- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Tencent Likely To Benefit From Switch Publishing Approval

Tencent (OTC:TCEHY) witnessed robust growth for its marquee games as millions of people were confined to their homes due to the global coronavirus outbreak.

Per sensor tower data, quoted by Bloomberg, flagship games like Honor of Kings and Peacekeeper Elite witnessed a significant surge in February. However, sales from other games declined sequentially and overall revenues fell as people are starting to go back to work.

While the aforementioned games could offset the company’s financial woes to an extent, government approval to release hits like Call of Duty: Mobile domestically will be a respite for the company. Fortunately, authorities in China have relaxed regulations to some extent as game developers are looking for ways to boost revenues amid the outbreak.

Notably, Tencent recently received the green light from the government to publish two additional Nintendo (OTC:NTDOY) Switch games in China.

Per Reuters, Tencent now has the approval to publish Super Mario Odyssey and Mario Kart 8 Deluxe, taking the number of licensed switch games in China to three. When the company started selling the Switch console in China, the only licensed switch game in the country was Mario Bros U Deluxe, which the authorities approved in October 2019.

The huge popularity of these games in international markets bodes well for the Tencent’s growth prospects amid the coronavirus outbreak.

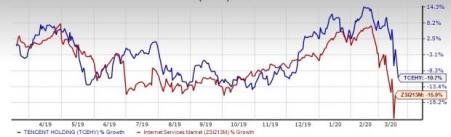

Tencent has outperformed the industry in the past year. The switch publishing approval as well as the revenue surge from its flagship games could further benefit the company’s share price performance in the near term.

Intense Competition in China Market

Tencent’s other segments also seem to have benefited from the pandemic coronavirus, with users on its WeChat app increasing $1.4 million since late January, per Apptopia data, quoted by Bloomberg.

Moreover, the company’s cloud division is not far behind Alibaba (NYSE:BABA) in terms of revenues. Notably, Tencent’s collaborative office apps –– Tencent Conference and WeChat Work –– are closely trailing Alibaba’s DingTalk on Apple’s (NASDAQ:AAPL) iOS store in China.

However, the growth in ByteDance’s popularity is a threat to the China giant, as the startup is attracting users and advertisers to its popular social media apps like Toutiao and Douyin.

Per eMarketer, Douyin’s user base increased 27.8% to 442.6 million users in 2019. Additionally, Douyin users make up 67.9% of China's mobile social network users and 59% of smartphone users overall.

Also, ByteDance’s focus on diversifying its revenue streams into areas like paid music services and video games is expected to intensify competition in China.

With advertisers looking for more reach, Tencent will have to double down on expanding its user base in order to survive in the Chinese market.

Zacks Rank

Tencent currently sports a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Apple Inc. (AAPL): Free Stock Analysis Report

Nintendo Co (T:7974). (NTDOY): Free Stock Analysis Report

Tencent Holding Ltd. (TCEHY): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.