- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Why Should You Add Intuit (INTU) To Your Portfolio Right Now

A successful portfolio manager is aware of the fact that adding well-performing stocks at the right time is of vital importance. Indicators of a stock’s bullish run include a rise in share price and strong fundamentals.

One such stock that investors need to pick up right now is Intuit Inc. (NASDAQ:INTU) . Though there are a few concerns, these are short lived and the stock has the potential to perform well over the long run.

Let’s delve deeper into the factors that make this stock an attractive investment option.

What Makes Intuit an Attractive Pick?

Solid Rank & VGM Score: Intuit currently has a Zacks Rank #2 (Buy) and a Value Growth Momentum Score (VGM Score) of ‘B’. Our research shows that stocks with a VGM Score of ‘A’ or ‘B’ combined with a Zacks Rank #1 (Strong Buy) or #2, offer the best investment opportunities for investors. Thus, the company appears to be a compelling investment proposition at the moment.

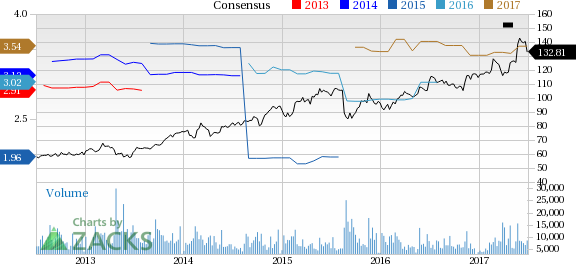

Upward Estimate Revision: Estimates for the current fiscal as well as fiscal 2018 moved north over the past 60 days, reflecting analysts’ confidence on Intuit. Over this period, the Zacks Consensus Estimate for fiscal 2017 increased around 2.9% to $3.54. The Zacks Consensus Estimate for fiscal 2018 also moved up 2.3% over the same timeframe to $3.99.

Positive Earnings Surprise History: Intuit has an impressive earnings surprise history. The company has outpaced the Zacks Consensus Estimate in the trailing four quarters, delivering a positive average earnings surprise of 24.3%.

Healthy Growth Prospects: The Zacks Consensus Estimate for earnings for Intuit for fiscal 2017 is currently pegged at $3.54, reflecting an anticipated year-over-year growth of 13.1%. Moreover, earnings are expected to register 12.6% growth in fiscal 2018. The stock has long-term expected earnings per share growth rate of 13.9%, which is way higher than the industry average of 10.5%.

Growth Drivers: The business and financial software space in which Intuit operates has huge growth opportunities. There are over 29 million small and medium businesses in the U.S. The company had over 2.22 million QuickBooks online subscribers in the country at the end of third-quarter fiscal 2017. We believe that Intuit’s increasing SMB exposure will boost the segment and drive long-term growth. Notably, Intuit has raised expectations to end fiscal 2017 with 2.3 million QuickBooks Online subscribers.

Furthermore, the company is refreshing its product line, in a move to shift its business model from selling desktop software to cloud-based subscription providers. With emerging technology and market trends, cloud-based solutions, as against software-based ones, have gained momentum in recent years. Hence, we are positive about Intuit’s increased adoption of its cloud-based services and products.

An Outperformer: Intuit has outperformed the Zacks categorized Computer-Software industry in the last 3 months. The stock returned approximately 14.4% over this period compared with roughly 6.4% growth recorded by the industry.

Other Stocks to Consider

Other similarly-ranked stocks in the Computer-Software space include Red Hat (NYSE:RHT) , DST Systems Inc. (NYSE:DST) and Oracle Corporation (NYSE:ORCL) . You can see the complete list of today’s Zacks #1 Rank stocks here.

5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

DST Systems, Inc. (DST): Free Stock Analysis Report

Red Hat, Inc. (RHT): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Intuit Inc. (INTU): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.