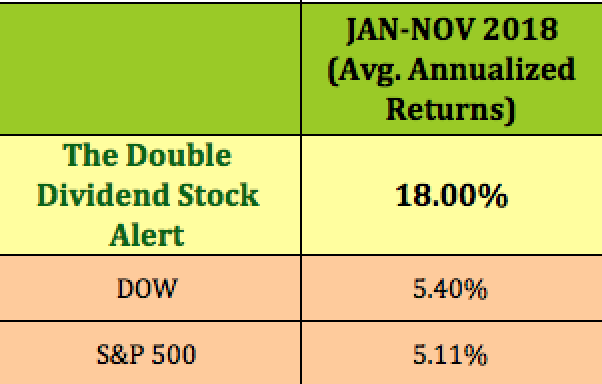

How is your portfolio handling the up and down market of 2018?

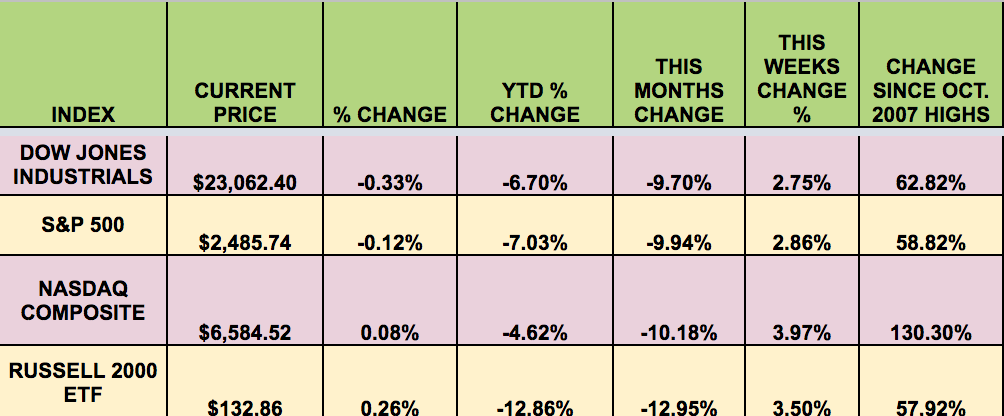

Markets: It was a historically up and down week for the market, with the DOW setting a record for a 1-day rise, and the S&P staging a big turnaround on Thursday for a 1-day reverse.

Volatility continued to reign Thursday, with stocks erasing heavy losses to end higher in a late-session turnaround that saw the Dow Jones Industrial Average end more than 800 points above its session low. The rebound came after stocks initially struggled to build on the previous session’s sharp rally, which in turn was a snapback from the worst Christmas Eve performance in history. (marketwatch.com)

High Dividend Stocks Going Ex-Dividend Next Week: CXW, JCAP, TSQ, ACRE, DTI, CGBD, CVA, MFA, PLYM, TPG, TRTX, AGNC, AHT, ANH, ATAX, BGS, BHR, CPG, CRT, EPR, GECC, GPMT, GS, BDC, GSBD, HCFT, JMP, NLY, ORC, PK, PRT, RC, SCM, SJT, TWO.

Volatility: The VIX fell 5.89% this week, ending at $28.34, after going over $35.00 during Monday’s meltdown.

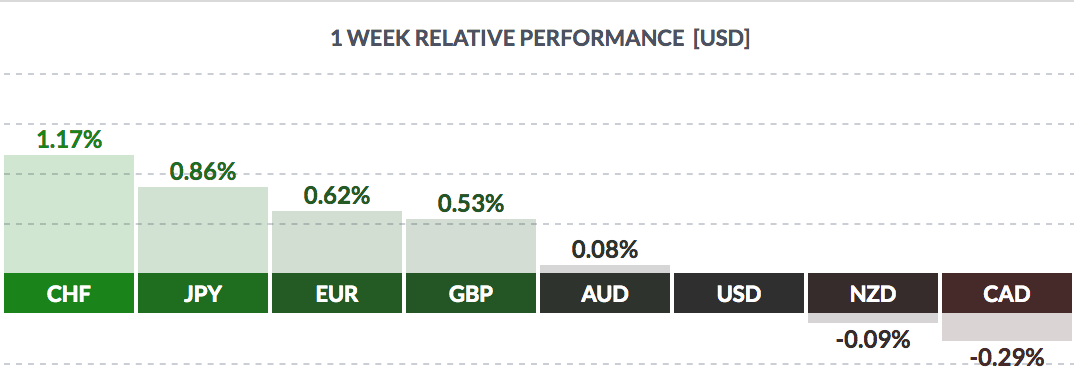

Currency: The U.S. dollar fell vs. the yen, euro, pound, and Swiss Franc this week, but fell vs. the New Zealand dollar and the Canadian dollar.

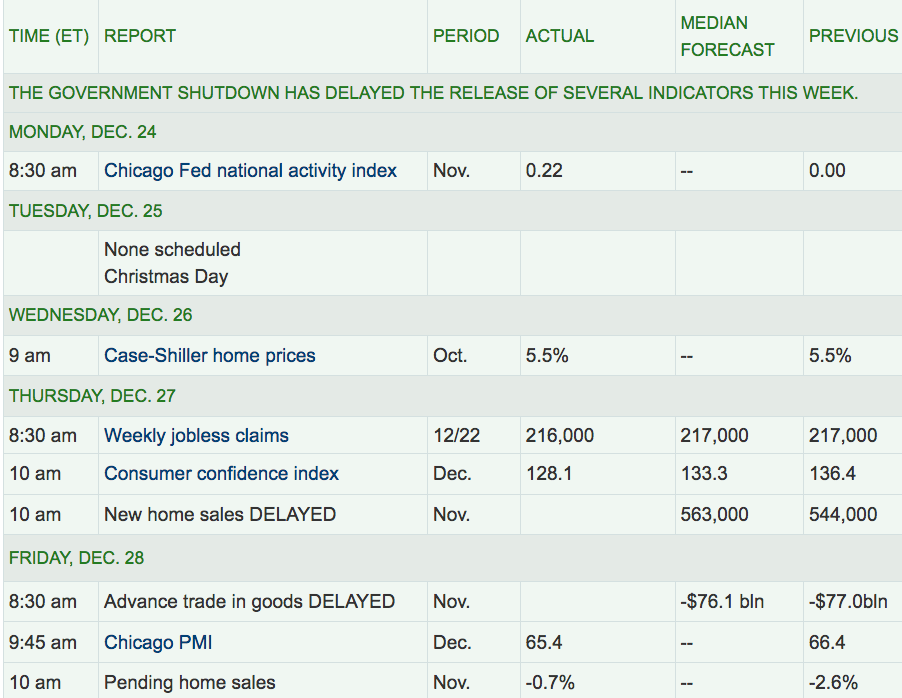

Economic News: Several reports were delayed this week, due to the government shutdown. Pending home sales decreased by-.7% in November. Consumer Confidence fell to 128.1.

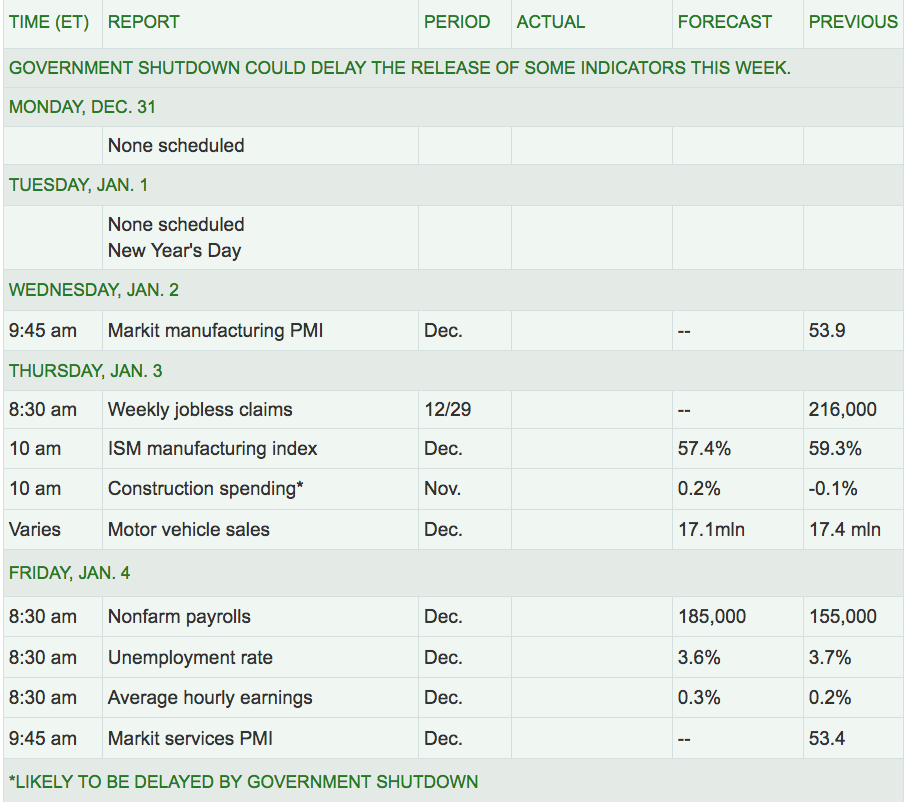

Week Ahead Highlights: U.S. and European markets will be closed on Tuesday, in observance of the New Year’s Day holiday. Additionally, the NYSE will close early, at 1 pm on Monday, New Year’s Eve.

Next Week’s US Economic Reports: Some of the economic reports due out next week may be delayed, due to the government shutdown.

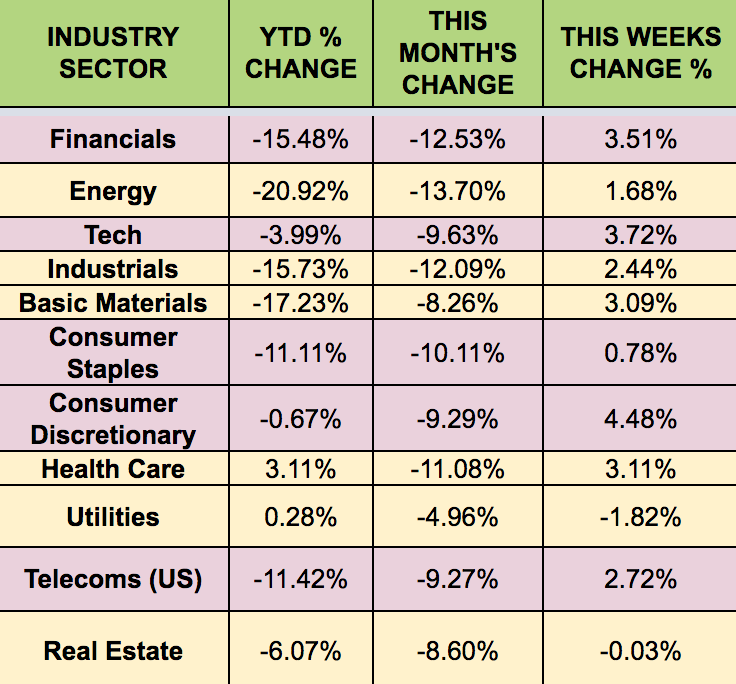

Sectors: Financials and Tech led this week, with Utilities and Real Estate trailing. Healthcare leads year to date and is the only sector with a positive return, other then Utilities.

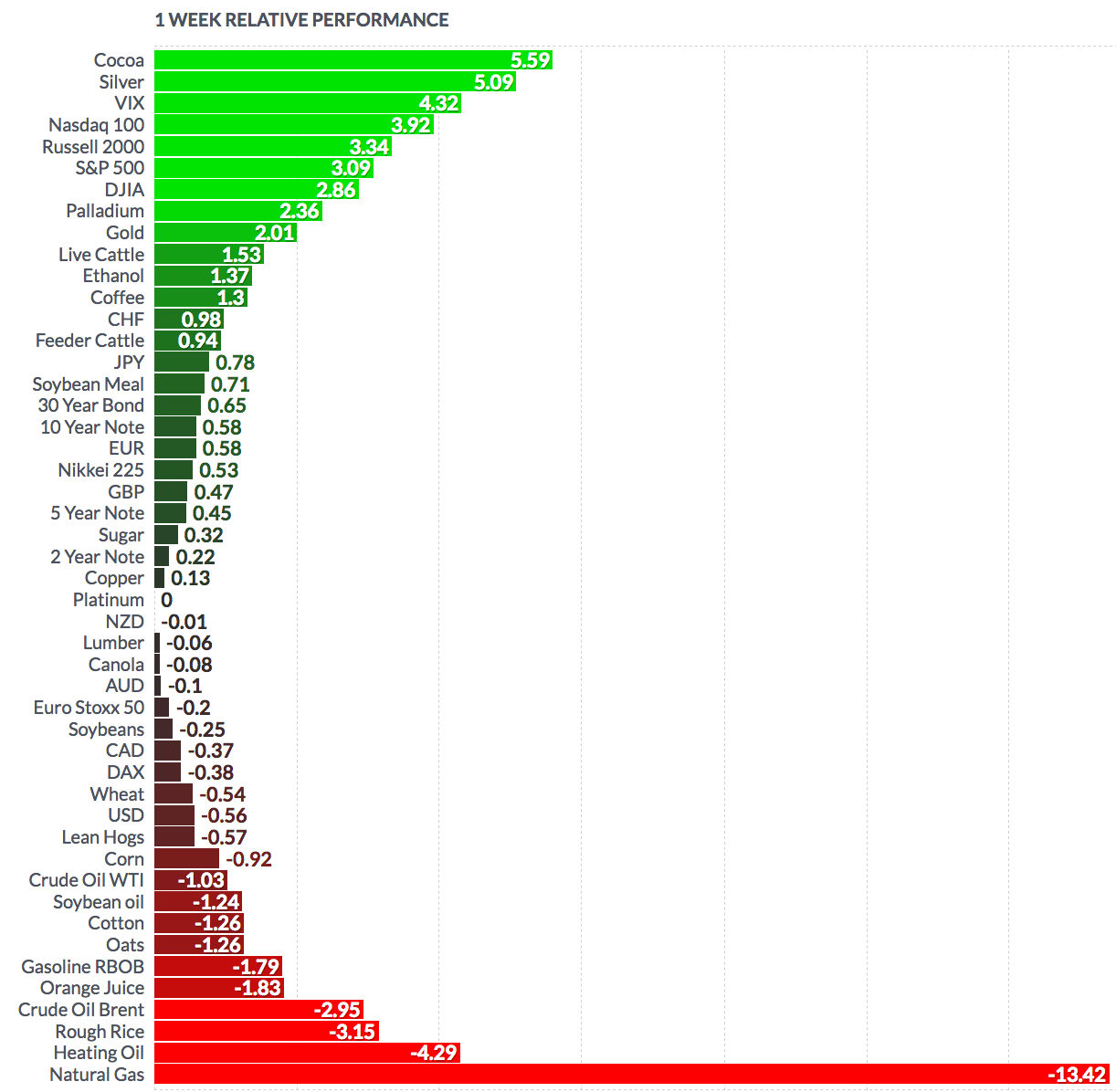

Futures:

WTI Crude fell -1% this week, finishing the week at $45.12, while Natural Gas fell -13.42% for the week.