- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

SPY Trends And Influencers: October 3, 2015

Last week’s review of the macro market indicators suggested as the market closed out the the quarter and moved into October that the Equity markets still looked weak. Elsewhere looked for gold (NYSE:GLD) to continue in its short term uptrend, while crude oil (NYSE:USO) consolidated. The US dollar index (NYSE:UUP) also looked to continue broad consolidation while US Treasuries (NYSE:TLT) were biased lower in consolidation. The Shanghai Composite (NYSE:ASHR) looked to continue its consolidation in the downtrend while Emerging Markets (NYSE:EEM) were biased to the downside.

Volatility (NYSE:VXX) looked to remain elevated, keeping the bias lower for the equity index ETFs NYSE:SPY, NYSE:IWM and NASDAQ:QQQ. Their charts suggested there might be more pain, with the SPY looking the worst on the short term basis and the IWM and QQQ possibly catching a break and just consolidating. The longer term all looked a bit stronger but nothing to have a party about with more downside risk as well.

The week played out with gold reversing lower before rebounding to end the week near unchanged, while crude oil continued in the consolidation. The US dollar also continued in consolidation, while Treasuries inched higher before a strong move up Friday. The Shanghai Composite had a short week and moved along sideways, while Emerging Markets started lower but finally met some support and bounced.

Volatility started the week higher but fell back as it went on, holding in the elevated range. The Equity Index ETFs started the week lower but rebounded by Wednesday, with the SPY and QQQ ending higher, but the IWM holding near the lows. What does this mean for the coming week? Lets look at some charts.

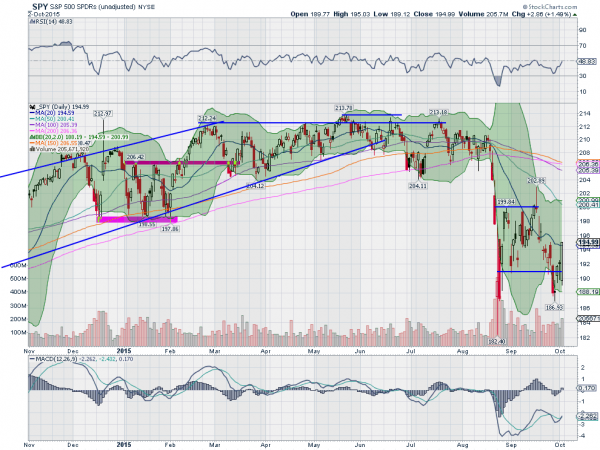

SPY Daily

The SPY started the week with a hard move lower through short term support. It stopped short of the long shadow on the candle from August 24th but close enough to the real body to be a possible double bottom. Tuesday saw a Spinning Top doji, a reversal candle, and it confirmed higher on Wednesday back over that short term support level. Thursday’s Hanging Man raised the specter of a possible reversal with a lower high.

But the strong Marubozu and engulfing candle Friday left no doubt the move was not done yet. It finished the week back over the 20 day SMA for the first time since the gap down September 22nd. The daily chart shows the RSI running higher and approaching the mid line, telling that the reversal is not confirmed yet by a move into the bullish zone, but has support for more upside. The MACD is about to cross up adding more upside support. Out on the weekly chart, the story is not so clear yet.

The price printed a Hammer for the week, a potential reversal candle if confirmed next week, but remains under the 100 week SMA. The RSI is leveling in bearish territory with the MACD continuing lower. There is support lower at 193.40 and 190.60 followed by 188.50 and 187.50. Resistance higher comes at 196 and 198 followed by 200 and 201.80. Short Term Strength in Consolidation of the Down Move.

SPY Weekly

Heading into the first full week of October, the indexes have again dodged a bullet and ending the week on strength. Elsewhere, look for gold to continue to consolidate in its downtrend, while crude oil consolidates in its downtrend. The US dollar index looks to mark time as it consolidates its move higher, while US Treasuries are biased higher in the short term. The Shanghai Composite looks to continue to consolidate in its trend lower, while Emerging Markets are biased to the upside in broad consolidation after their move lower.

Volatility looks to remain elevated but moving back toward normal levels easing the headwind for the equity index ETFs SPY, IWM and QQQ. The indexes themselves all look good in the short term while they consolidate in the intermediate term. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.

Related Articles

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.