SKP-2075/SKP-2076: future stars aligning

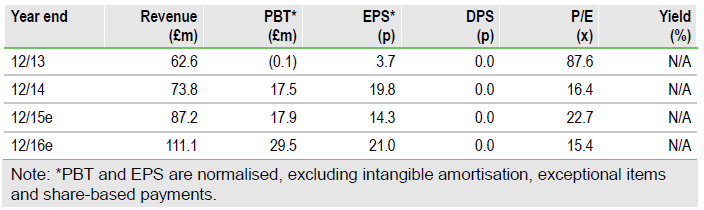

We recently attended Skyepharma's (L:SKP) capital markets day (CMD). Flutiform continues to post strong revenues, contributing directly to margins and underpinning strong growth in cash from operations. Post the CMD we have higher conviction for the potential mid- to long-term contributions from the respiratory assets in development, in particular the groundbreaking SKP-2075 for COPD/smoking asthma with headline Phase II data due in 2017 and SKP 2076, the triple therapy for asthma, which has potential for early partnering. At this stage we maintain our current forecasts but highlight that our 377p/share valuation looks conservative, particularly as we envisage the mid- to long-term earnings story unfolding.

flutiform remains the near-term earnings driver

Revenues from the largest single product, flutiform continue to rise and production capacity is being expanded, with notably positive impacts on the expected contribution from the supply chain. As a result, the company has guided that yearend (December 2015) cash will be ahead of the board’s previous expectations. Importantly, this highlights the operational cash-generating capacity of the business. Additionally, progress is being made on a breath-actuated version of flutiform, along with ongoing clinical trials to support treatment in COPD in Europe and Asia Pacific. All told, approvals for additional indications should result in increased sales and a higher net contribution to margins and cash generation.

SKP-2075 Phase II data potential in 2017

We are encouraged by the scientific rationale behind the development of SKP-2075 for COPD/smoking asthma. Dose ranging and Phase II efficacy/safety studies recruiting > 500 patients are due to begin in 2016 with headline data possible in 2017. SKP-2076, triple therapy inhaler for asthma is expected to move into GMP pilot scale manufacturing in 2016 and has the potential for early partnering in 2016.

To Read the Entire Report Please Click on the pdf File Below