- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

GBP/USD: Pound Surges As BOE Hints At Rate Hike

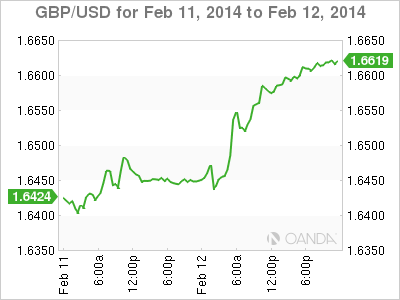

The GBP/USD has shot higher in Wednesday trade, as the pair trades in the high-1.65 range in the North American session. In economic news, the BOE said it may have to raise rates in 2015. It's a quiet day in the US, with no major releases on the schedule.

The BOE Governor Mark Carney has done his best to dampen speculation about a rate hike in recent months, but with the UK economy continuing to improve, he was forced to change his stance. On Wednesday, Carney said that the central bank may have to raise interest rates in the second half of 2015 to keep inflation in check. The BOE also sharply revised up its forecast for the next three years, and added that inflation, which has fallen faster than expected, should remain close to the 2% target. The positive news was just the tonic the pound needed, and the currency has responded by jumping about 150 points against the dollar on Wednesday.

Fed chair Janet Yellen, who just started her new job on February 1, didn't generate much excitement in her appearance before Congress on Tuesday. She said that the Fed plans to continue trimming QE, provided that the employment picture continues to improve and inflation rises. She acknowledged that event though the unemployment rate has improved steadily, the recovery in the labor market is far from complete. Meanwhile, JOLTS Job Openings, a key event, showed little change in January, with a reading of 3.99 million. This was short of the estimate of 4.04 million.

GBP/USD for Wednesday, February 12, 2014

GBP/USD February 12 at 16:25 GMT

GBP/USD 1.6582 H: 1.6587 L: 1.6426

GBP/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.6329 | 1.6416 | 1.6549 | 1.6705 | 1.6896 | 1.6964 |

- GBP/USD has posted strong gains in Wednesday trading. The pound barreled past the 1.65 line in the European session and is within striking distance of the 1.66 line in North American trade.

- 1.6549 has reverted to a support role as the pound surges higher. This is followed by support at 1.6416.

- 1.6705 is the next resistance line. There is stronger resistance at 1.6896, which has remained firm since August 2009.

- Current range: 1.6549 to 1.6705.

Further levels in both directions:

- Below: 1.6549, 1.6416, 1.6329, 1.6231 and 1.6125

- Above: 1.6705, 1.6896, 1.6964 and 1.7087

OANDA's Open Positions Ratio

The GBP/USD ratio has reversed directions on Wednesday, pointing to gains in short positions. With the pound posting huge gains on the day, numerous long positions have been covered, resulting in a larger percentage of open short positions. A large majority of the open positions in the GBP/USD ratio are short, indicative of a trader bias towards the dollar recovering from its sharp slide.

The pound has jumped about 150 points on Wednesday, following remarks by the BOE about a possible rate hike next year. The dollar remains under pressure in the North American session.

GBP/USD Fundamentals

- 10:00 British CB Leading Index. Actual -0.1%.

- 10:30 BOE Inflation Report.

- 10:30 BOE Governor Mark Carney Speaks.

- 15:00 US Crude Oil Inventories. Estimate 2.5M. Actual 3.3M.

- 18:01 US 10-year Bond Auction.

- 19:00 US Federal Budget Balance. Estimate -16.4B.

Related Articles

The Canadian dollar is calm in the European session, trading at 1.4438, up 0.02% on the day. Later today, Canada releases GDP and the US publishes the Core PCE Price...

USD/CAD recoups drop below EMAs as March tariffs become reality Technical indicators suggest quick rebound is fragile; focus on 1.4470 USD/CAD made a strong comeback just when...

In response to criticism of tariff 'confusion', President Trump stepped in emphatically yesterday to announce that tariffs would be going ahead on Canada, Mexico, and China next...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.