- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Reasons Why Investors Should Hold On To SABESP (SBS) Stock

We issued an updated research report on Companhia de Saneamento Basico do Estado de Sao Paulo (NYSE:SBS) or SABESP on Nov 27. The company stands to gain from growing demand for water and sewage services in Brazil, lower costs and expenses and wide coverage area. However, high debt levels and governmental interference remain issues. The company currently has $7.4 billion market capitalization.

SABESP currently carries a Zacks Rank #3 (Hold).

Below we briefly discuss the company’s potential growth drivers and possible headwinds.

Factors Favoring SABESP

Lower Costs & Forex Gains, Share Price Performance: In third-quarter 2017, SABESP’s net income surged 56.9% year over year on the back of 8.5% fall in operating costs and a decline in selling expenses and financial expenses. Favorable impacts of exchange variations also boosted results. Margins improved in the quarter, with gross margin rising 180 basis points (bps) year over year and adjusted earnings before interest, tax, depreciation and amortization margin increasing 550 bps. We believe continuance of such favorable factors in the quarters ahead will be advantageous for the company.

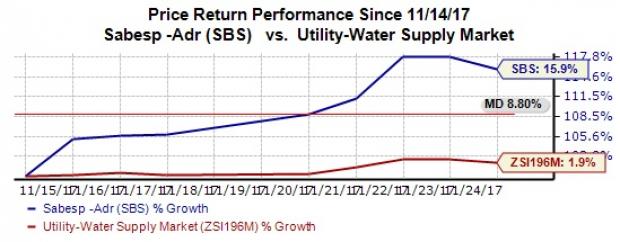

Since the release of third-quarter results on Nov 14, SABESP’s American Depository Receipts have yielded 15.9% return, outperforming 1.9% gain recorded by the industry.

Wide Coverage Area: SABESP is one of the largest water and sewage service providers in the world, serving approximately 24.9 million customers for water and 21.5 million for sewage at third-quarter end. Also, the company covers approximately 66% of the urban population in the state of Sao Paulo and serves 366 of total 645 municipalities.

Promising Long-Term Targets: We believe SABESP’s long-term growth prospects are bright, especially with growing demand for better water and sewage facilities in Sao Paulo. The company aims to add nearly one million new water connections and 1.3 million new sewage connections by 2022.

In addition, the company aims at improving its services through investment of nearly R$13.9 billion from 2017 through 2021. Of the total, roughly R$7.1 billion will be spent on water, R$5.4 billion on sewage collection and R$1.4 billion on sewage treatment. Also, per a 12-year Corporate Program for Reduction of Water Losses, which started in 2009, the company aims at achieving a water loss ratio of 18% by 2020.

Challenges Faced by SABESP

Weakness in Construction Revenues: SABESP’s net operating revenues include the sales generated from construction business. In the third quarter, the company’s net operating revenues declined 5.6% year over year due to 35.1% fall in construction revenues as a result of lower investments in municipalities served. We believe that recurrence of such weakness in construction revenues might be detrimental to the company’s top-line results.

Governmental Interference: Of SABESP’s share capital, roughly 50.3% is owned by the government of Sao Paulo, giving it the power to select the majority of members comprising the board of directors and senior management. Under such circumstances, regulatory uncertainty or delay by the government in taking any decisions pose substantial hindrance. We believe such unwarranted political or governmental interference can jeopardize the company’s future planning and growth prospects.

Huge Debt Level: SABESP is a highly leveraged company, with long-term debt of approximately R$10.5 billion at third-quarter end. Its net debt to equity for the first nine months of 2017 was 0.6x. We believe, if unchecked, such high debt levels can lead to increased financial obligations, posing serious threats to the company’s financial health. In this regard, the company’s plans to fund roughly 26% of its R$13.9 billion investment plan for 2017 to 2021 through institutional financing is worth mentioning.

Earnings Estimates and Stocks to Consider

SABESP’s earnings estimates for 2017 have been revised upward by one analyst while that for 2018 has been lowered by one in the last 30 days. Currently, the Zacks Consensus Estimate for the stock stands at $1.12 for 2017 and $1.19 for 2018, representing growth of 12% and decline of 0.8% from their respective estimates 30 days ago.

Better-ranked stocks in the industry include American States Water Company (NYSE:AWR) , The York Water Company (NASDAQ:YORW) and Global Water Resources, Inc. (NASDAQ:GWRS) . All these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

American States Water’s earnings estimates for 2017 remained stable in the last 60 days while increased for 2018. Also, the company pulled off an average positive earnings surprise of 10.58% in the last four quarters.

The York Water’s performance was better than expected in the third quarter of 2017, with a positive earnings surprise of 10.71%. Its earnings estimates for 2017 and 2018 improved in the last 60 days.

Global Water Resources’ earnings estimates in 2017 improved in the last 60 days while remained stable for 2018. Its financial performance in the last quarter was impressive, with earnings surpassing estimates by 50%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Companhia de saneamento Basico Do Estado De Sao Paulo - Sabesp (SBS): Free Stock Analysis Report

The York Water Company (YORW): Free Stock Analysis Report

American States Water Company (AWR): Free Stock Analysis Report

Global Water Resources, Inc. (GWRS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.