- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

VIX Resilience And UVXY Divergence Represent A Persistent Unease

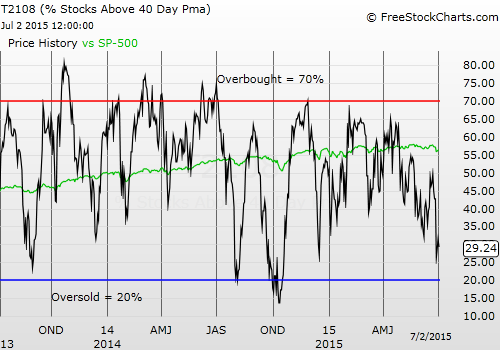

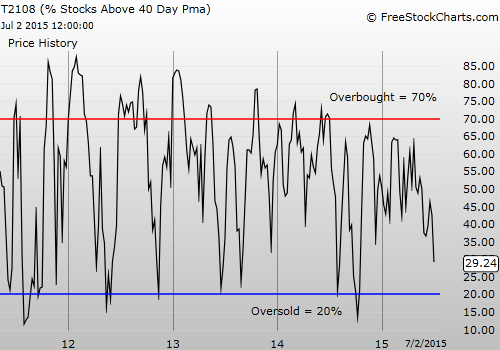

T2108 Status: 29.2%

T2107 Status: 41.4%

VIX Status: 16.8

General (Short-term) Trading Call: Bullish

Active T2108 periods: Day #177 over 20%, Day #1 under 30% (underperiod), Day #4 under 40%, Day #30 under 50%, Day #47 under 60%, Day #246 under 70%

ARCA:SPY has made "reluctant" bounce from 200DMA and "close enough" oversold. 3-day recovery good enough for swing trade.

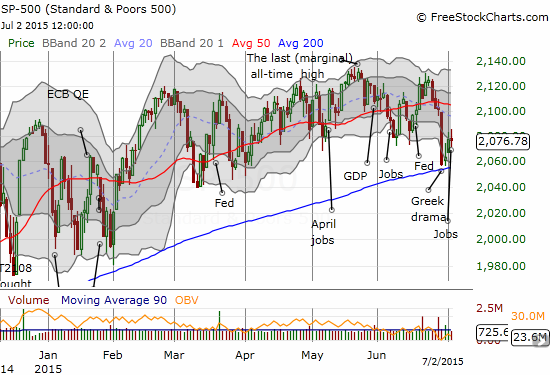

With those posts, I closed out the first half of my “oversold enough” trade from the last T2108 Update (for whatever reason, StockTwits did not upload them into my twitter feed). I wanted to hold my call options on ProShares Ultra S&P500 (ARCA:SSO) longer, but the bounce from the low on Monday was not quite convincing enough. I called the bounce “reluctant” because on each day, sellers were able to fade the index well off the highs. This reluctance was particularly on display on Tuesday and on Thursday. The S&P 500 ended the holiday-shortened week with a stalemate between buyers and sellers: a flat close well off both the highs and the lows of the day.

The S&P 500 makes a picture-perfect bounce off its 200DMA support on strong volume but ends the week in a stalemate.

The SSO gains were modest. I plan to plow that money right back into call options if T2108 hits official oversold conditions (below 20%) and/or volatility spikes to a fresh high.

The fistful of put options on ProShares Ultra VIX Short-Term Futures ETF (ARCA:UVXY) went through all sorts of gyrations. I felt immediate vindication when UVXY opened on Tuesday with a 10% or so gap down, but volatility rose from there. I felt double vindication on Wednesday when UVXY gapped down yet again and closed on its lows. On Friday, however, UVXY took out its revenge with a picture-perfect bounce of its 20DMA for a 12.6% gain. I took mild solace in the close just below 50DMA resistance.

After a wild week, the ProShares Ultra VIX Short-Term Futures ETF (UVXY) closed below resistance but still with a substantial gain from the previous week

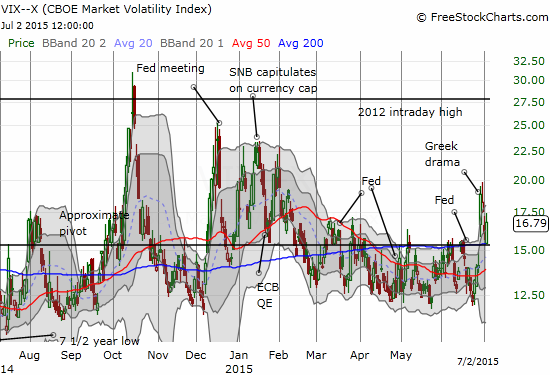

While I was able to stave off some sense of regret for not locking in profits on Wednesday’s close, I could not shake the sense that I should have tried a counter-trade on UVXY or ARCA:VXX. I noticed too late that the VIX had bounced cleanly off the good ol’ 15.35 pivot line. This pivot line continue to perform surprisingly well. This was one of those rare moments where it was not front and center for my trading.

The volatility index, the VIX, bounces cleanly off the 15.35 pivot line

The VIX’s relative resilience since Monday’s surge and UVXY’s surprising divergence in performance with a decline of just 4.2% versus the VIX’s 11% decline combined represent a persistent unease in the market. The coming Greek referendum on the bailout package from the country’s creditors leaves residual uncertainty in the air. I do not think the outcome matters at all to the larger scheme of things for trading. Greece has effectively defaulted, and it has been quite clear for some time that Greece cannot service its debts without a generous restructuring. Only the removal of uncertainty matters. If I am correct, volatility should experience a large plunge next week. At a minimum, UVXY’s out-performance versus the VIX should come to a rapid close with a decline commensurate with the VIX’s performance (it SHOULD move double). The currency markets, for example, are still not flagging any out-sized concerns after Sunday’s initial plunge in the euro (NYSE:FXE.

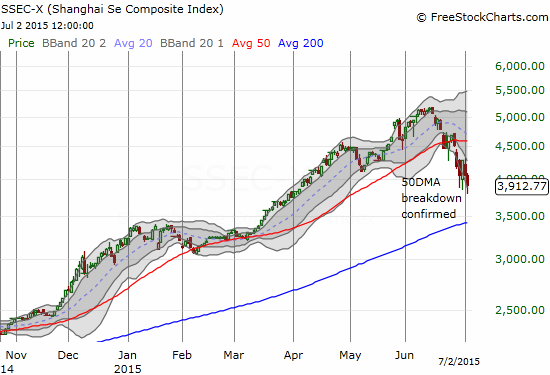

China is likely presenting another salient concern for the market. The Shanghai Composite’s (SSEC) breakdown continues. While this index is not representative of the Chinese economy, it does hold a lot of psychological value and is a proxy for the speculative frenzy among retail investors in China. As I demonstrated earlier, the Shanghai Composite is collapsing much like the NASDAQ bubble from 15 years ago.

The Shanghai Composite Index has a confirmed breakdown with a well-defined downtrend from the recent high

This situation will not likely resolve anytime soon with another rate cut in China failing to stem the losses this time. This trouble reminded me to look at Caterpillar (NYSE:CAT). As soon as I saw that CAT had broken down below its 50DMA as well as the June low that found support at the 50DMA, I rushed to fade CAT’s meager bounce with a small number of put options. As regular readers know, CAT is my favorite hedge. I really should have been ready with puts a lot earlier – like the day of the breakdown or even the failure to break through recent highs.

A lower low confirms a 50DMA breakdown for Caterpillar, Inc. (CAT)

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

Be careful out there!

Full disclosure: long put options on UVXY and CAT, long EUR/JPY

Related Articles

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

If the Vanguard S&P 500 Index ETF (VFV) doesn’t give you enough large-cap U.S. equity exposure as a Canadian investor, Invesco NASDAQ 100 Index ETF (QQC) is one of the most...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.