Unshackled from its bonds

Skyepharma (SKP.LSE) has reported a strong set of 2013 results, but the big news is the £112m (£104m net) fund-raise to repay the bonds back early. The new shares, priced at 191p a share, have been placed with new and existing institutions. A tender offer for the bonds, at 115% of face value, will cost £95.6m (plus £0.4m costs) and represents a £25.2m discount to the total forecast cash payments to redemption in 2017. We have raised our valuation from £87.2m, or 189p per share, to £273m, or 260p per share.

New shares placed at 191p, a 4.3% discount

A total of 58.7m new shares have been issued at 191p a share, a modest 4.3% discount to the price of 199.5p (at 28 March), to raise £112m (£104m net). The capital raise consists of a firm placing of 4% (£4.4m) with a placing and open offer for the remaining 96% (£107.6m), and has been placed (subject to clawback) with new and existing institutional holders. The proceeds will be used primarily for the early re-payment of the bonds, which have an earliest put date of 4 November 2017.

Lower costs and greater investment capacity

The tender offer for the bonds is at 114.85% of face value, which equates to £95.6m and represents a £25.2m discount to the total forecast cash payments that would be payable to redemption in 2017. The repayment transforms the balance sheet, with pro forma FY13 net debt falling from £84.2m to £9.0m (IFRS basis). The reduction in interest costs is significant, with the greater net cash flows opening up the possibility of further investment in product and technology development.

Strong FY13 results confirm operational progress

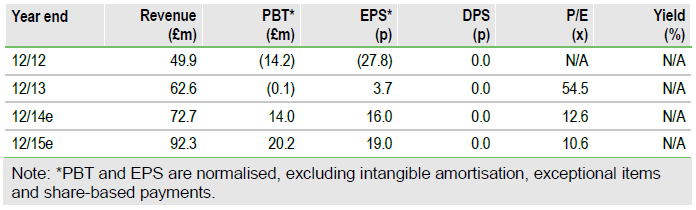

FY13 results saw revenues rise by 25% to £62.6m, with higher than expected flutiform supply chain volumes resulting in the Edison adjusted operating profit being up 9% to £14.5m. Operating cash flow remained strong at £14.4m. Looking ahead, FY14 should see further growth in revenues, with an operating profit increase despite the forecast rise in net R&D spend to £3-6m pa.

Valuation: Raised to £273m, or 260p a share

We value Skyepharma using a DCF model based on detailed revenue projections through to 2024, followed by a terminal value. Factoring in the effect of the fund-raise and bond repayment yields an enterprise value of £281m, which, after netting out the remaining debt, results in an equity value of £273m, or 260p a share. This compares to our previous equity valuation of £87.2m, or 189p per share.

To Read the Entire Report Please Click on the pdf File Below