- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

RH Q3 Earnings Meet Estimates, Membership Model Bodes Well

RH (NYSE:RH) reported strong third-quarter results despite the adverse effect of hurricanes Harvey and Irma on Dec 5, after market close. The new membership model (RH Members Program) is improving its brand image, streamlining operations and enhancing customer experience. The company’s efforts to redesign its supply chain network and rationalize product offerings also bode well.

RH reported third-quarter fiscal 2017 earnings per share of $1.04, reflecting a substantial a improvement compared from the prior-year quarter’s 20 cents. Also, earnings were in line with the Zacks Consensus Estimate.

Revenues increased 8% to $592.5 million. Revenues surpassed the Zacks Consensus Estimate of $599.2 million by 1.1%. RH’s comparable brand revenues increased 6% year over year, against 6% decline in the prior-year quarter. The company’s direct revenues increased 3% and store revenues rose 12% from the year-earlier quarter.

Margins

Adjusted operating income in the reported quarter improved from the prior-year figure of $18.1 million to $48 million. Adjusted operating margin expanded 480 basis points (bps) to 8.1%. Adjusted gross profit came in at $218.6 million, up 23.1% year over year. Adjusted gross margin improved 460 bps to 34.1%.

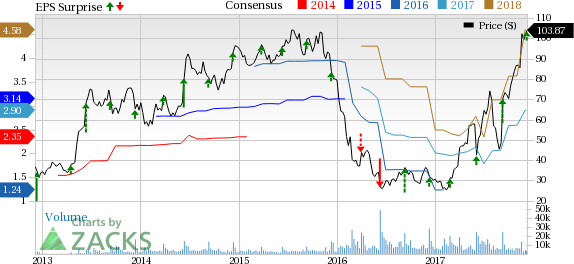

Restoration Hardware Holdings Inc. Price, Consensus and EPS Surprise

Store Update

As of October 2017, RH operated 84 retail galleries, slightly lower than 85 in the prior-year quarter. These included 48 legacy galleries, six large format galleries, nine next generation design galleries, one RH Modern Gallery and five Baby & Child galleries in the United States and Canada, and 15 Waterworks showrooms in the United States and the U.K.

Balance Sheet

RH had cash and cash equivalents of $22.2 million as on Oct 28, 2017, compared with $87.0 million as on Jan 28, 2017. The company ended the quarter with merchandise inventories worth $557.3 million, compared with $752.3 million as on Jan 28, 2017.

Fourth-Quarter Outlook

Revenues are projected in the $655 million to $680 million range.

Adjusted net income is expected in the $37 million to $41 million range.

Fiscal 2017 Outlook

The company expects adjusted net income in the $83 million to $87 million band (previously $70-$77 million).

Net capital expenditures are expected in the $120 million to $130 million band.

Free cash flow is anticipated in the $420 million to $440 million range.

Preliminary 2018 Outlook

Net revenues are expected in the $2.58 billion to $2.62 billion range.

Adjusted operating margin is anticipated in the range of 9% to 10%.

Adjusted net income of $125 million to $145 million is expected in 2018.

Net capital expenditures are projected in the range of $65 million to $75 million.

Free cash flow is anticipated in excess of $240 million.

Zacks Rank & Other Key Picks

RH carries a Zacks Rank #2 (Buy).

Other top-ranked stocks in the Retail-Wholesale sector include Arcos Dorados Holdings Inc. (NYSE:ARCO) , Alibaba Group Holding Limited (NYSE:BABA) and Boot Barn Holdings, Inc. (NYSE:BOOT) .

All the companies carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Arcos Dorados is likely to witness 16.2% earnings growth in 2017.

Full-year 2017 earnings for Alibaba Group are expected to increase 52.7%.

Boot Barn Holdings is expected to see 10.6% growth in fiscal 2018 earnings.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO): Free Stock Analysis Report

Restoration Hardware Holdings Inc. (RH): Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.