- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Rexnord (RXN) To Gain From Buyouts, Solid Segmental Business

We issued an updated research report on Rexnord Corporation (NYSE:RXN) on Mar 12. The company’s earnings are projected to grow 12.40% in the next three to five years.

This machinery company has a Zacks Rank #1 (Strong Buy) and a market capitalization of approximately $3.2 billion.

Let’s delve deeper and discuss why investors should consider adding Rexnord’s stock to their portfolio.

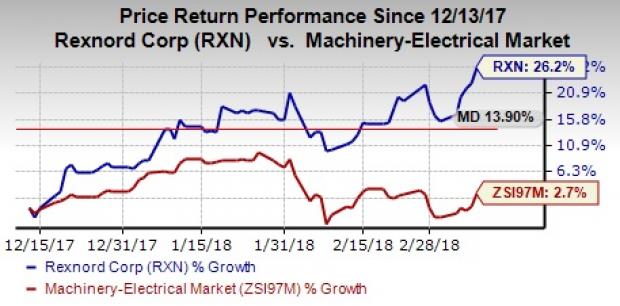

Share Price Performance and Earnings Estimates Revision: Rexnord’s financial performance has been impressive in the last four quarters, with an average positive earnings surprise of 12.55%. In the last quarter, the company’s earnings and sales topped the Zacks Consensus Estimate by 37% and 2%, respectively. In the last three months, market sentiments have been positive for Rexnord, with its shares yielding 26.2%. This hike clearly outpaces 2.7% growth recorded by the industry it belongs to.

Underpinning the favorable sentiments reflects positive revisions in earnings estimates for the stock. In the last 60 days, seven brokerage firms have raised estimates both for fiscal 2018 (ending March 2018) and 2019 (ending March 2019). Currently, the stock’s Zacks Consensus Estimate is pegged at $1.34 for fiscal 2018 and $1.72 for fiscal 2019, representing growth of 7.2% and 11.7% from their respective tallies, 60 days ago.

Healthy Business Prospects: Rexnord currently operates in two business segments — Process and Motion Control, and Water Management. Globally recognized brands in the Process and Motion Control segment are Rexnord, Rex, Falk and Link-Belt while brands in the Water Management segment are Zurn, Wilkins, VAG, GA, Rodney Hunt and Fontaine. These products are used in various industries like mining, food & beverage, aerospace, non-residential construction and global water infrastructure.

For fiscal 2018, the company anticipates strengthening demand from global food & beverage, global process industries and global commercial aerospace end markets to benefit Process & Motion Control segment. Further, industrial distribution business in the United States & Canada, Europe and Rest of the World will grow. For the Water Management segment, healthy demand from non-residential and residential construction markets of the United States and Canada, as well as water and wastewater infrastructure markets of China and Rest of the World will be beneficial.

Inorganic Activities — Key to Profitability Enhancement: Over time, acquired assets have helped Rexnord leverage benefit from easy penetration into markets and expanded product offerings. Meanwhile divestments of non-strategic business have aided better usage of resources and profitability improvement. In this regard, the acquisition of Cambridge International Holdings and divestiture of non-strategic RHF product line in fiscal 2017 are worth mentioning.

The company efforts continued in fiscal 2018 as well. In the third quarter, the company acquired World Dryer Corporation. The World Dryer’s hand dryers strongly complement Water Management segment’s Zurn business. The combined businesses will offer superior products to commercial building owners. In the fourth quarter, the company completed the buyout of Centa Power Transmission, to be integrated with the Process and Motion Control segment. This asset will create new business opportunities in the couplings market and is anticipated to enhance Rexnord’s revenue generation capability by approximately $100 million.

Solid Near-Term Prospects, Long-term Targets: Rexnord believes that its business segments will benefit from synergistic benefits from acquired assets in fiscal 2018. Moreover, its digital enterprise strategy, DiRXN — this platform integrates innovative Industrial Internet of Things and e-commerce technologies to help customers to improve productivity — will enhance performance of the Process & Motion Control segment. Also, the company stands to gain from its supply-chain optimization and footprint-repositioning programs.

Core sales in the year are anticipated to grow in mid-single digits (higher than the previous expectation of low-to-mid single digits). Adjusted earnings before interest, tax, depreciation and amortization (EBITDA) are projected to be $381-$387 million (above $375-$385 million expected earlier).

Over the long term, Rexnord targets core growth to be in mid-single-digit and profit margin to be roughly 30%. Free cash flow is predicted to be in excess of net income. Adjusted EBITDA margin is expected within 30-35% and 20-25% for the Process & Motion Control and Water Management segments, respectively.

Other Stocks to Consider

Some other top-ranked stocks worth considering in the industry are ESCO Technologies Inc. (NYSE:ESE) , Emerson Electric Company (NYSE:EMR) and Regal Beloit Corporation (NYSE:RBC) . All these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The earnings estimates of these three stocks improved for both the current year and the next year in the last 60 days. Also, average earnings surprise for the last four quarters was a positive 2.44% for ESCO Technologies, 2.79% for Emerson Electric and 2.88% for Regal Beloit.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

ESCO Technologies Inc. (ESE): Free Stock Analysis Report

Emerson Electric Company (EMR): Free Stock Analysis Report

Rexnord Corporation (RXN): Free Stock Analysis Report

Regal Beloit Corporation (RBC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.