- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Rockwell Automation (ROK) Tops Q1 Earnings, Revises Outlook

Rockwell Automation Inc. (NYSE:ROK) reported adjusted earnings per share of $1.96 in first-quarter fiscal 2018 (ended Dec 31, 2017), up 12% from $1.75 recorded in the prior-year quarter. The year-over-year performance was driven by elevated sales, partially offset by higher investment spending. Earnings also surpassed the Zacks Consensus Estimate of $1.74.

Including one-time items, the company recorded a loss of $1.84 per share, compared to earnings of $1.65 per share reported in the year-ago quarter.

Total revenues came in at $1.59 billion in the quarter, up 6.5% year over year. Revenues, however, missed the Zacks Consensus Estimate of $1.60 billion. Organic sales rose 5.3%. Foreign currency translations boosted sales by 2.5%, while divestitures in the prior year reduced sales by 1.3%.

Operational Update

Cost of sales increased 4.9% year over year to $889.5 million. Gross profit inched up 0.6% to $697 million from $642 million reported in the year-ago quarter. Selling, general and administrative expenses flared up 5.2 % to $389.3 million.

Consolidated segment operating income was $355.5 million, up 12.3% from $316.6 million recorded in the prior-year quarter. Segment operating margin was 22.4% in the reported quarter, a 120-basis-point expansion from the year-earlier quarter due to higher sales, partially offset by higher investment spending.

Segment Results

Architecture & Software: Net sales rose 7.3% year over year to $746.9 million in the fiscal first quarter. Organic sales were up 4.6% and currency translation bolstered sales by 2.7%. Segment operating earnings were $224.6 million compared with $208.6 million recorded in the prior year. Segment operating margin was 30.1% compared with 30.0% witnessed in the year-ago quarter.

Control Products & Solutions: Net sales climbed 5.8% to $839.7 million in the reported quarter. Organic sales increased 5.9%, currency translation boosted sales by 2.3%, and the prior-year divestiture reduced sales by 2.4%. Segment operating earnings increased 21% to $131 million from $108 million in the year-ago quarter. Segment operating margin came in at 15.6% compared with 13.6% recorded in the prior-year quarter.

Financials

As of Dec 31, 2017, cash and cash equivalents were $1,547 million, up from $1,411 million as of Sep 30, 2017. As of Dec 31, 2017, total debt was $2,079 million, up from $1,844 million as of Sep 30, 2017.

Cash flow from operations came in at $212.7 million in the reported quarter compared with $310.8 million recorded in the year-ago quarter. Return on invested capital was 40.8% as of Dec 31, 2017, up from 34.6% as of Dec 31, 2016.

During the fiscal first quarter, Rockwell Automation repurchased 1.1 million shares for $208.6 million. As of Dec 31, 2017, $399.8 million remained available under the Apr 6, 2016 share repurchase authorization. On Jan 15, 2018, the board of directors authorized the company to expend up to an additional $1 billion to repurchase shares.

Guidance

Rockwell Automation revised its fiscal 2018 guidance. The company raised its adjusted EPS guidance to the range of $7.60-$7.90 from the prior band of $7.20-$7.50. However, the company lowered its reported sales growth outlook range to 4.5-7.5% from the previous range of 5-8%.

Rockwell Automation expects to benefit from expanded product offering and strong customer relationships. Its strategic focus on the Connected Enterprise and substantial investments in technology will steer growth. The company is well positioned to benefit from attractive opportunities in the industrial automation and information market.

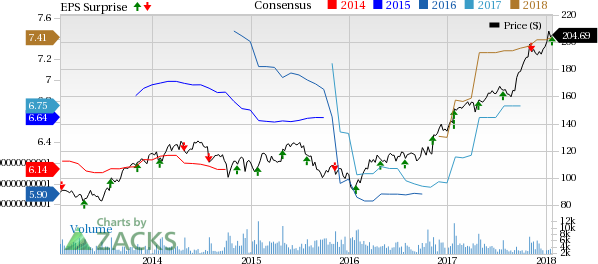

Share Price Performance

Rockwell Automation's shares have underperformed the industry in the past year. The company’s shares have appreciated 33.8%, while the industry recorded 34.1% growth.

Zacks Rank & Key Picks

Rockwell Automation currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the same sector are iRobot Corporation (NASDAQ:IRBT) , Deere & Company (NYSE:DE) and TriMas Corporation (NASDAQ:TRS) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

iRobot Corporation has a long-term earnings growth rate of 20%. Its shares have gained 4.3%, over the past six months.

Deere has a long-term earnings growth rate of 8.2%. The company’s shares have rallied 31.8% during the same time frame.

TriMas Corporation has a long-term earnings growth rate of 5%. The stock has gained 26.2% in six months’ time.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Rockwell Automation, Inc. (ROK): Free Stock Analysis Report

iRobot Corporation (IRBT): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

TriMas Corporation (TRS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.