- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

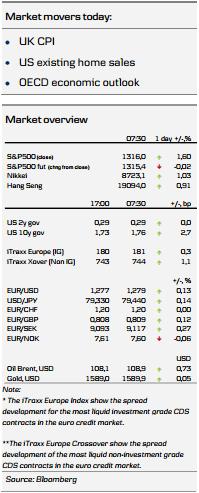

Risk Appetite Improves Slightly With Equities Up In The US And Asia

- Risk appetite improved a bit yesterday with equities up in the US and Asia.

- EU diplomats are planning "project bonds" according to FT.

- Focus today will be on UK CPI and US existing home sales.

Markets Overnight

Risk appetite improved a bit yesterday after the strong sell-off last week. The news flow overnight has been relatively quiet with focus turning to Wednesday's informal EU summit and the long list of activity indicators that will be released on Thursday.

FT reports that diplomats have approved the formation of so-called "project bonds." The amount is small so far and only EUR 230m in EU funds will be allocated through 2013 to back the bonds. The money should be spent on cross-border infrastructure investments and is highly symbolic. FT writes that the "growth compact" will also include increased funding for the European Investment Bank for infrastructure projects and speeding up the disbursement of EU development funds with focus on the poorer regions. These issues are likely to be discussed at Wednesday's informal summit but we should not expect a fully-fledged plan until the summit on 28 June.

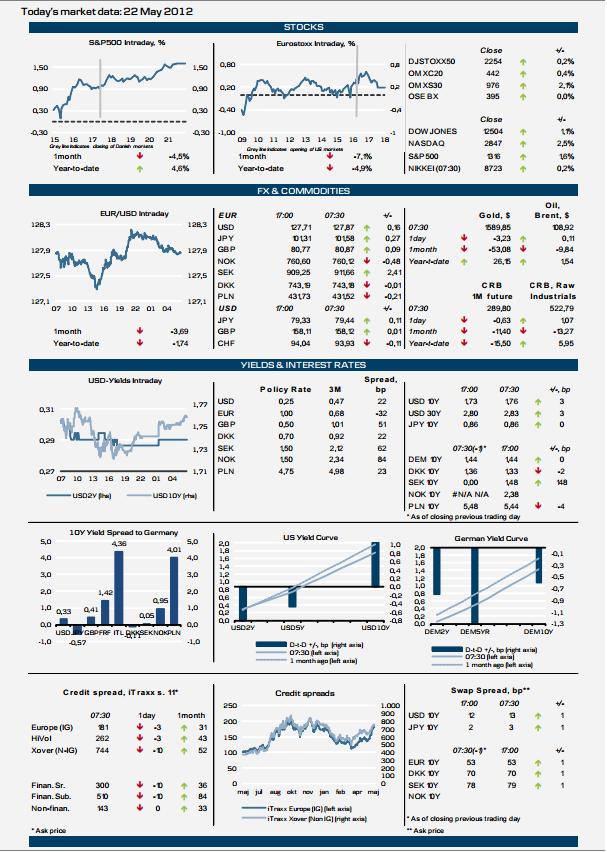

The improved sentiment from the European trade carried over to the US equities. The S&P500 ended the trade up 1.6% after six days with decreases. The S&P future has decreased slightly in Asian trading. In Asia stock indices are trading in positive territory this morning. Nikkei is up by 1.0%, while Hang Seng is up by 0.9%.

US bond yields increased slightly on improved sentiment. In FX markets EUR/USD has climbed back above 1.28 overnight but this morning the cross is trading just below 1.28 again.

Greece remains the centre of attention and yesterday the German and French Finance Ministers repeated their call for Greece to stay in the euro. Based on the most recent polls it appears that it will be a very close call between Syriza and the New Democracy on who will become the biggest party (and win the 50 bonus mandates) in the second election round. While waiting for the Greek election on 17 June we are likely to see continued high uncertainty and stress in the markets and things are likely to get worse before they get better in our view. Yesterday, we noted that Greek chaos continues but a solution can ultimately found in which we look at three different post-election scenarios. We are in for a long period of uncertainty but we believe that ultimately a deal will be struck between the EU/IMF and Greece that keeps Greece in the euro and austerity will continue. The alternative is too severe for both the EU and Greece.

Fixed income markets: In our view the focal point this week is the EU summit tomorrow. There appears to be growing discontent with the German view on austerity. Southern European countries will try to push harder for a growth agenda but the truth is there is little they can do through fiscal policies that can boost demand. In our view the key to unleashing growth in Europe is monetary rather than fiscal. With the effects of the 3Y LTROs fading, there is a growing need for the ECB to increase support to the markets. This is however not that likely to happen in other forms than verbally in the near term.

US Treasurys and German Bunds should therefore be able to continue to perform, while Spanish and Italian 10-year yields are likely to continue to climb towards 7%. Overall market conditions are expected to worsen further ahead of the Greek election in four weeks' time. Today the Netherlands is coming to the market with a tap of up to EUR3.5bn of 0.75% 2015 bonds.

FX markets: This morning EUR/USD fell below 1.28 again after a strong correction higher last night from 1.2725 to 1.2820. Near-term development remains highly uncertain and it is all about risk-off at the moment. Hence, look out for downside to EUR/USD, EUR/GBP and the cyclical and commodity-sensitive currencies. Speculation about a new boost of stimulus measures is likely to keep demand for JPY limited today as Bank of Japan starts its two-day rate-setting meeting.

We have seen support for USD/JPY below 80 and as long as deflation continues intervention fears will re-emerge when USD/JPY trades around 79. Yesterday EUR/DKK continued to decline and dropped below 7.4320 for the first time since February. It is now trading at or close to levels that earlier have triggered intervention from the Spanish central bank and the possibility of an independent rate cut is increasing day by day.

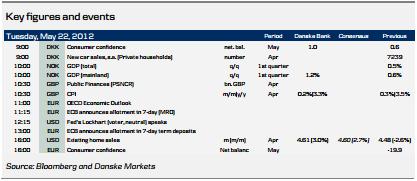

Scandi

The most important economic data from Norway this week will be the GDP figures for Q1. The regular data releases have shown that economic growth has accelerated in the opening months of 2012. Strong private consumption has been the prime driver here, although leading indicators such as PMI and the Regional Network show that the upswing is broadly based, with oil-related businesses, service industries and the construction sector all performing strongly. This is supported by employment growth that also appears to have been solid in the early part of the year. We therefore expect that mainland GDP grew 1.2% q/q in the first quarter, which would be well above trend growth (roughly 0.75%). It would also be significantly higher than Norges Bank‟s (central bank) estimate in its Monetary Policy Report 1/12 from March, thus underlining the risk of allowing exchange rates to determine monetary policy.

Disclosure

This research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank").

Analyst certification

Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research an alyst’s personal view about the financial instruments and issuers covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report.

Regulation

Danske Bank is authorized and subject to regulation b y the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Services Authority (UK). Details on the extent of the regulation by the Financial Services Authority are available from Danske Bank upon request.

The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts’ rules of ethics and the recommendations of th e Danish Securities Dealers Association.

Conflicts of interest

Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and independence. These procedures are documented in the research policies of Danske Bank. E mployees within the Danske Bank Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to the Research Management and the Compliance Department. Danske Bank Research Departments are organised independently from and do not report to other business areas within Danske Bank.

Research analysts are remunerated in part based on the over -all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate finance or debt capital transactions.

Financial models and/or methodology used in this research report

Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be obtained from the authors upon request.

Risk warning

Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis

of relevant assumptions, are stated throughout the text.

Expected updates

Danske Daily is updated on a daily basis.

First date of publication

Please see the front page of this research report for the first date of publication. Price-related data is calculated using the closing price from the day before publication.

General disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a soli citation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.

Disclaimer related to distribution in the United States

This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S. Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to “U.S. institutional investors.”

Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction.

Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission.

Related Articles

The central bank’s job is never easier, but in the current climate, it’s unusually tricky. In addition to the usual challenges that complicate real-time monetary policy decisions,...

At age 94, Warren Buffett can still formulate a shareholder letter like no other. His humility, candor, and wisdom is special. I always make it a point to read these because you...

The EU’s most costly budgets, bitcoin’s market swings, and rising US bankruptcies. Each week, the Syz investment team takes you through the last seven days in seven charts. 1. The...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.