The gradual improvement in the economy and the job market is hurting demand for higher education and thereby enrolment trends of for-profit schools. However, education companies are deploying strategies to attract students. These initiatives are focused on improving the affordability of the programs, upgrading the programs regularly, and ensuring that the students complete their graduation. Companies are reaching out to students with new campuses and online programs to enhance accessibility. However, there is still an unwillingness among the student community to enroll in academic programs and take loans to fund them.

According to our Earnings Preview report, 86.6% of the companies in the S&P 500 index have already reported their second-quarter results. Of these, 70.7% have surpassed earnings estimates and 52.7% beat revenue expectations.

Among the education companies that reported last week, Universal Technical Institute, Inc. (NYSE:UTI) reported an operating loss with revenues declining 3.3% due to weak enrolment trends. However, its loss per share was narrower than the Zacks Consensus Estimate. This automotive technician training company once again cut its outlook for enrolments and sales. Grand Canyon Education, Inc. (NASDAQ:LOPE) reported better results, delivering a positive earnings surprise. Its sales increased 9.5% while operating income rose 5.9%.

Two more companies from the education sector are set to report their quarterly results on Aug 9. Let's see how things are shaping up for their respective announcements.

K12, Inc. (LRN)

K12, Inc. posted a positive surprise of 19.35% in the last reported quarter. The company has beaten estimates in two of the past four quarters, resulting in an average positive surprise of 23.36%.

The company has an Earnings ESP of 0.00% and a Zacks Rank #3 (Hold). The Zacks Consensus Estimate for the fourth-quarter of fiscal 2016 is pegged at 13 cents.

American Public Education, Inc. (NASDAQ:APEI)

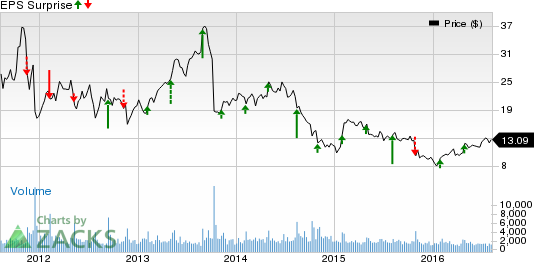

American Public Education, Inc. (APEI) is an online provider of higher education, focused primarily on serving the military and public service communities.

Last quarter, American Public delivered a positive earnings surprise of 42.22%. The company surpassed estimates in three of the trailing four quarters with an average positive surprise of 20.58%.

The company has an Earnings ESP of 0.00% and a Zacks Rank #3. The Zacks Consensus Estimate for the quarter is pegged at 39 cents per share.

Don’t miss out on our full earnings release articles for these school stocks, as the actual results might hold some surprises!

AMER PUB EDUCAT (APEI): Free Stock Analysis Report

SNYDERS-LANCE (LNCE): Free Stock Analysis Report

UNIVL TECH INST (UTI): Free Stock Analysis Report

GRAND CANYON ED (LOPE): Free Stock Analysis Report

Original post

Zacks Investment Research