- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Raytheon Wins Navy Deal To Repair F/A-18 Jets Radar Systems

Raytheon Company (NYSE:RTN) recently received a contract for the repair of the APG 65/73 radar systems to support the F/A-18 aircraft. Work related to the deal is scheduled to be over by March 2022.

Valued at $18.2 million, the contract was awarded by the Naval Supply Systems Command, Weapon Systems Support, Philadelphia, PA. The deal will be executed in Indianapolis, IN.

Importance of APG 65/73 radar

Raytheon’s APG-73 is an all-weather, coherent, multimode, multiwave form search-and-track sensor. It is an upgrade of the APG-65 that provides higher throughputs, greater memory capacity, improved reliability, and easier maintenance without associated increases in size or weight.

An upgraded version of the APG series radars incorporates a motion-sensing subsystem with reconnaissance software, a stretch waveform generator module, and a special test equipment instrumentation and reconnaissance module. With these enhancements, the F/A-18 aircraft will have the hardware capability to make high-resolution radar ground maps comparable with those of the F-15E and the U-2 aircraft, enabling it to perform precision strike missions using advanced image correlation algorithms.

Raytheon & the Radar Market

Being a renowned radar manufacturer, Raytheon wins a steady flow of contracts involving its combat proven radar and sensor products. In 2019, Raytheon’s Space and Airborne Systems (SAS) unit was selected as a radar supplier for Boeing’s (NYSE:BA) B-52 bomber radar modernization program, to develop and deliver a new active electronically scanned array (AESA) radar. In addition, the U.S. Marine Corps selected SAS’s APG-79(v)4 AESA radar for its F/A-18C/D classic Hornet fleet.

SAS was also awarded a contract by the U.S. Air Force to develop two prototype high-energy laser (HEL) counter-UAS for year-long overseas deployment.

Such notable contract wins reflect the dominant position that Raytheon enjoys in the radar market. The latest contract win is a testament to that.

Looking ahead, per a report by Research and Markets firm, the Global Electronically Scanned Arrays (ESA) market is expected to reach $12.39 billion by 2026, witnessing CAGR of 7.1% from 2018.

Such growth can be attributed to factors like increasing preference for technologically advanced radar for providing all-weather battlefield surveillance against incoming threat, integration of ESA into radar systems and replacement of traditional ESA systems. This, in turn, will further lead to robust demand for its spare parts, components and technical services, bolstering growth prospects of defense contractors like Raytheon in this market.

Price Movement

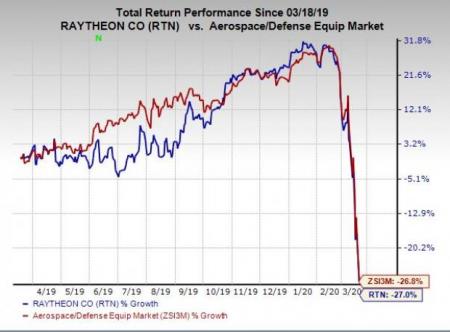

In the past one year, shares of Raytheon have lost 27% compared with the industry’s 26.8% decline.

Zacks Rank & Other Key Picks

Raytheon currently carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the same space are Transdigm Group Incorporated (NYSE:TDG) and AeroVironment, Inc. (NASDAQ:AVAV) , both of which carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AeroVironment delivered a four-quarter earnings beat of 5.72%, on average. It currently has a solid long-term earnings growth rate of 25%.

Transdigm delivered a four-quarter earnings beat of 10.67%, on average. It currently has a solid long-term earnings growth rate of 11.9%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

The Boeing Company (BA): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Transdigm Group Incorporated (TDG): Free Stock Analysis Report

AeroVironment, Inc. (AVAV): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.