As we headed into the options expiration week for May, last week’s review of the macro market indicators suggested that the equity markets remain strong. Look for Gold to continue its correction, while Crude Oil might consolidate with an upside bias. The U.S. Dollar Index seemed content to move sideways, but with a upward bias as U.S. Treasuries moved lower in the broad consolidation zone. The Shanghai Composite was building towards a break of consolidation higher, while Emerging Markets looked to pullback in their uptrend. Volatility looked to remain subdued keeping the wind at the backs of the equity index ETF’s SPY, IWM and QQQ, despite their moves to new highs. Their charts corresponded with a continued upward bias, but with the IWM the strongest on the short term basis and the QQQ strongest on the intermediate term. Rotation into small caps might result. The week played out with Gold continuing lower, while Crude Oil bounced and moved higher in the range. The US Dollar took that upward bias and ran while Treasuries bounced around in a lower range. The Shanghai Composite continued to consolidate before popping Friday. Emerging Markets went flat as a pancake and consolidated. Volatility remained stable before making lower lows Friday. With this positive backdrop the Equity Index ETF’s continued their march higher with the SPY and IWM making new all-time highs and the QQQ multi-year highs. What does this mean for the coming week? Lets look at some charts.

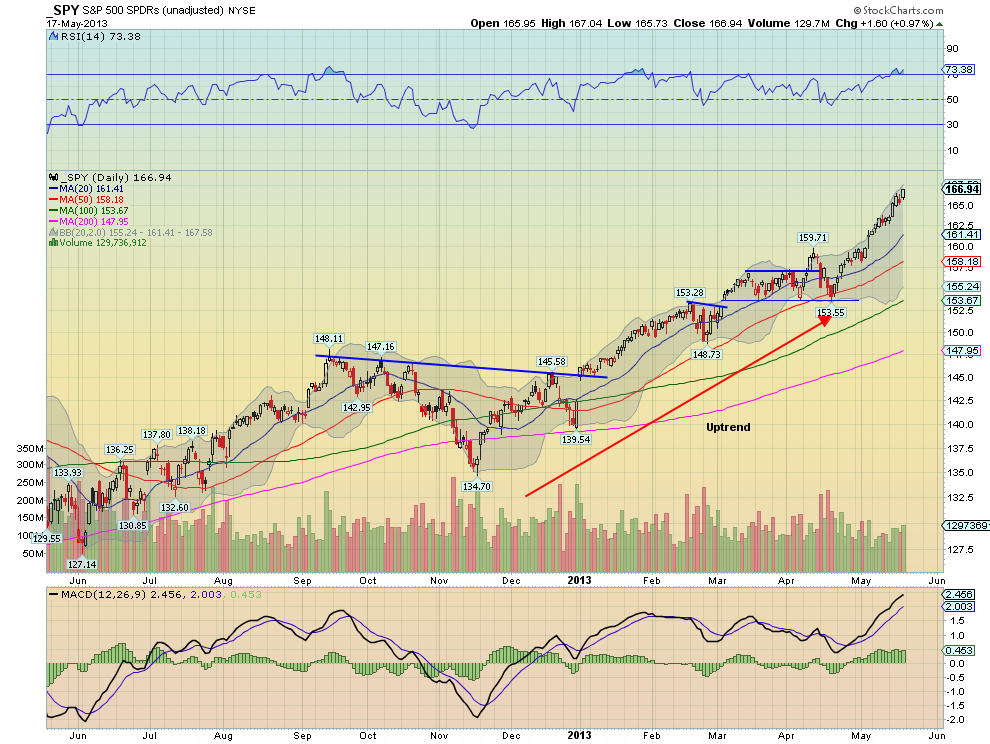

SPY Daily (SPY)

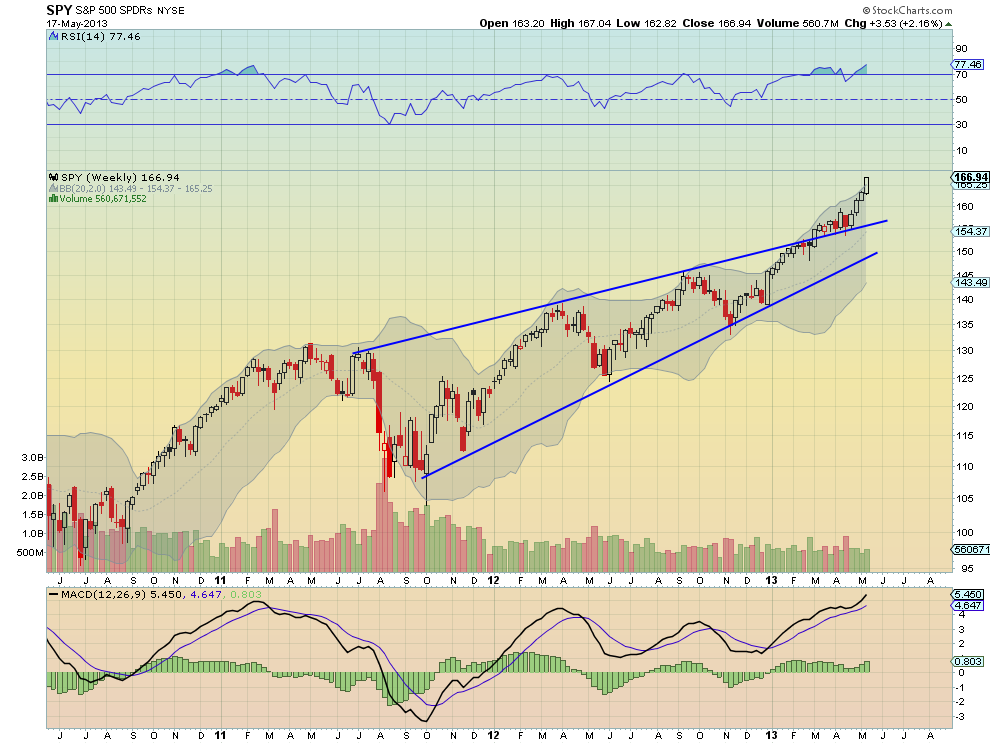

SPY Weekly (SPY)

The SPY continued higher on the week ending at new all-time highs. The steps higher off of the November low have averaged between 11 and 14 points. This move would end at 167.50 if it obeyed that limit. Pullbacks have averaged about 6 points. As it stands today, the RSI is bullish and only just at the 70 level, technically overbought, but leveling. Not a problem yet. The MACD is continuing to rise as well with no sign of fading. These point higher, still on the daily chart. This market does not want to make it easy to get in on this timeframe. Out on the weekly chart, the move up off of the wedge break continues with the RSI reaching multi-year highs and the MACD rising to new highs as well. Some cautious signals here as well. There is no resistance higher, and support below is found at 163 and 159.72. Continued Upside, But with Caution in the Short Term.

Running into the Memorial Day Weekend, the equity markets continue to look strong but the potential for rotation into the small caps noted last week still exists. Look for Gold to continue the trend lower while Crude Oil is biased higher in its neutral channel. The U.S. Dollar Index sins on the verge of a full blown bullish move higher, while U.S. Treasuries are biased lower. The Shanghai Composite also looks to be ready to move back higher while Emerging Markets are biased to the downside as they consolidate. Volatility looks to remain a non factor and should be ignored until it breaks above 22, keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ, despite the moves to new highs. Their charts agree although the SPY is showing the most signs of caution as the IWM and QQQ plow forward. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

SPY Trends And Influencers: May 18, 2013

Published 05/18/2013, 02:41 AM

Updated 05/14/2017, 06:45 AM

SPY Trends And Influencers: May 18, 2013

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.