Navistar International Corporation (NAV) is a holding company whose principal operating subsidiaries are Navistar, Inc. and Navistar Financial Corporation (NFC). The Company is a manufacturer of International brand commercial and military trucks, IC Bus (IC) brand buses, MaxxForce brand diesel engines, Workhorse Custom Chassis (WCC) brand chassis for motor homes and step vans, and Monaco RV (Monaco) recreational vehicles (RV), as well as a provider of service parts for all makes of trucks and trailers.

This is a vol note on a company with some valuation changing news of late with front month vol that is truly extraordinary for the company. Further, a research note has come out stating that even given the recent news, the company is worth 2005-300% of its current value in a takeover. Let's start with the news, and then move onto the vols and stock n' stuff n' stuff. First, on 6-7-2012, the stock dropped from $28.15 to $24.11 off of an earnings report. But, the stock actually recovered nicely intraday after it reached its low of $20.11. Here's the news snippet summarizing the earnings results (and stock move):

What: Shares of U.S. truck and engine manufacturer Navistar (NYSE: NAV) are backfiring badly today, with shares down as much as 28% after the company reported a worse-than-expected second-quarter loss.

So what: Today's loss doesn't come as a surprise, as Navistar had cautioned that warranty repairs to engines built in 2010 and 2011 would eat into its bottom line. Unfortunately, the claim the company had made that warranty claims had peaked in March turned out to be false and Navistar reported a loss of $2.50 per share, reversing a $0.93 profit one year ago. Navistar is also waiting for the Environmental Protection Agency to finish its review process of nitrogen oxide emissions in its newer heavy-duty truck engines with no timetable on when that will be completed. Add all of this together and Navistar forecast full-year EPS of breakeven to $2 versus its initial forecast of $5.00 to $5.75 and Wall Street's expectation of $3.73. -- Source: The Motely Fool via Yahoo! Finance; Why Navistar Shares Imploded, written by Sean Williams.

The stock has rallied all the way back above that pre-earnings price, closing at $28.74, Monday. But, note the last part of that Motley Fool article, " Navistar is also waiting for the Environmental Protection Agency to finish its review process of nitrogen oxide emissions in its newer heavy-duty truck engines with no timetable on when that will be completed." Well, it turns out the timetable was yesterday. Here's that news:

6-12-2012: Navistar: Believe that NAV's shares are worth $50-75 per share, if considered as a strategic acquisition - Barrington Research (25.67 -3.12) -Update

Barrington Research says their investment thesis is unchanged following the Q2/12 earnings release and today's negative U.S. Court of Appeals ruling regarding the EPA's interim ruling that allowed NAV to pay NCPs ( http://www.nasdaq.com/article/us-court-tosses-epa-diesel-engine-rule-that-helped-navistar-20120612-00942). Firm says NAV's low valuation and prospects as an acquisition target should support the stock at the current levels. They believe that the EPA final ruling will allow NAV to continue paying NCPs and that the 13L 2010 EPA certification should happen soon. Whatever the time frame, they know that the EPA overhang will continue to impact 2012 profitability and market share, creating uncertainty about NAV's chances for long-term success. Firm says potential synergistic truck buyers like VW or Fiat might go for a takeover to gain a larger share in the North American truck market. -- Provided by Briefing.com (www.briefing.com)

ANALYSIS

The stock is off more than 10% again, after rallying all the way back from the earnings report. Let's take a look at the Charts Tab (six months), below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

On the stock side we can see the drop off of earnings and that very low candlestick reflecting the $20.11 price (intra-day low). We can also see the abrupt recovery back above the earnings price, and yet again, a large drop off of today's news.

On the vol side, we can see how vol actually increased off of the earnings report. That vol rise has continued and is now highly irregular for NAV given it's recent (two year) past. On 6-6-12, NAV IV30™ was trading at 57.36%. Today it's up to 83.78%, or a 46% increase in just six calendar days. To give the current level some perspective, the 52 wk range in IV30™ for NAV is [29.97%, 75.53%], so it's well into a new annual high today. Looking back even further, the 104 wk range (2 year) for IV30™ is [27.51%, 75.53%]. In English, the implied is now trading more than 10% higher than the two-year high. That's a lot of vol...

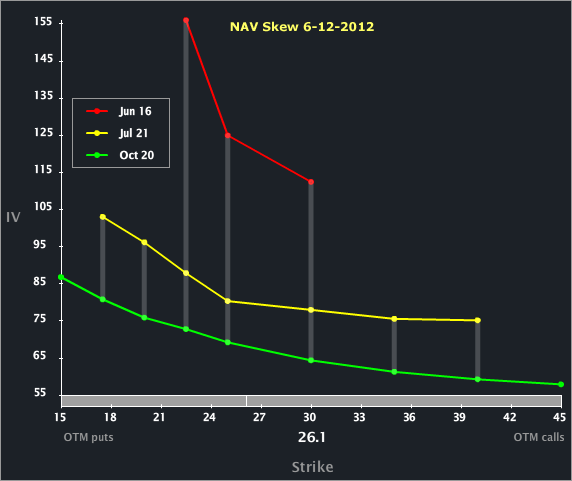

Let's turn to the Skew Tab to examine the line-by-line and month-to-month vols.

Given how quickly news is coming out in this name, it's no wonder that the front month (3.5 trading days left until expiry) is so elevated to the back months. I do note as well that the skew shape in the front month does not show an upside bend, unlike the recent past. In English, before this second bit of news (but after the earnings report), NAV options reflected greater risk (potential) to the upside than the downside. Today, that has changed.

To read about what options skew is, why it exists and what "normal" is, you can read this post: Understanding Option Skew -- What it is and Why it Exists.

SUMMARY

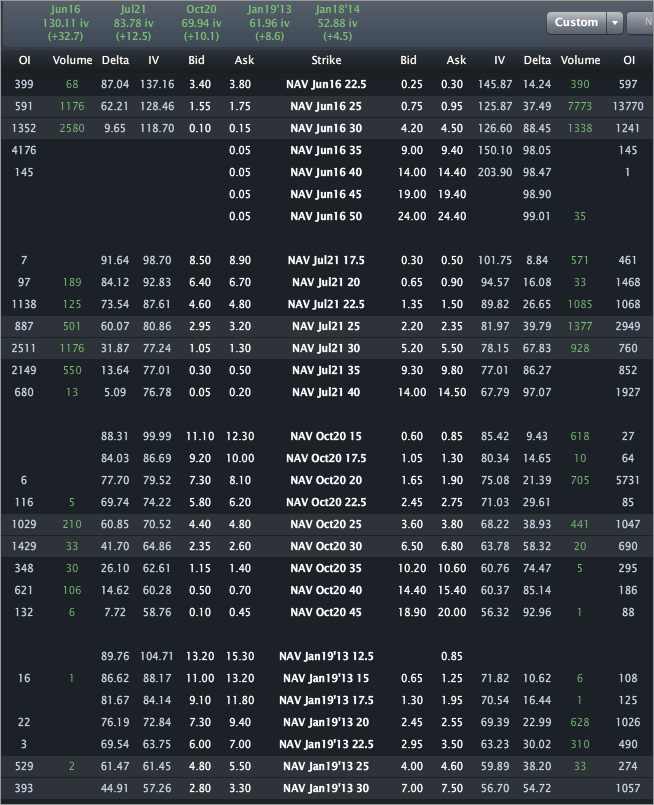

Finally, let's turn to the Options Tab.

We can see the vols by expiry across the top. Note the enormous number in Jun, which is trading at 130.11%, up 32.7 vol points today, alone. Jul and Oct are priced to 83.78% and 69.94%, respectively, yielding over 45 vol points in the front to second month vol spread, and nearly 14 vol points from Jul to Oct. Keeping in mind the implied vol ranges for NAV over the last couple of years, we can see how much risk is priced into the next few days (Jun vol). It's quite extraordinary...

DISCLAIMER: This is trade analysis, not a recommendation.

FULL DISCLOSURE: I am short puts in NAV.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Research Firm Claims Stock Worth 200%-300% More In Takeover

Published 06/13/2012, 05:54 AM

Updated 07/09/2023, 06:31 AM

Research Firm Claims Stock Worth 200%-300% More In Takeover

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.