringing a positive contribution. Our view was always that once the fiscal outlook would be cleared, the business sector would accelerate investment and hiring, supporting households’ disposable income otherwise dampened down by budget austerity. As for now, the ISM is supportive of our view.

BY Alexandra ESTIOT

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Week In The US: Guns And Butter

Published 02/04/2013, 03:04 AM

Updated 03/09/2019, 08:30 AM

The Week In The US: Guns And Butter

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.