- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

SPY Trends And Influencers December 29, 2018

Last week’s review of the macro market indicators noted that heading into the Christmas shortened week, equities looked the worst they had in at least 2 years. Elsewhere looked for gold to continue in its uptrend while crude oil continued the path lower. The U.S. dollar index continued to mark time moving sideways, while U.S. Treasuries were biased higher short term. The Shanghai Composite and Emerging Markets had resumed their downtrends.

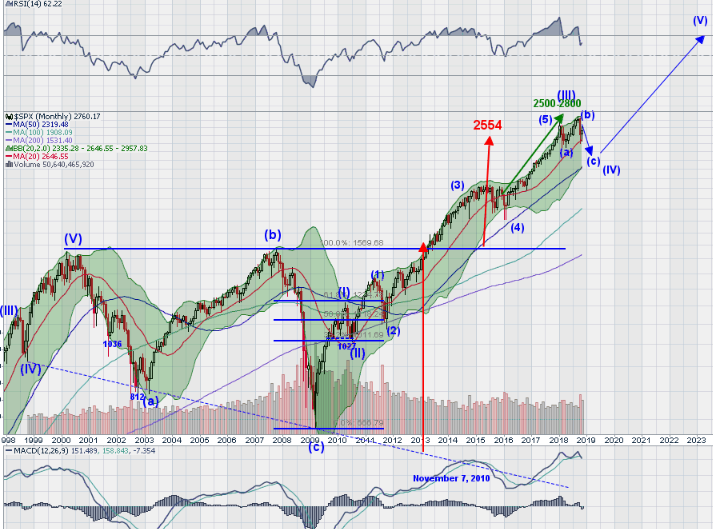

Volatility (NYSE:VXX) looked to remain elevated and creeping higher keeping the bias lower for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and Invesco QQQ Trust Series 1 (NASDAQ:QQQ). Their charts were in solid downtrends on both the daily and weekly view, with the IWM and QQQ in unofficial bear markets, off more than 20%, with the SPY close behind.

The week played out with gold continuing higher, while crude oil dropped early but recovered late in the week. The U.S. dollar remained in a tight range consolidating, while Treasuries bounced up and down like ping pong balls. The Shanghai Composite continued its move lower, but Emerging Markets found support and bounced.

Volatility shot up Monday in the short session but reversed it all Wednesday and held firm the rest of the week. The Equity Index ETF’s reacted with a violent move lower Christmas Eve, but even bigger reversal Wednesday with follow on Thursday after a deep intraday drop and reversal. They ended the week gapping up and then filling. What does this mean for the coming week? Let's look at some charts.

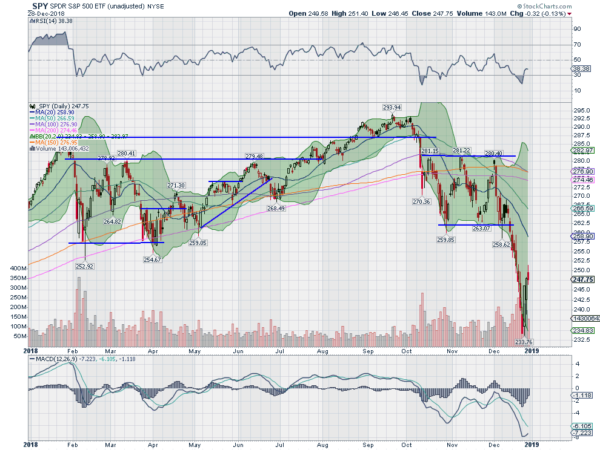

SPY Daily

The SPY came into the week driving lower out of consolidation. It continued lower Monday to a 20 month low on a Christmas Eve massacre. After the break, it gapped higher though and drove to a better than 4% gain. Thursday looked to reverse with a gap down open and drive lower. but a spectacular intraday reversal saw it close up almost 1% on the day. It ended the week with a slight pullback.

A nearly 3% gain on the week and the first positive week in the last 4 but still below the breakdown level. The daily chart shows the RSI stalling as the price filled the gap Friday. The MACD has turned up though from extreme levels. Continuation next week would need to move over 262.50 give the bulls some swagger.

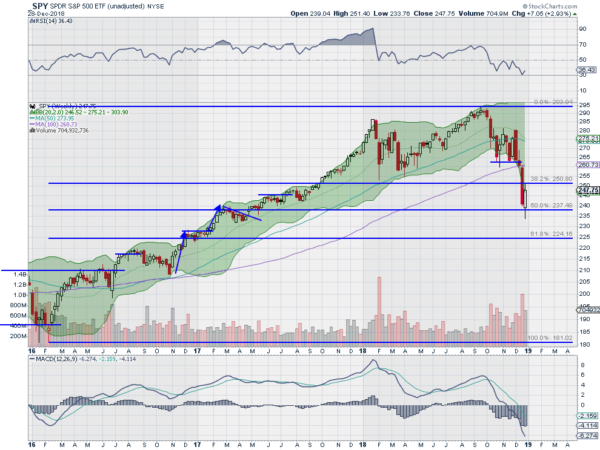

The weekly chart shows the current bottom at a 50% retracement of the move up from the 2016 low. The RSI is bouncing off of the oversold line with the MACD driving lower. There is support lower at 246 and 241.50 then 238 and 236. Resistance above comes at 248 and 249 then 250.50 and 254. Bounce in Downtrend.

SPY Weekly

With one trading day left in the year equity markets put in a strong case for a reversal this week. They are still a long way from confirming a bottom though and not just a bear flag build. Elsewhere look for gold to continue in its uptrend, while crude oil may possibly pause in the downtrend. The U.S. dollar Index continues to consolidate sideways while U.S. Treasuries pause in their uptrend.

The Shanghai Composite and Emerging Markets continue to show an easier path to the downside. Volatility looks to remain elevated keeping the bias lower for the equity index ETF’s SPY, IWM and QQQ. Their charts showed a strong bounce during the week but not enough to do anything to alter the current downtrends. Very short-term uptrends are beginning, but it is too soon to declare a bottom. Use this information as you prepare for the coming week and trade them well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Related Articles

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.