- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Mnuchin Mania Adds To Dollar Negativity

The lack of any key U.S. economic data overnight had dealers focused exclusively on the Trump Administration’s trade policy and the signing of the executive order to pull out of the TPP. U.S. fixed income is feeling the stress, with ten year UST leading the charge as the yield toppled from 2.47% to 2.38%. The move on Treasuries has dragged the dollar lower throughout the New York session.

Adding to the negative dollar headline hysteria were comments, late in the New York session, from Treasury Secretary-designate, Steven Mnuchin who reiterated his previous view that “EXCESSIVELY STRONG USD MAY BE NEGATIVE IN SHORT TERM”. The comments all but stuck a dagger into an already reeling greenback and the dollar gapped lower.

Yet at the heart of the debate is the fact that this market is tough to figure out, as key storylines intersect with one another in a baffling way. The fear factor is dominating sentiment as traders are desperately trying to find out if this is merely a glitch in opinion or a broader evaluation of US asset markets. Nonetheless, we are entering some perilous times in capital markets.

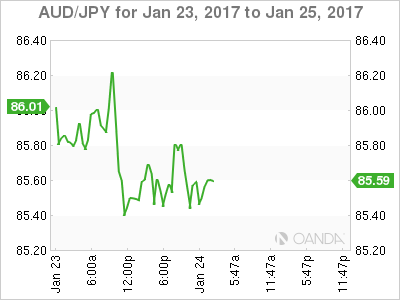

Australian Dollar

The Australian Dollar shot higher on Mnuchin’s comments, and the U.S. dollar market remains very nervous, not only driven by Trump uncertainties, but very unsure of what additional daunting headlines may lie ahead.

The market views U.S. protectionism as negative for the dollar, but given Australia’s strong position in the global supply chain, along with negative implications of possible regional trade disruptions, the AUD underperformed its G10 peers overnight. The Aussie bulls are also holding back, probably due to the slide in Iron ore prices. I think the slowdown in overall trading activity as China nears the lunar new year is a factor, but chatter coming from the Commodity pits suggest that new high–grade supply may also be a trigger for the long Iron ore position unwind.

While external developments dominate price action, local traders are keenly anticipating tomorrow’s CPI release. I do not expect a positive print to have any immediate policy implications, as it would continue to support the bias that the RBA’s next move will be a rate hike and because investors will likely bring forward expectations for interest rate tightening and buy AUD on the print.

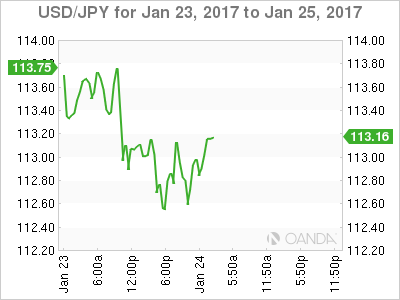

Japanese Yen

Unsurprisingly, Trump trade unwinds were felt first and foremost against the Yen, as US Treasury yields succumbed and with it, the Nikkei floundered. I expect the Nikkei to remain short-term “heavy” after Trump targeted Tokyo and the Japanese auto industry in his trade rhetoric.

We made seven-week lows on USD/JPY this morning, in low liquidity, as traders unwind their blind optimistic view on the USD dollar. However, trying to differentiate between politics and economics is incredibly challenging for dealers, who are accustomed to a more analytical approach to their bias. As such, I expect more confusion and at times, irrationality to dominate market moves. However, with the lack of economic data, traders had tunnel vision on Trump; but with microscopic follow through on USD rallies, dealers continue to probe lower, and may eventually bring the significant 112.15 level into the equation.

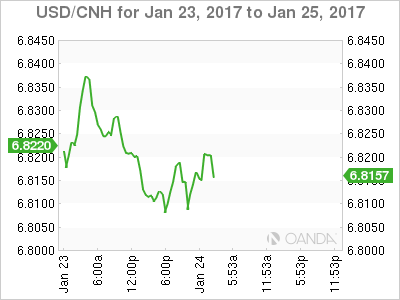

Chinese Yuan

The broader dollar unwinds as the market probes below 6.81 in early APAC trade. However, with China’s most significant holiday nearing, the RMB complex will likely remain in tight ranges.

The Trump effect on the greenback appears all but over, but we should be reminded that the Fed is still relatively hawkish, as the U.S. economy is turning over extremely well. However, given the enormous uncertainties with any current bias, dealers will continue to run day positions, but will have little appetite to build or maintain a longer term view. Look for the current USD whipsaw to remain the name of the game.

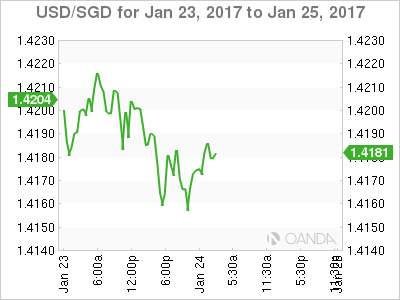

EM Asia

Volatility is still ratcheting higher, and indeed, long USD positioning has tapered significantly since the start of 2017. Moreover, while I expect volatility to remain high, I struggle to find lots of conviction one way or the other in the APAC EM space. While U.S. Economic fundamentals support a strong USD, the shifting US political landscape confuses this view, and I suspect traders will tread lightly in these conditions.

USD Asia appears to be moving lower again, much in line with the broader USD moves. The current emphasis on trade protectionism equals a weaker US dollar, something that is still not entirely clear to me, so look for KRW and the SGD to continue to outperform in the regions.

Related Articles

The Canadian dollar is calm in the European session, trading at 1.4438, up 0.02% on the day. Later today, Canada releases GDP and the US publishes the Core PCE Price...

USD/CAD recoups drop below EMAs as March tariffs become reality Technical indicators suggest quick rebound is fragile; focus on 1.4470 USD/CAD made a strong comeback just when...

In response to criticism of tariff 'confusion', President Trump stepped in emphatically yesterday to announce that tariffs would be going ahead on Canada, Mexico, and China next...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.