- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

4 Reasons To Add New Oriental (EDU) Stock To Your Portfolio

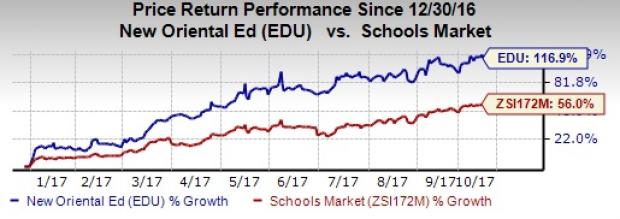

Shares of New Oriental Education & Technology Group Inc. (NYSE:EDU) have lately been riding high. This year, the stock has climbed almost 117% comparing favorably with the 56% growth of the industry it belongs to.

Earnings estimates for New Oriental have exhibited an uptrend, reflecting optimism in the stock’s prospects. Although the Zacks Consensus Estimate for the company’s current-year earnings has remained unchanged over the past 30 days, it has moved up 1.6% for the next year. The positive earnings estimate revision testifies to the confidence that analysts have in the company and substantiates the Zacks Rank #2 (Buy) for the stock.

Let us delve deeper into the other factors which make this Zacks Rank #2 (Buy) stock a lucrative pick.

What Else Makes New Oriental a Solid Pick?

Healthy Growth Prospects

New Oriental is increasing the pace of its learning center network expansion. That said, management remains confident that margins will be unaffected. The company’s strong guidance seems to be encouraging enough keeping in view its expansion plans. Management guided 17-21% year-over-year revenue growth for the first quarter of fiscal 2018 in USD terms and guided between 20% and 24% in Rmb terms. Management also noted that it expects to see an acceleration in revenue growth per quarter for the remainder of fiscal year. Notably, the company’s total enrolment increased 36.9% year over year to 1.42 million students in the last reported quarter.

New Oriental reported a historical (three-five year) earnings per share (EPS) growth rate of 15.7% compared with the industry’s average of negative 1.8%. Moreover, the company is expected to grow at a rate of 29.2% this year, significantly higher than the industry’s average of 11.1%.

Meanwhile, the company’s sales are expected to increase 24.5% in the current year compared with the industry’s average growth of just 0.8%. Hence, New Oriental makes a great pick in terms of growth investment supported by Growth Score of A.

Valuation Looks Rational

New Oriental has a Value Score of B, putting it into the top 40% of all stocks we cover from this perspective.

The stock currently has a trailing 12-month Price/Book (P/B) ratio of 8.4 comparing favorably with the industry’s P/B ratio of 9.91. Hence, its lower-than-market positioning hints at more upside in the quarters ahead.

An often overlooked ratio that can still be a great indicator of value is the price/cash flow (P/CF) metric. This ratio doesn’t take amortization and depreciation into account, so can give a more accurate picture of the financial health of a business. New Oriental has a P/CF of 43.81, lower than the industry’s average of 65.82.

Solid VGM Score

The company flaunts an impressive VGM Score of B. Our VGM Score identifies stocks that have the most attractive value, growth, and momentum characteristics. In fact, our research shows that stocks with VGM Scores of A or B when combined with a Zacks Rank #1 (Strong Buy) or 2 make solid investment choices.

Superior Return on Equity (ROE)

New Oriental has an ROE of 17%, a lot better than the industry average of 14.6%. This shows that the company reinvests its cash more efficiently.

Other Stocks to Consider

A few other top-ranked stocks worth considering in the Consumer Discretionary sector are Prestige Brands Holdings, Inc. (NYSE:PBH) , Vista Outdoor Inc. (NYSE:VSTO) and Genius Brands International, Inc. (NASDAQ:GNUS) , each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Prestige Brands is likely to witness a rise of 11.5% in earnings for the current year.

Vista Outdoor has witnessed an upward earnings estimate revision of 0.8% for the current year, in the past 60 days.

Genius Brands is expected to witness 68.2% growth in 2017 earnings.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Prestige Brand Holdings, Inc. (PBH): Free Stock Analysis Report

Vista Outdoor Inc. (VSTO): Free Stock Analysis Report

New Oriental Education & Technology Group, Inc. (EDU): Free Stock Analysis Report

Genius Brands International, Inc. (GNUS): Free Stock Analysis Report

Original post

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.