Selecting for value and growth in Asia

Schroder Asia Pacific Fund (LONDON:SDP) aims to achieve long-term capital growth by investing in companies across Asia, excluding Japan. Matthew Dobbs has managed the portfolio since launch in 1995 focusing on individual stock selection supported by Schroder's considerable Asian research resource. A bias towards value can prompt some contrarian positions while ‘real’ growth stocks such as Baidu also have a place in the fund. Performance has been ahead of the benchmark since inception and over most periods, with a notable pick-up in absolute and relative performance over the last year.

Investment strategy: Seeking insights

The manager selects a portfolio of 70-90 stocks primarily on a bottom-up basis drawing on ideas generated by the in-house analyst team, but also with an awareness of the macro environment. A key characteristic of the investment process is the emphasis on gaining insights into businesses and identifying when these have not already been recognised by the market. Dobbs seeks companies with visible earnings growth and sustainable returns above their cost of capital trading at an attractive price. Dobbs is aware of the MSCI AC Asia ex-Japan benchmark weightings but is not driven by them; the trust has a high active share (only 22.1% direct overlap with the benchmark at end February) and 38.2% of the stocks held were outside the index.

Market outlook: Relative value and growth

Asian equity markets have lagged the world market since 2011, primarily reflecting the sustained strength of the US market. There are signs this year that this trend may have run its course, with markets increasing their focus on the timing of US rate increases and the pace of its economic growth. Asian growth prospects are a source of uncertainty as well, particularly in China, but on a longer view are still expected to outpace advanced countries significantly. Valuations in Asia are now standing at a significant discount to the world market (see page 3), suggesting that relative value exists while a selective fund can aspire to pick out genuine opportunities and gauge country allocations prudently.

Valuation: Stable discount, could narrow

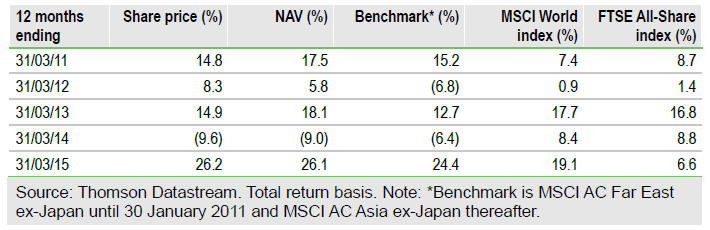

SDP trades at a discount to NAV of c 7.5%, modestly below its three- and five-year averages and in line with the board’s indication that it will seek to maintain the discount at this level or below, subject to review. Given the performance record and potential for sentiment towards the region to improve, there may be scope for the discount to narrow from here.

To Read the Entire Report Please Click on the pdf File Below