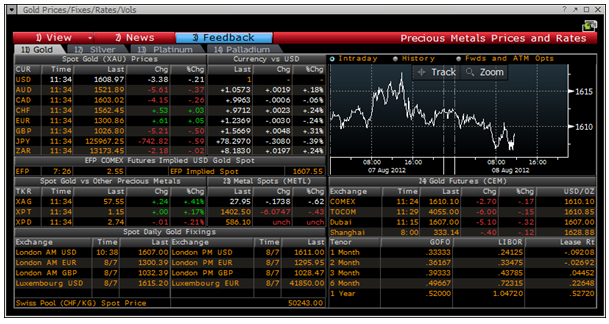

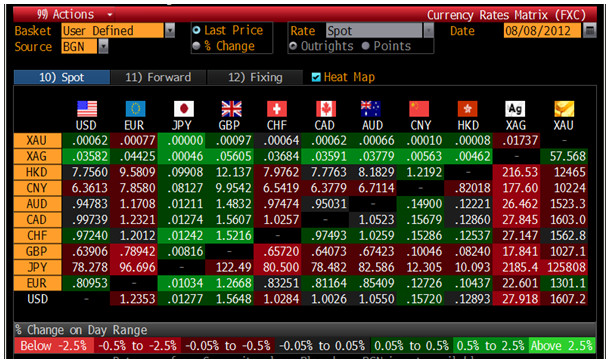

Today's AM fix was USD 1,607.00, EUR 1,298.90, and GBP 1,030.33 per ounce.

Yesterday’s AM fix was USD 1,613.00, EUR 1,300.39 and GBP 1,032.39 per ounce.

Gold climbed $0.40 or 0.02% in New York yesterday and closed at $1,611.60/oz. Silver climbed to $28.21 and dipped again but finished with a gain of 0.68%.

Gold initially traded sideways in Asia then dipped below $1,610/oz but then recovered and has traded in a range between $1,605/oz and $1,610/oz.

Gold edged down on Wednesday on profit taking after sustaining 3 days of gains which saw gold creep slowly above the $1,600/oz level again.

Recent dollar strength and a lack of clarity in the minds of many market participants regarding whether the ECB or the US Federal Reserve Bank will employ more quantitative easing to prevent double dip recessions and even depressions may be partly to blame for gold’s lack of gains recently.

However, the dollar is set to weaken again due to the appalling US fiscal situation and further quantitative easing and money printing on behalf of the FED, ECB and BOE is almost inevitable.

Eric Rosengren, a Boston Fed Bank President, made comments that the US Fed should launch QE3 to prevent recession and ultra ‘dovish’ or uber accommodative monetary policies are set to continue which is bullish for gold.

Other macro data and developments were also gold positive and likely to lead to safe haven demand.

Standard & Poor’s downgraded Greece’s sovereign rating to negative and a Greek default continues to be almost certain – with the attendant risk of contagion in the European and global financial system.

Italy sank further into a recession as its Q2 ranked in 2.5% yearly decline. German industrial orders surprised on the downside for June showing the contagion is not felt by European so called ‘PIIGS’ alone.

The Bank of England has slashed growth forecasts to zero and inflation predictions again. The BOE has been overly optimistic on growth and wrong regarding inflation for some time and looks set to continue to be so.

As long as governments and central banks continue to pile debt upon debt and substitute sovereign debt for financial and banking debt – the crisis will continue.

A proper diagnosis is necessary before applying the right remedy. Central banks continue to deal with the symptoms of the crisis and not the causes. As any doctor will tell you, that is not in the patient's long-term interest and risks making the illness worse – and potentially fatal.

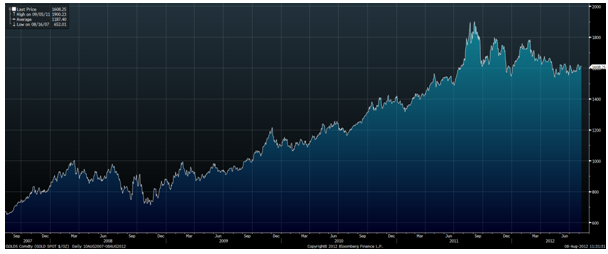

A debt crisis will never be solved by creating more debt. Gold remaining not far from record highs in most fiat currencies shows this and the consolidation of recent months has set the stage for a marked increase in prices in the coming months.

Real diversification remains crucial and those who have allocations to gold will continue to be rewarded.

Silver Market Sees ‘Anomalies’ and ‘Devious Efforts’ - CFTC’s Chilton

The silver market was affected by “devious efforts” to move the price of the precious metal, according to Bart Chilton, a member of the U.S. Commodity Futures Trading Commission, as reported by Bloomberg.

“I continue to believe, consistent with my previous statements and information from the public, that there have been devious efforts related to moving the price of silver,” Chilton said by e-mail today in response to questions from Bloomberg. “There have also been silver and gold market anomalies outside of the silver investigate window that have raised, and continue to raise, market concerns.”

The enforcement division of the Washington-based agency, the main U.S. overseer of derivatives markets, began pursuing allegations of manipulation in the silver market in September 2008.

Investigators have analyzed more than 100,000 documents and interviewed dozens of witnesses, the CFTC said in a November 2011 statement. Chilton said last month the investigation may be completed as early as September.

In a story published Sunday, the Financial Times stated, "A four-year investigation into the possible manipulation of the silver markets looks increasingly likely to be dropped after US regulators failed to find enough evidence to support a legal case.”

The FT based their story on three unidentified people “familiar with the situation."

However, Steve Adamske, a CFTC spokesman, said on the silver investigation that “we will decline to comment because the commission has not decided a course of action on this matter.”

One of the identified targets of the current CFTC silver market investigation has been JP Morgan Chase and some have long voiced concerns that the concentrated short positions held by some banks, including JP Morgan, could allow manipulation of the price and price capping.

This could result in a massive short squeeze which propels prices much higher leading to further massive losses for "too big to fail" and "too big to bail" banks should the small silver market see sharp moves upwards due to the tight physical market.

NEWSWIRE

(Thomson Reuters Gold Forum) – India Gold Demand Slow

India's gold demand at the start of the festival season has been slow with rural buyers staying on the sidelines, preferring to hold on to their cash at a time when deficient monsoon rains threaten to dent their incomes.

(Bloomberg) -- Gold Recovery Seen by Deutsche Bank From More Dollar Weakness

A “meaningful recovery” in gold may occur with further weakness in the dollar, Deutsche Bank AG said.

“We still view the ongoing underfunding in the U.S. external deficit as the dollar’s Achilles heel and one of the factors that could drive gold prices higher,” Michael Lewis, an analyst at Deutsche Bank, said in a report dated today.

(Bloomberg) -- Russia’s First-Half Gold Output Falls 2.4% to 79.2 Metric Tons

Russia’s first-half gold output fell 2.4 percent to 79.2 metric tons, led by a decline at Kinross Gold Corp.’s mine in the Chukotka region, the country’s Gold Producers’ Union said today in a statement.

(Bloomberg) -- Gold in Euros Seen Climbing to All-Time High: Technical Analysis

Gold priced in euros may reach a record in the next six months after sliding toward a support area comprising several key levels including the 200-day moving average, according to a technical analysis from Commerzbank AG.

Gold denominated in euros continues to come off its peak at end-July and is slipping toward 1,283.70 to 1,274.70, an area of support made up of the 55-day moving average, the May-to-August support line, the lows seen in mid-July and the 200-day moving average, technical analyst Axel Rudolph wrote in a report.

Gold priced in the 17-nation currency reached an all-time high of 1,374.76 euros on Sept. 12, 2011, according to Bloomberg data. It peaked this year at 1,344.39 euros on Feb. 22, Bloomberg data show. Support levels are marked by clusters of buy orders, according to technical analysts, who say that past moves may be used to predict trends.

The long-term resistance at 1,325.30, made by a straight downward sloping line joining the September and February peaks, is expected to give way before the end of September with an advance towards the highs in February then being “on the map,” Rudolph wrote in a report dated yesterday.

“While trading above the 200-day moving average, our medium term outlook will remain bullish,” he wrote. “A new all-time high above that seen in 2011 is expected to be seen within the next half year or so.”

Bullion is poised to extend an 11th year of gains on expectations that central banks around the world will add further stimulus to boost economic growth hurt by Europe’s debt crisis. Euro-denominated bullion traded at 1,299.20 an ounce at 11:42 a.m. in Singapore, while gold priced in dollars was at $1,610.15 an ounce.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Silver Market Sees ‘Anomalies’ And ‘Devious Efforts’

Published 08/08/2012, 08:40 AM

Updated 07/09/2023, 06:31 AM

Silver Market Sees ‘Anomalies’ And ‘Devious Efforts’

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.