- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Silver Sets Up And Continues To Lead

Another solid week for stocks who are resting but trending upwards and acting as they should still which is a great, great change.

Finally, we’re making money.

We’ve had a sideways market since late 2014 which made it tricky to really make much since trades had to be quick and many just didn’t work but for now, the action is strong and predictable.

The metals are consolidating nicely and ready to move higher in the week ahead now with silver still acting better than gold and leading the charge.

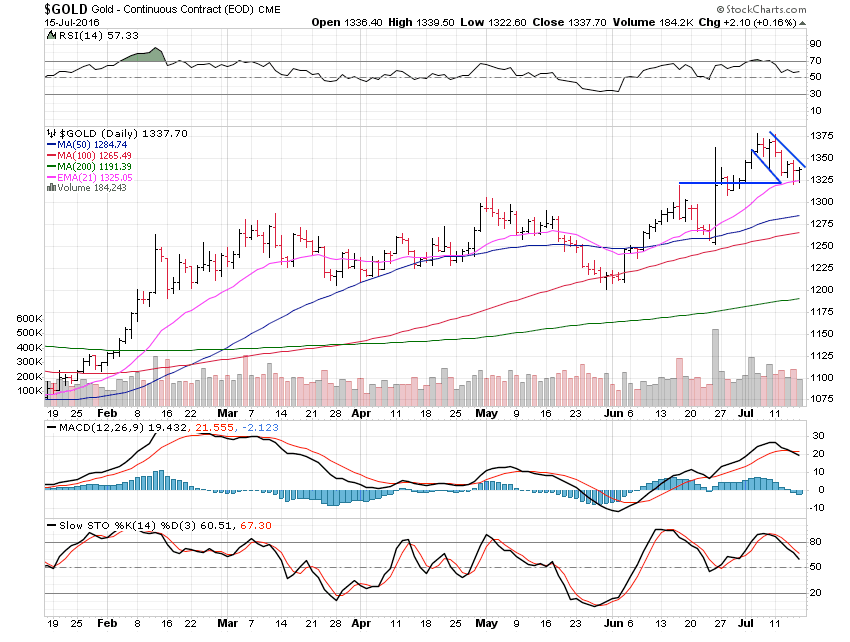

Gold lost 2.17% this past week as it builds a small descending channel.

Gold is holding the 21 day moving average well and starting to turn higher.

I’d look at $1,340 as the buy level out of the descending channel and I’d continue to use weakness to accumulate gold as we are in the early stages of this new up-trending market.

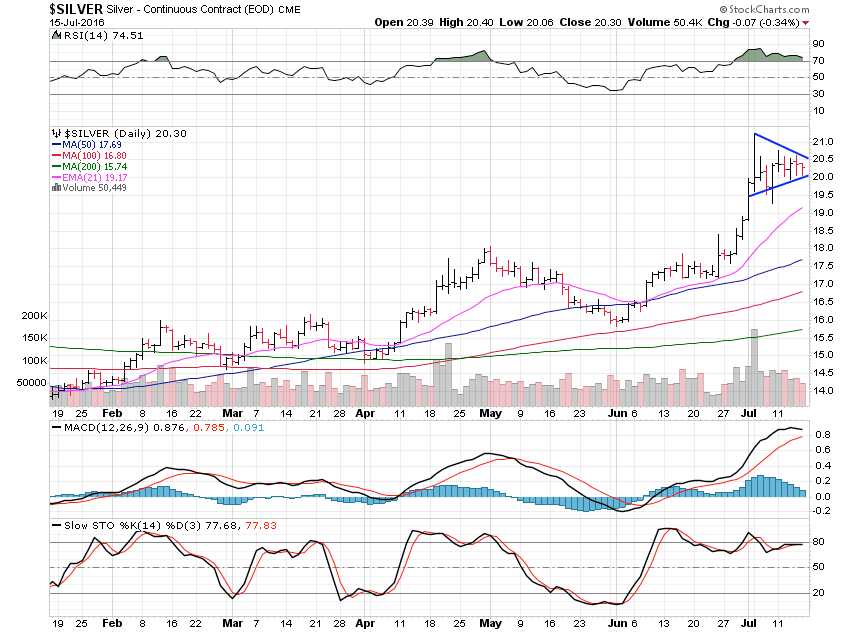

Silver lost just 0.27% and is holding up nicely, much better than gold.

We’ve got a nice triangle continuation pattern now with $20.50 the buy point for the next bump higher as we move to the next major resistance area on the weekly chart at $28.

Palladium gained a solid 5.12% this past week as it continues to trend higher very well in this uptrend channel.

The next major resistance level on the weekly chart remains $690 and we are fast approaching that area where a nice rest of 6 to 8 weeks should be due.

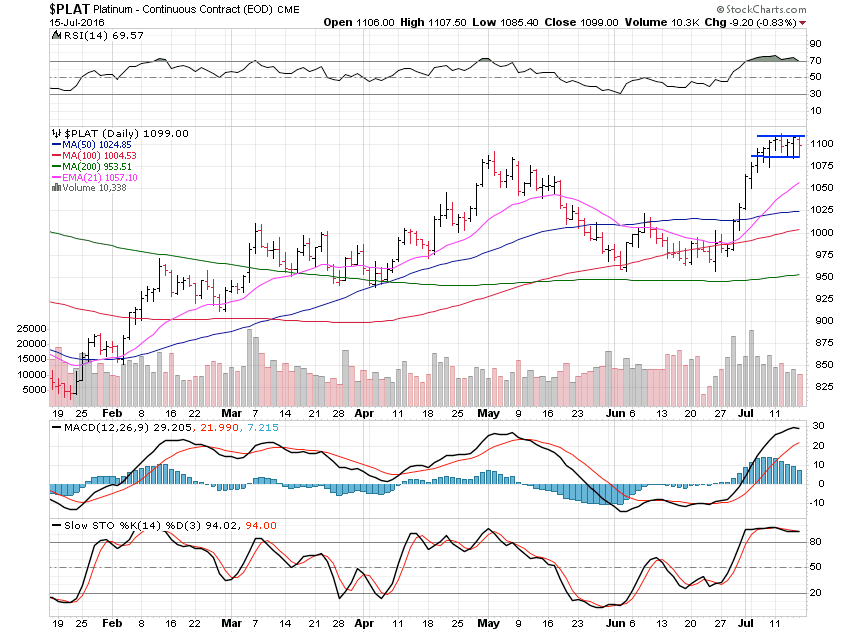

Platinum lost 0.30% this past week as it finishes off building this bull flag pattern which is ready to go anytime now.

$1,112 is now the buy point out of the bull flag as we quickly move to the minor resistance level of $1,170 on the weekly chart.

All in all the metals are acting great while stocks rock.

I hope you’re having a great summer thus far and sitting in the best of the best in terms of stocks and letting them ride while working on your tan and enjoying the sun, as I’m trying my best to do.

Related Articles

Monday’s Daily talked about Biotechnology. I would continue to keep that on your list as today it made a move above price resistance. Yesterday I wrote about Adobe (NASDAQ:ADBE)...

Crude oil has accelerated its decline since the start of the month, testing the area of the lows of the past four years, as fears of a slowing global economy clash with hints from...

Energy prices remain under pressure amid demand concerns, while copper prices get a boost from tariff uncertainty Energy- Brent Breaks Below $70/bbl Sentiment remains negative in...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.