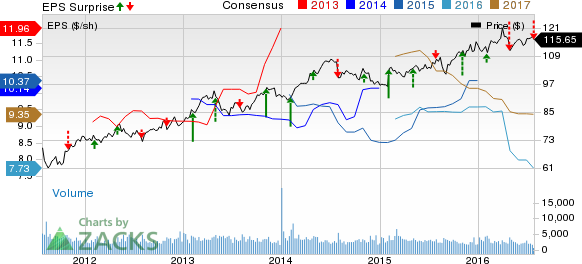

RenaissanceRe Holdings Ltd.’s (NYSE:RNR) second-quarter 2016 operating earnings per share of $1.55 missed the Zacks Consensus Estimate of $2.01 by 22.9%. The bottom line plunged 29% year over year.

The downside can be attributed to a rise in total expense, including claim expenses and underwriting expenses, which offset revenue growth. The Texas hailstorms and the Fort McMurray wildfire were primarily responsible for higher cliam expenses.

Including non-recurring items, the company reported net income of $3.22 per share, up 102% year over year from $1.59 in the year-ago quarter.

RenaissanceRe’s operating revenue of $408 million declined 2.6% year over year on 7.4% lower net premiums earned. The top line also missed the Zacks Consensus Estimate of $419 million by 2.6%.

Underwriting income plunged roughly 31% year over year to $63.6 million, attributable to higher net claims and claim expenses and underwriting expenses driven by catastrophe events. Combined ratio increased 670 basis points (bps) to 81.9%.

Gross premiums written of $1.6 billion jumped 23% year over year.

RenaissanceRe reported total investment result of $123.8 million in the quarter as against $11.3 million a year ago. The improvement was supported by net unrealized gains in fixed maturity investments trading and an increase in net investment income.

During the quarter, RenaissanceRe witnessed a 1.3% year-over-year decline in total expenses to $304 million. This was mainly due to lesser net claims and claim expenses, operational expenses and corporate expenses.

Segment Update

Catastrophe Reinsurance: Gross premiums written were $397.4 million, up 3% year over year.

Underwriting income was $50.6 million, down 23% year over year. Combined ratio increased 480 bps year over year to 64.3%.

Specialty Reinsurance: Gross premiums written were $200 million, up 25% from the prior-year quarter. This was largely due to significant growth in credit and casualty business lines.

Underwriting income came in at $15.4 million as against $22.5 million in the year-ago quarter. Combined ratio increased 330 bps to 88.8%.

Lloyd’s: Gross premiums written were $160.9 million, up 38% from the year-ago quarter. This upside is attributable to solid performance across all business lines under Lloyd.

The Lloyd segment reported an underwriting loss of $2.3 million, narrower than a loss of $5.9 million in the second quarter of 2015. Combined ratio for the quarter was 103.1% compared with 90.4% a year ago.

Financial Position

As of Jun 30, 2016, total asset of RenaissanceRe was $12.5 billion, up from $11.5 billion as of Dec 31, 2015. The company had a total debt burden of $954.6 million as of Jun 30, 2016 compared with $960.5 million as of Dec 31, 2015.

Cash and cash equivalents came in at $455.5 million as of Jun 30, 2016, down from $506.9 million as of Dec 31, 2015. Shareholders’ equity at RenaissanceRe totaled $4.70 billion at the end of the quarter, higher than $4.73 billion at the end of 2015.

RenaissanceRe’s annualized operating return on average common equity or ROCE was 6.1% as of Jun 30, 2016. This represents a decline of 300 bps from Dec 31, 2015.

Tangible book value per common share plus accumulated dividends increased 2.8% year over year to $113.07 in the quarter.

Share Buyback

RenaissanceRe repurchased 1.7 million shares for $187.1 million.

Subsequent to the second quarter through Jul 25, 2016, the company repurchased another 0.3 million shares for $33.1 million.

Zacks Rank

RenaissanceRe currently carries a Zacks Rank #4 (Sell).

Performance of Other Insurers

Among other property and casualty insurers that have reported their second-quarter earnings so far, the bottom line at RLI Corp. (NYSE:RLI) and Progressive Corp. (NYSE:PGR) missed their respective Zacks Consensus Estimates, while First American Financial Corporation’s (NYSE:FAF) earnings beat the same.

RLI CORP (RLI): Free Stock Analysis Report

RENAISSANCERE (RNR): Free Stock Analysis Report

PROGRESSIVE COR (PGR): Free Stock Analysis Report

FIRST AMER FINL (FAF): Free Stock Analysis Report

Original post