- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

SPY Trends And Influencers: June 27th, 2015

Last week’s review of the macro market indicators suggested, as the markets head out of June Options Expiration and officially into summer, that equities continued to churn with an upward bias.

Elsewhere looked for gold (ARCA:GLD) to be biased to the upside short term in its consolidation, while crude oil (NYSE:USO) consolidated with an upward bias. The US dollar index (NYSE:UUP) looked headed lower in its broad consolidation of the long move up, while US Treasuries (ARCA:TLT) might consolidate in their downtrend. The Shanghai Composite (NYSE:ASHR) seemed to be beginning its long awaited correction, or just doing its 4th 10% plus move lower before another launch higher, while Emerging Markets (ARCA:EEM) were biased to the downside, but might consolidate after their move lower.

Volatility (ARCA:VXX) looked to remain subdued, keeping the bias higher for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ. The IWM continued to look the strongest on the short time frame as it sat at all-time highs, with the QQQ strong as well on the weekly timeframe and the SPY stuck in a funk consolidating.

The week played out with gold moving lower right out of the starting blocks and continued all week, while crude oil continued to hold in the consolidation range. The US dollar moved higher, while Treasuries started higher but hit overhead resistance and pulled back to new lows. The Shanghai Composite took a hard turn lower, while Emerging Markets tried higher but found resistance quickly.

Volatility moved lower before rebounding slightly, but holding in a tight range. The Equity Index ETF’s started the week moving higher, with the IWM making a new all-time high, the SPY coming close, and the QQQ reaching the previous resistance before all moved lack lower through out the week. What does this mean for the coming week? Lets look at some charts.

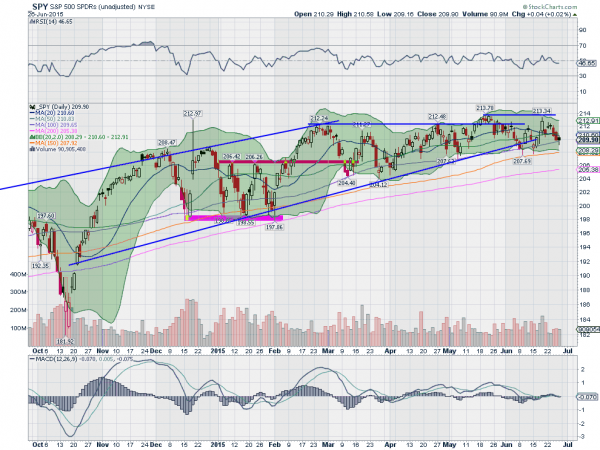

SPY Daily

The SPY started the week moving higher off of the 20 and 50 day SMA. But the price stalled Tuesday at prior resistance before reversing lower. By Friday, it had fallen back to the 100 day SMA and printed a Hammer candle. The daily chart shows the longer SMA continuing the steady trend higher, with the RSI starting to level after a pullback. It never moved into the bearish zone. The MACD remains flat.

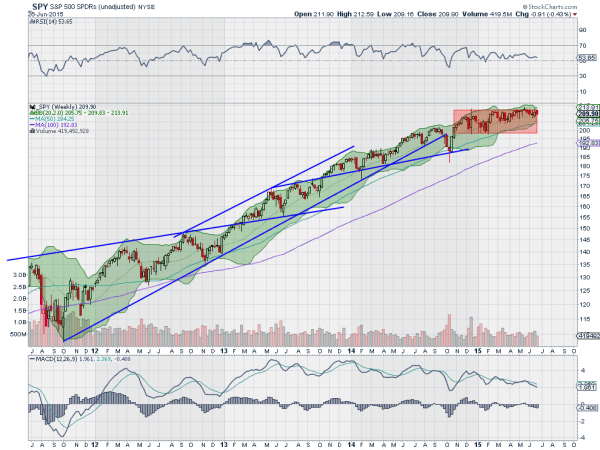

On the weekly chart, the consolidation at the top of the box that started in October continues. The RSI also continues to hold over the mid line, in the bullish zone, on this time frame. The MACD is falling, but at where it has reversed many times since October. The Bollinger Bands® are getting tighter, a precursor to a move many times. There is resistance higher at 210.25 and 211 followed by 212.50 and 213.35. Support lower comes at 209 and 208 followed by 206.40. Continued Consolidation in the Long Term Uptrend.

SPY Weekly

Heading into the holiday shortened week, the equity markets continue to look better on the longer timeframe, with some vulnerability on the short timeframe. Elsewhere, look for gold to continue consolidation with a downward bias, while crude oil consolidates with an upward bias. The US dollar index continues to move sideways in broad consolidation after the uptrend, while US Treasuries are biased lower. The Shanghai Composite may finally be in the long awaited correction, while Emerging Markets are biased to the downside.

Volatility looks to remain subdued, keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts continue to show the SPY and QQQ moving similarly on the shorter timeframe, while the IWM was stronger until late in the week. The rotation may be starting out of the small caps again. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.