- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Should You Buy Macy's (M) Ahead Of Earnings?

Shares of Macy’s Inc. (NYSE:M) gained more than 1.2% in morning trading Monday, less than one day before the retail giant is scheduled to post its latest quarterly earnings report. Macy’s serves as an important bellwether for mall-based retailers and department store brands, so investors will want to pay close attention when the company reports on Tuesday morning.

Macy’s is one of the nation’s top retailers, operating about 860 stores throughout the country. The company owns stores under the names of Macy's, Bloomingdale's, Bloomingdale's Outlet and Bluemercury, as well as the macys.com, bloomingdales.com and bluemercury.com websites.

Shares of Macy’s have gained more than 27% over the past three months, meaning that the pressure will be on the company to deliver solid results. But what does Macy’s have in store? Let’s take a closer look.

Latest Outlook

Based on our latest consensus estimates, we expect Macy’s to report adjusted quarterly earnings of $2.69 per share and revenues of $8.71 billion. These results would represent growth of 33.2% and 2.3%, respectively.

Full-year earnings are projected to come in at $3.63 per share, up from about 16.2% from the previous year. Macy’s said that it expects sales on an owned basis to decline between 2.2 % and 3.3%, with comparable sales on an owned plus licensed basis to decline between 2.0% and 3.0%.

Earnings ESP

Investors will also want to anticipate the likelihood that Macy’s surprises investors with better-than-anticipated earnings results. For this, we turn to our Earnings ESP figure.

Zacks Earnings ESP (Expected Surprise Prediction) looks to find earnings surprises by focusing on the most recent analyst estimates. This is done because, generally speaking, when an analyst posts an estimate right before an earnings release, it means that they have fresh information which could potentially be more accurate than what analysts thought about a company two or three months ago.

A positive Earnings ESP paired with a Zacks Rank #3 (Hold) or better ranking helps us feel confident about the potential for an earnings beat. In fact, our 10-year backtest has revealed that this methodology has accurately produced a positive surprise 70% of the time.

Just one day before its report, M is sporting a Zacks Rank #2 (Buy), but its Earnings ESP sits at -0.6%. This is because the company’s Most Accurate Estimate for earnings sits at $2.67 per share, meaning that the most recent analyst estimates have been lower than the consensus.

Despite the stock’s strong Zacks Rank, our model does not conclusively indicate that we are in store for a beat.

Price Performance and Surprise History

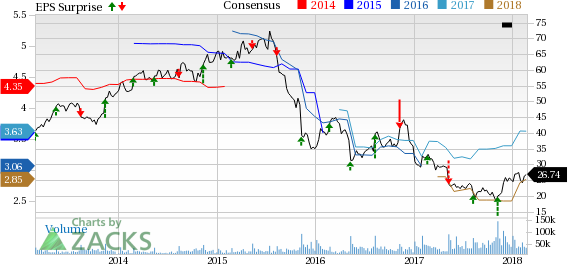

Another important thing to consider ahead of M’s report is the company’s history of earnings surprises and the effect that these surprises have had on share prices.

Macy’s has surpassed the Zacks Consensus Estimate in two-consecutive quarters, but the retailer does not have the most rock-solid earnings surprise history. We have witnessed periods of positive momentum in the wake of the company’s recent beats, and earnings misses have been met with periods of sluggishness over the past few years.

One final thing to consider is that Macy’s is currently trading about 21% lower than its 52-week high, so the stock probably has a good amount of room to run higher if its report impresses. However, the stock’s climb in recent weeks also presents downside potential.

Want more market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Macy's Inc (M): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.