Tencent Music Entertainment Group (NYSE:) reported fourth-quarter 2019 adjusted earnings of 12 cents per American Depositary Shares (ADS) that beat the Zacks Consensus Estimate by 20%.

In domestic currency, the company reported adjusted earnings of RMB0.62 per ADS.

Revenues jumped 35.1% year over year to RMB7.29 billion ($1.05 billion).

Top-Line Details

Revenues from online music services increased 40.7% year over year to RMB2.14 billion ($307 million), driven by higher revenues from user subscriptions supplemented by growth in revenues from advertising services and sales of digital music albums.

Revenues from paid music through sales of subscription packages were RMB1.11 billion ($160 million), up 60.1% year over year due to improved paid user retention rate and increased number of paying users.

Revenues from social entertainment services and others soared 32.9% to RMB5.15 billion ($740 million), primarily driven by higher revenues from both online karaoke and live streaming services.

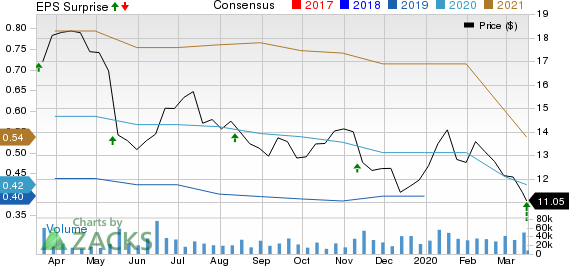

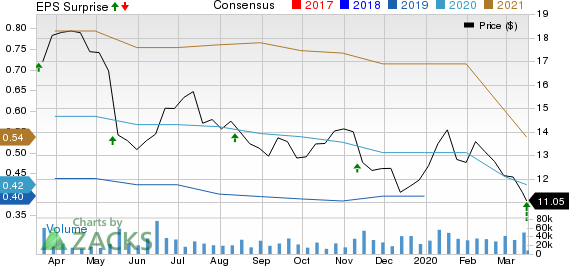

Tencent Music Entertainment Group Sponsored ADR Price, Consensus and EPS Surprise

Tencent Music Entertainment Group Sponsored ADR Price, Consensus and EPS Surprise

Tencent Music Entertainment Group Sponsored ADR price-consensus-eps-surprise-chart | Tencent Music Entertainment Group Sponsored ADR Quote

Q4 User Base Details

Mobile MAU - online music remained flat year over year at 644 million. Paying users - online music jumped 44.8% to 39.9 million. Moreover, monthly ARPPU - online music increased 8.1% to RMB9.3.

Meanwhile, Mobile MAU - social entertainment declined 2.6% year over year to 222 million. Nonetheless, paying users - social entertainment improved 21.6% to 12.4 million. Moreover, monthly ARPPU - social entertainment rose 9.3% to RMB138.5.

During the reported quarter, Tencent announced that it will join a consortium led by Tencent Holdings Limited to acquire a 10% equity stake in Universal Music Group (UMG) through up to a 10% equity interest in the consortium.

In December 2019, Tencent Music held its first Tencent Music Entertainment Award in Macau which was also live streamed, with a strong lineup of top domestic and international singers. The event became a national hit, attracting nearly 7 billion of cumulative page views online.

The company also took initiatives to diversify by adding video content, and long and short-form audio content, including podcasts and audiobooks. Currently, the company's library covers over 90% of OST music for films and drama series and all original soundtracks copyright of the most popular variety shows launched in 2019.

Additionally, Tencent Music continued to make advancement with technology innovation. The number of daily active users of song recognition feature increased double digits year over year in fourth-quarter 2019.

Moreover, the company also upgraded its Tencent Musician Program, which continued to enjoy rising popularity as a preferred destination for emerging indie artists and original content creation.

Operating Details

Tencent Music’s fourth-quarter 2019 cost of revenues increased 34.9% year over year to RMB4.81 billion ($690 million), primarily due to increased content and revenue sharing fees.

Nevertheless, gross profit increased 35.5% to RMB2.49 billion ($357 million) in the reported quarter.

Selling and marketing expenses were RMB671 million ($96 million), up 23.8% year over year due to increased spending to promote the company's brands and content offerings.

However, general and administrative expenses declined 7.8% to RMB747 million ($107 million) on IPO related expenses from the year-ago quarter.

Operating profit rose to RMB1.20 billion ($173 million) in the fourth quarter of 2019 against operating loss of RMB970 million reported in the year-ago quarter.

Balance Sheet & Cash Flow

As of Dec 31, 2019, Tencent Music’s cash and cash equivalents and term deposits were RMB22.93billion ($3.29 billion) compared with RMB21.14 billion as of Sep 30, 2019.

Net cash from operations was RMB2.03 billion ($292 million), compared with RMB1.93 billion in the year-ago quarter.

Zacks Rank & Stocks to Consider

Tencent Music currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader computer and technology sector are Garmin Ltd. (NASDAQ:) , Applied Materials, Inc. (NASDAQ:) and Microsoft Corporation (NASDAQ:) . All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Garmin, Applied Materials and Microsoft is currently pegged at 7.4%, 9.9% and 13.2%, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.