- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Snapchat Brings New Advertising Tools To Aid Revenue Growth

Snap Inc. (NYSE:SNAP) recently unveiled two new forms of advertising, Promoted Stories and Augmented Reality (AR) Trial.

Reportedly, advertisers can create Promoted Stories by putting up three to 10 Snaps of a product together that will be visible to users in a particular country for 24 hours. On the other hand, the AR trial ads will be based on the company’s World Lens feature and will enable users to play with the AR version of the products being promoted.

Time Warner (NYSE:TWX) owned HBO is the first advertiser to put up Snapchat’s Promoted Stories. HBO used the platform to publicize why its highly popular Game of Thrones and other shows should be watched on Black Friday.

Not just in the United States, Promoted Stories was also availed by Europe-based clothing brand ASOS (LON:ASOS) for its Black Friday campaign in the U.K. and France.

Moreover, Snap has collaborated with luxury car brand BMW to promote the new BMW X2 model by creating a three dimensional AR version that will enable users to view the product from different angles and also customize the colors per their choice.

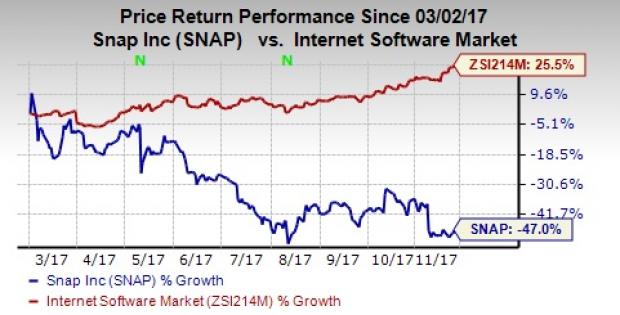

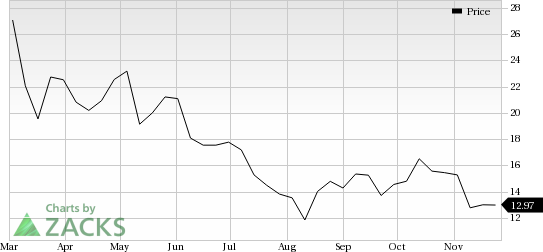

Snap really needs to find luck with these tools as shares have had a bloodbath at trading and investors are fast dumping stock. Notably, shares of Snap have lost 47% since its listing date of Mar 2, 2017 against 25.5% growth of its industry.

Push To Advertising Revenue

Advertising is the primary contributor to Snap’s Revenues. In late 2016, the company launched a hardware product, Spectacles, to diversify its revenue stream. However, we note that it has not yet been able to generate significant revenues for Snap.

Per USA Today, Spectacles is the biggest tech turkey of 2017. Given the initial supply shortage of Spectacles, the company increased its production in February, which unfortunately led to a large number of unsold items. Analysts believe that it will take a decade for the demand of such wearables to escalate. Notably, in the last reported quarter, the company incurred $39.9 million of charges for excess inventory for Spectacles.

Although Snap’s revenues in the third quarter increased 62% year over year, growth rates have come down significantly compared with the past quarters. Reportedly, in the first and second quarters of 2017, the company’s revenues increased 286% and 153% year over year, respectively.

The company also registered decelerating growth in terms of user base. In the last reported quarter, its daily active users (DAU) ticked up just 2.8% sequentially to 178 million, declining from 4.2% sequential increase in the second quarter and 5% in the first.

Analysts fear that the company’s growth opportunities can be dampened because of slowing growth in its user base as advertisers will no longer be attracted to the platform.

We believe that the company’s response to advertising partners’ requests “to tell deeper stories on mobile" will help it attract more advertisers. However, competition from other platforms poses serious concern.

Competition from Facebook

The major concern for Snapchat has been the increasing popularity of Facebook (NASDAQ:FB) and its photo application Instagram. After CEO Evan Spiegel turned down Facebook’s offer to buyout Snapchat, Facebook started to mimic all features of Snap and unfortunately made them more popular.

Reportedly, Instagram Stories, a blatant copy of Snapchat’s feature of the same name, has more than 300 million DAUs almost double that of Snapchat’s total DAU.

Advertisers, in our opinion, are more likely to opt for Instagram that has thrice the Total Addressable Market (TAM) of Snap's. Facebook and Instagram have 1.37 billion and 500 million DAUs and boast more than 6 million and 2 million advertisers, respectively.

Zacks Rank and a Key Pick

Snap carries a Zacks Rank #3 (Hold).

A better-ranked stock in the broader technology sector is Micron Technology (NASDAQ:MU) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Long-term earnings growth rate for Micron is projected to be 10%.

"Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Time Warner Inc. (TWX): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Snap Inc. (SNAP): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.