- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Rudolph Technologies (RTEC) Soars To A 52-Week High, Time To Cash Out?

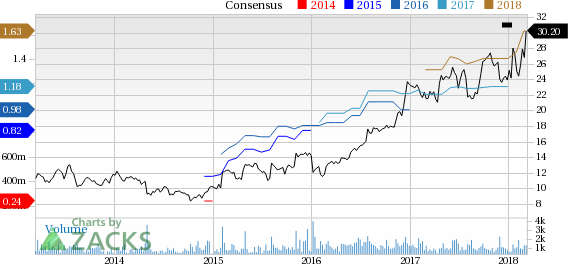

Have you been paying attention to shares of Rudolph Technologies, Inc. (NYSE:RTEC) ? Shares have been on the move with the stock up 26.1% over the past month. RTEC hit a new 52-week high of $30.25 in the previous session. Rudolph Technologies has gained 26.36% since the start of the year compared to the 9.16% move for the Computer and Technology sector and the 15.09% year-to-date return for its peer group.

What's Driving the Outperformance?

The stock has an impressive record of positive earnings surprises, having beaten the Zacks Consensus Estimate in each of the last four quarters. In its last earnings report on February 1, 2018, Rudolph Technologies reported EPS of $0.29 versus the Zacks Consensus Estimate of $0.26 while it missed the consensus revenue estimate by 1.88%.

For the current fiscal year, Rudolph Technologies is expected to post earnings of $1.47 per share on $285.23 million in revenues. This represents a 34.71% change in EPS on a 11.81% change in revenues.

Valuation Metrics

While RTEC has moved to its 52-week-high in the recent past, investors need to be asking, what is next for the company? A key aspect of this question is taking a look at valuation metrics in order to determine if the company is due for a pullback from this level.

On this front, we can look at the Zacks Style Scores, as these give investors a variety of ways to comb through stocks (beyond looking at the Zacks Rank of a security). These styles are represented by grades running from A to F in the categories of Value, Growth, and Momentum, while there is a combined VGM Score as well. The idea behind the style scores is to help investors pick the most appropriate Zacks Rank stocks based on their individual investment style.

Rudolph Technologies, Inc. has a Value Score of D. The stock's Growth and Momentum Scores are A and C, respectively, giving the company a VGM Score of B.

In terms of its value breakdown, the stock currently trades at 20.54x current fiscal year EPS estimates. On a trailing cash flow basis, the stock currently trades at 24.19x versus its peer group's average of 17.05x. Additionally, the stock has a PEG ratio of 2.05. This isn't enough to put the company in the top echelon of all stocks we cover from a value perspective.

Zacks Rank

We also need to look at the Zacks Rank for the stock, as this supersedes any trend on the style score front. Fortunately, Rudolph Technologies, Inc. currently has a Zacks Rank of #2 (Buy) thanks to favorable earnings estimate revisions from covering analysts.

Since we recommend that investors select stocks carrying Zacks Rank of 1 (Strong Buy) or 2 and Style Scores of A or B, it looks as if Rudolph Technologies meets the list of requirements. Thus, it seems as though RTEC shares could still be poised for more gains ahead.

Rudolph Technologies, Inc. (RTEC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.