- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Southern Company Lowers Kemper Project Cost, Reduces Rates

Electric utility firm The Southern Company (NYSE:SO) finally reached a settlement with the Mississippi Public Utilities Staff regarding the rate issue concerning the controversial Kemper Project. Mississippi Power, subsidiary of Southern Company and in charge of the Kemper Project, has agreed to lower the price tag of the Kemper Project by $85 million. This will help to lower the amount the company needs to recover from customers by $13.4 million.

Looking Back

The Kemper plant had been central to ex-President Obama’s Climate Plan and was designed to reduce up to 65% of carbon dioxide emissions. Notably, the project also received the support of President Trump.

However, the project has been facing continuous criticism owing to its poor execution, cost overruns and multiple delays. The plant is already three years behind schedule and is over $4 billion beyond the stipulated budget. The overall cost of the plant was estimated to be around $3 billion in 2010. However, with several delays adding to the project’s cost, the current price tag of the plant has ballooned over $7.5 billion. In the past 18 months, the company has announced 10 delays due to project management problems. The project found it difficult to get its two gasifiers to operate consistently. Mississippi Power has been unable to make the project economically viable in the face of volatile natural gas prices.

In June, Mississippi Public Service Commission (MPSC) issued an ultimatum ordering Southern Company to redesign plans and run the Kemper Project solely on natural gas. Thereafter, the company suspended all coal gasification operations at its Kemper plant.

Mississippi regulators, who do not wish ratepayers to incur additional costs, ordered the company not to increase the rates for Mississippi Power customers. In fact, they want the company to lower the rates, if feasible.

Recent Updates

Mississippi Power’s settlement deal has resulted in the rate reduction for the customers from $126 million to $112.6 million. The move entitles customers to pay $1 less every month than what they are currently paying.

The company believes that it has complied with all the requirements of Public Service Commission including the rate reductions and the operation of the plant solely as a natural gas facility. The company now thus wants the MPSC to re-evaluate the settlement agreement. The final decision on which is expected by January.

Zacks Rank

Southern Company is one of the largest generators of electricity in the nation along with the likes of Exelon Corporation (NYSE:EXC) , Atlantic Power Corporation (NYSE:AT) and RWE AG (OTC:RWEOY) among others.

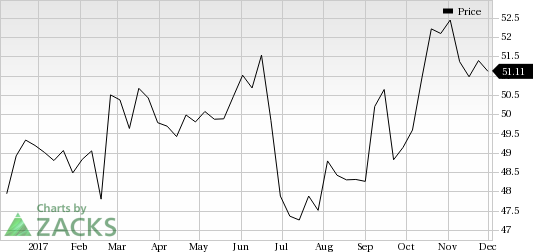

Southern Company carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Exelon Corporation (EXC): Free Stock Analysis Report

Southern Company (The) (SO): Free Stock Analysis Report

Atlantic Power Corporation (AT): Free Stock Analysis Report

RWE AG (RWEOY): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.