- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

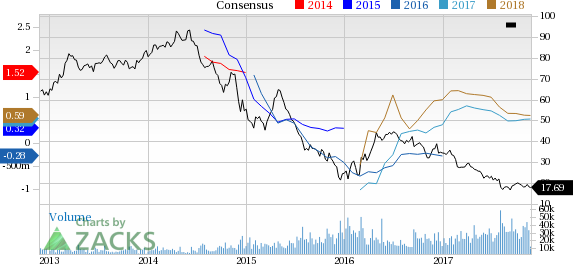

Range Resources (RRC) Down 5.1% Since Earnings Report: Can It Rebound?

A month has gone by since the last earnings report for Range Resources Corporation (NYSE:RRC) . Shares have lost about 5.1% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Third-Quarter 2017 Results

Range Resources reported third-quarter 2017 adjusted earnings of 5 cents per share that surpassed the Zacks Consensus Estimate of 2 cents. The company had incurred a loss of 6 cents in the year-ago quarter.

Total revenue of $482.2 million failed to beat the Zacks Consensus Estimate of $530 million but jumped 17% year over year from $413.2 million.

The third-quarter numbers were supported by an increase in oil and gas equivalent production and price realizations, partially offset by higher expenses.

Operational Performance

The company’s third-quarter production averaged almost 1,986.2 million cubic feet equivalent per day (MMcfe/d). Natural gas made up for 66.6% of the total production, while natural gas liquids (NGLs) and oil accounted for the remaining 33.4%.

Total production volume not only improved 32% from the year-earlier quarter but also beat the Zacks Consensus Estimate of production of 1,983 MMcfe/d. The improvement was aided by the company’s highly successful drilling program.

On a year-over-year basis, oil production increased 59%, while NGL production rose 32%. Moreover, natural gas production jumped 30% year over year.

The company’s total price realization (including the effects of hedges and derivative settlements) averaged $1.82 per Mcfe, up 15% year over year. Of this, NGL prices rose 29% to $8.54 per barrel while crude oil prices fell 3% to $48.46 per barrel, both on a year-over-year basis. Natural gas prices were up 12% year over year to $1.60 per Mcf.

Expenses

Total third-quarter 2017 expenses were $681.9 million, up 45% year over year.

Financials

At the end of the quarter, the company had long-term debt of approximately $3,981.9 million with a debt-to-capitalization ratio of 41.8%. The company incurred expenditures of $305 million in the third quarter for drilling and completion of 35 wells.

Guidance

For the fourth quarter of 2017, the company maintained the estimate of 2.2 billion cubic feet equivalent (Bcfe) per day. With this, the annual output will likely rise 30%.

Range Resources also reiterated the 2017 capital budget at $1.15 billion.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed a downward trend in fresh estimates. There have been three revisions higher for the current quarter compared to four lower.

VGM Scores

At this time, Range Resources' stock has an average Growth Score of C, however its Momentum is doing a bit better with a B. Following the exact same course, the stock was allocated a grade of B on the value side, putting it in the top 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is equally suitable for value and momentum investors.

Outlook

While estimates have been broadly trending downward for the stock, the magnitude of these revisions indicates an upward shift. The stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Range Resources Corporation (RRC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Pretty rough day out there—S&P 500 down about 1.8%, Nasdaq down around 2.2%, and small caps hit even harder, dropping 2.7%. However, the S&P 500 is approaching a crucial...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.