- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

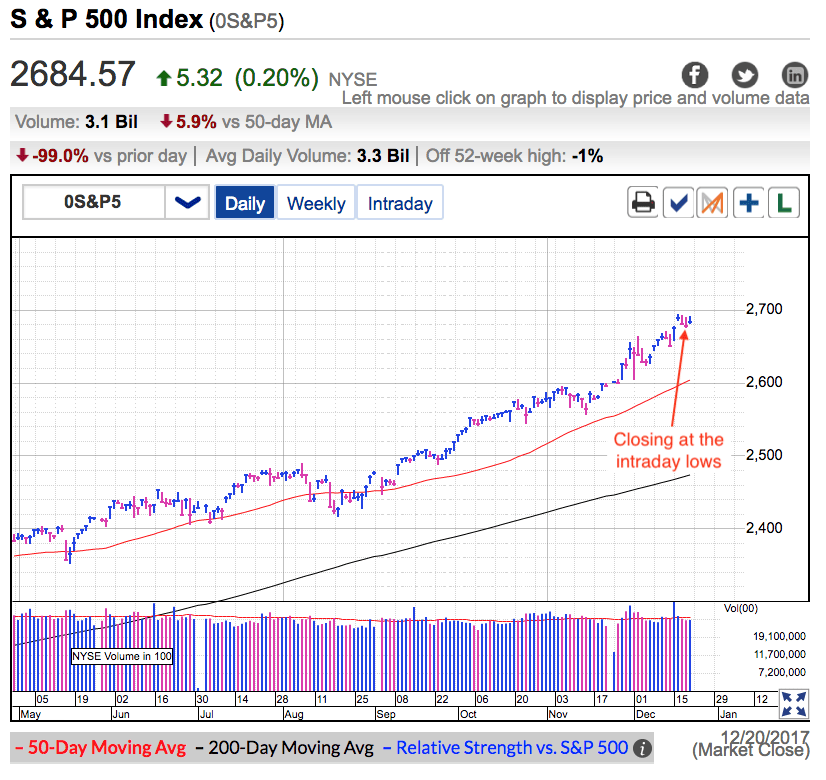

S&P 500 Struggling To Rally On Good News

Thursday was another indecisive session for the S&P 500 as early gains fizzled into the close. This was the fourth day in a row stocks finished at the lower end of the intraday range. Under normal circumstances weak closes are a concern, but these are anything but normal times.

On Wednesday Republicans cleared the last major hurdle on the way to Tax Reform. The revised tax bill sailed through Congress and is now waiting for Trump’s signature. There is some discussion on if that will happen this month or early next month, but the day doesn’t matter much since the cuts take effect January 1st regardless.

These were the tax cuts everyone has been waiting and hoping for since Trump won the election over a year ago. And what did the market do when Republicans cleared the last hurdle? It gave up early gains and finished ever so slightly in the red. Quite the underwhelming performance given how significant this Tax Reform package is. But that is how the market works. It is always looking ahead and this tax bill was already old news.

The other complication is we are quickly approaching the Christmas and New Year’s holiday dead zone where volumes drop off dramatically. When big money leaves for vacation, it gives smaller and less rational traders control of the market. While volatility might pick up over the next several sessions, small traders run out of money quickly and most of these moves reverse within hours or days. Don’t pay much attention to the price-action when big money isn’t participating.

The market is generally feeling optimistic. Stock are near all-time highs and Tax Reform just passed. The weekly AAII sentiment survey reveals bulls out number bears by 25-points, and on Stocktwit’s $SPY stream bullishness was at 72% a few days ago. While nothing says these levels cannot get even more bullish, we are approaching extreme levels and one has to wonder where the next buyer will come from.

And that is exactly what happened Wednesday when the market failed to rally following the Tax Reform vote. Everyone who wanted to buy tax cuts had already bought, meaning there was no one left to buy the news. Momentum is definitely higher and anything can happen during this holiday lull, but bulls need to be careful. Markets move in waves and it has been a nice ride to this point. The question is if this wave is running out of steam and we are approaching a normal and healthy consolidation. Few things make me more nervous than a market that cannot go higher on good news. That is the market’s way of telling us it is ready to take a break.

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.