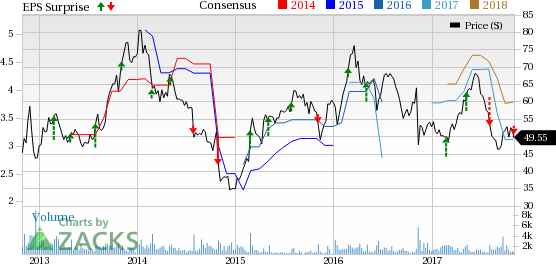

Leading publicly traded U.S. firearms maker, Sturm, Ruger & Company, Inc.’s (NYSE:RGR) third-quarter 2017 earnings of 53 cents per share missed the Zacks Consensus Estimate of 60 cents by 11.7%.

The bottom line also declined 48.5% from $1.03 a year ago. The downturn was primarily due to sales decline and unfavorable de-leveraging of fixed manufacturing costs due to decrease in production volumes.

Revenues

The company reported revenues of $104.8 million in the third quarter, down 35.1% from the prior-year figure of $161.4 million. The top line also missed the Zacks Consensus Estimate of $121 million by 13.5%. The decline in year-over-year performance can be attributed to lower firearm and casting sales.

While firearm sales (comprising 99% of total sales) decreased 35.2%, castings sales dropped 15.3%. Notably, new product sales accounted for 30% of total firearm sales in the reported quarter.

Dividend

Sturm, Ruger declared a third-quarter dividend of 21 cents per share, payable on Nov 30 to shareholders of record as of Nov 15, 2017. The dividend represents about 40% of the company’s net income.

Per management, dividend payouts vary every quarter as it is based on a percentage of earnings rather than a fixed amount.

Operational Highlights

Gross profit declined 39.9% to $30.2 million from $50.3 million in the year-ago quarter.

Total operating expenses fell 16.3% to $16.9 million due to lower selling, general and administrative expenses. Operating income was also down 55.7% to $13.3 million from $30.1 million in the third quarter of 2016.

Sturm, Ruger’s earnings before interest, taxes, and depreciation and amortization in the reported quarter was $20.8 million, down 46.6%.

Financial Performance

Sturm, Ruger ended the third quarter with $45.4 million cash compared with $87.1 million at 2016-end.

Cash generated from operations was approximately $59 million in the nine months of 2017 compared with $85.4 million a year ago. The current ratio is 2.8 to 1, with no outstanding debt.

Capital expenditure was $13 million at the end of the nine months of the current year. The company expects capital expenditure of about $30 million in 2017.

Sturm, Ruger returned $85 million to its shareholders through dividend payments of $20 million during the nine months of 2017. Also, the company repurchased 1.3 million of its common stocks for $65 million.

Zacks Rank

Sturm, Ruger carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here..

Recent Peer Releases

Pool Corporation’s (NASDAQ:POOL) third-quarter earnings of $1.16 per share surpassed the Zacks Consensus Estimate of $1.14 by 1.8%. Moreover, the figure rose 13% on a year-over-year basis backed by higher sales.

Callaway Golf Company (NYSE:ELY) reported third-quarter adjusted earnings of 5 cents per share. The Zacks Consensus Estimate was pegged at a loss of 5 cents. In the year-ago quarter the company had incurred a loss of 3 cents.

An Upcoming Peer Release

Malibu Boats, Inc. (NASDAQ:MBUU) is slated to report earnings on Nov 7. The company holds a Zacks Rank #2 (Buy) and has an Earnings ESP of 0.00%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Pool Corporation (POOL): Free Stock Analysis Report

Sturm, Ruger & Company, Inc. (RGR): Free Stock Analysis Report

Malibu Boats, Inc. (MBUU): Free Stock Analysis Report

Callaway Golf Company (ELY): Free Stock Analysis Report

Original post