- US stocks remain at record highs, enabled by falling real yields

- Dollar a touch softer amid rumors Brainard could replace Powell

- Yen and gold enjoy more gains, sterling recovers despite risks

Euphoria in the air

Can anything stop the runaway train that is the US stock market? The S&P 500 closed at another record high on Monday, bringing its total gains for the year to a stunning 27%. Infrastructure spending, assurances from Fed officials that they won’t slam on the brakes too hard, and stellar earnings have all been cited as catalysts for the melt-up.

In reality, the drivers of this rally may be more arcane. Stock buybacks are on track to hit new records, real yields have fallen to the point where frothy valuations are more palatable, volume in call options has exploded, and momentum chasing algorithms have served as rocket fuel for everything else.

Even the Fed is worried about asset prices racing too far ahead of fundamentals. The central bank’s Financial Stability report was released yesterday and highlighted a range of risks, from a liquidity crunch in China spilling over into the global financial system to rising interest rates and surging inflation threatening elevated valuations.

All told, this seems like an unstable environment. Sure, markets could storm even higher heading into year-end, but chasing the rally at this stage feels like picking up pennies in front of a steamroller. The catalyst for a reality check could be tomorrow’s US inflation report.

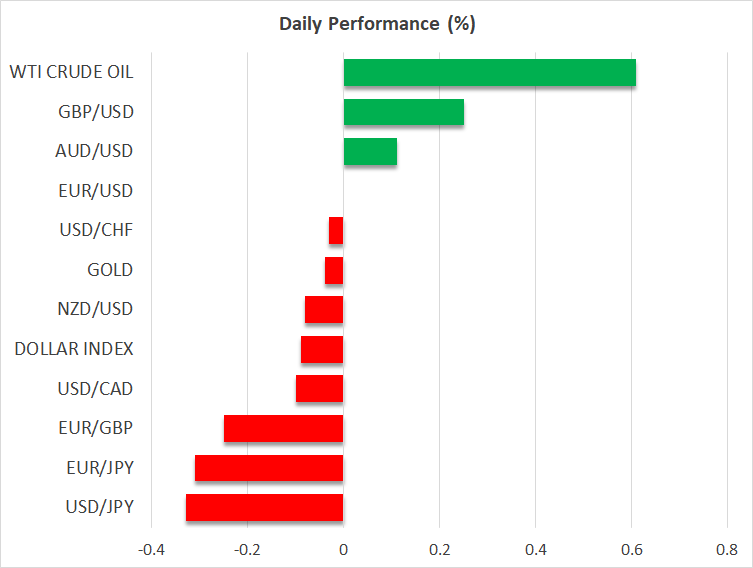

Dollar retreats, yen climbs

In the currency market, the dollar took a small step back this week. The pullback in real Treasury yields along with the euphoria in equity markets seem to be the driving forces behind this softness.

There’s also speculation that Powell’s days as Fed Chairman may be numbered. Powell is a registered Republican, so the White House may prefer to replace him with someone like Brainard who is a Democrat. Brainard is arguably more dovish, meaning that with her at the helm, the Fed could be even more cautious about raising rates.

Meanwhile, with real yields falling back towards record lows and the dollar retreating, both the Japanese yen and gold prices have emerged victorious. The question is how sustainable this rebound is, as nothing has really changed in the inflation outlook to justify real yields sinking so much.

Sterling fights back, key events ahead

The British pound has also managed to claw back some of its latest losses. There hasn’t been any seismic news from the UK, so sterling’s recovery seems linked primarily to the cheerful mood in stock markets.

However, there are still storm clouds hanging over the pound. Market expectations for BoE rate increases remain overly aggressive with almost four hikes priced in for next year, and political risk is back on the radar amid rumors that PM Johnson could trigger Article 16 to renegotiate parts of the Brexit deal.

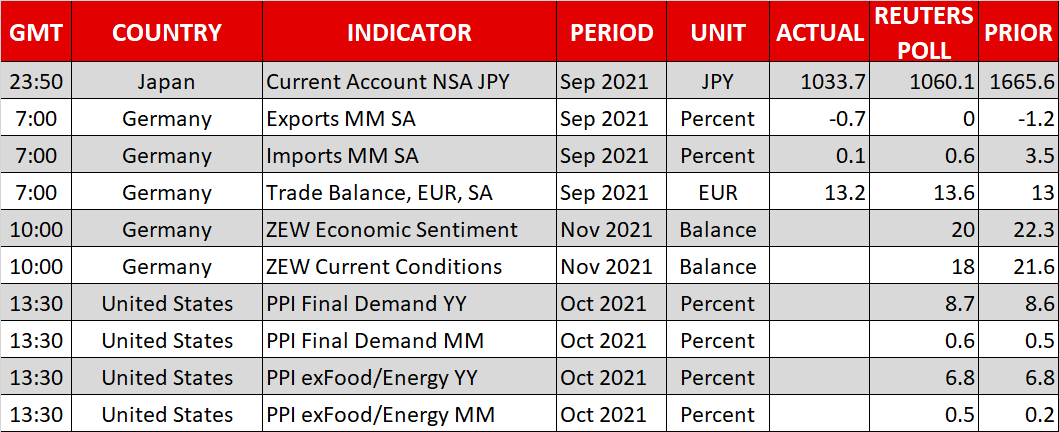

As for today, the schedule is relatively light. The latest US producer prices will serve as a prelude for tomorrow’s CPI numbers, while on the central bank front, we will hear from the heads of the Fed, ECB, and BoE. All of them have spoken recently so any groundbreaking policy signals are unlikely.

Instead, the fireworks could come overnight when China releases its own inflation data for October. The focus will fall on producer prices, which are expected to show that Chinese factories keep exporting inflation abroad at an accelerating pace.