- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Tetra Tech Vs. Donaldson: Facts, Figures & Growth Prospects

Tetra Tech Inc. (NASDAQ:TTEK) has charted an impressive trajectory of late, having grown 10% in just the last six months. This is much superior to its peer Donaldson Company, Inc.’s (NYSE:DCI) shares, which have increased just 2% over the same time frame.

In fact, Donaldson has underperformed the industry's gain as well, which has climbed 7.1% during the same period, while Tetra Tech has maintained the momentum, outperforming the industry.

Tetra Tech’s prospects look quite robust now. In its fiscal fourth quarter earnings report, the company’s earnings and revenues comfortably outpaced the Zacks Consensus Estimate. The bottom line also rose nearly 7% on strong top-line growth, driven by a solid demand for the company’s high-end water, environment and infrastructure services.

Tetra Tech’s backlog too reached a record high of $2.54 billion in the quarter, up 8% year over year on the back of strong orders in the federal, state and local markets. This is the seventh consecutive quarter of backlog growth and also the highest level in the company’s 51-year old history, which bodes well for its growth, going into fiscal 2018.

Tetra Tech has had a solid run in recent times owing to its impressive revenue growth, restructuring efforts and accretive acquisitions. Riding on its business model’s continued execution, Tetra Tech remains bullish about its growth across all four client sectors, namely, U.S. federal, U.S. state and local, the U.S. commercial work and finally, international.

The company won six major contracts worth $644 million during the fourth quarter fiscal 2017.

In addition, the company holds over $5 billion in contract capacity across the Department of Defense and 40 indefinite delivery plus indefinite quantity contracts with the Army to offer engineering services. The budget for Department of Defense has recently been raised by $15 billion, providing the company with even more opportunities. Also, early indications suggest that the budget may increase again in 2018, which could mean a string of new task orders for upgrades, design projects and accelerated cleanups for Tetra Tech.

Going forward, we believe that Tetra Tech has a solid base for future growth, driven by its strong backlog levels plus a robust pipeline with major government organizations fetching in billion-dollar deals for the company.

Coming to Donaldson, the company’s last earnings report was tad disappointing. Earnings missed estimates by almost 4% but rose 10.9% year over year. The company’s Engine Products segment (which accounted for 65.4% of fiscal fourth-quarter revenues) has been enjoying a good momentum with sales up 18% in the fiscal fourth quarter.

However, the industrial product segment’s growth has been strained recently, thanks to continued softness in Gas Turbine Systems sales. In fact, the company expects gas turbine sales to continue to decline further in fiscal 2018. Donaldson also anticipates disk drive business to follow the market's secular downward graph.

The company’s margins have suffered lately due to adverse sales mix, higher raw material costs and other charges. Donaldson also expects Engine Products’ momentum to somewhat deteriorate with sales expected to grow in the 6-10% range in fiscal 2018. Poor sales of Aerospace and Defense are anticipated to restrict the segment’s growth.

Both companies have delivered similarly when it comes to earnings performance. Both Tetra Tech and Donaldson have had a decent earnings surprise history of late, having surpassed estimates thrice in the trailing four quarters.

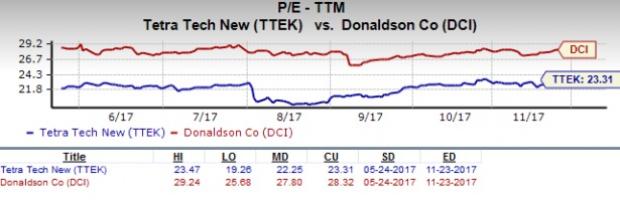

Tetra Tech boasts a Value Score of A while Donaldson has a Value Score of B. Further, Tetra Tech’s shares look undervalued compared with Donaldson’s, if we analyze in terms of Price-to-Earnings ratio too, as depicted in the chart below:

Both Tetra Tech and Donaldson have a Zacks Rank #3 (Hold) but we believe, Tetra Tech has better growth prospects as of now.

Stocks to Consider

Better-ranked stocks in the broader sector include Caterpillar, Inc. (NYSE:CAT) and Terex Corporation (NYSE:TEX) , both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Caterpillar has a robust earnings surprise history with an average beat of 53.1%. The bottom line has surpassed estimates in each of the trailing four quarters.

Terex too boasts a striking earnings history, having generated a positive earnings beat of 135.9% over the trailing four quarters, exceeding estimates all through.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Terex Corporation (TEX): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Tetra Tech, Inc. (TTEK): Free Stock Analysis Report

Donaldson Company, Inc. (DCI): Free Stock Analysis Report

Original post

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Pretty rough day out there—S&P 500 down about 1.8%, Nasdaq down around 2.2%, and small caps hit even harder, dropping 2.7%. However, the S&P 500 is approaching a crucial...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.