- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Ralph Lauren (RL) Beats Q3 Earnings Estimates, Sales Miss

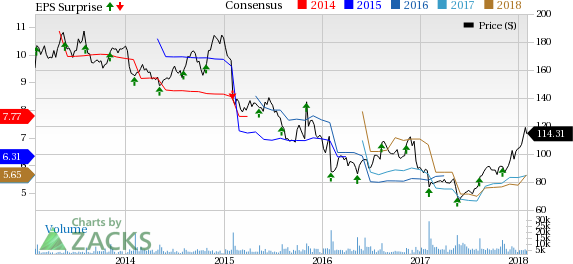

Ralph Lauren Corporation (NYSE:RL) , a designer, marketer and distributor of lifestyle products, released third-quarter fiscal 2018 results, wherein adjusted earnings of $2.03 came ahead of the Zacks Consensus Estimate of $1.87, and climbed 9.1% from $1.86 earned in the year-ago quarter.

Earnings Estimate Revision: The Zacks Consensus Estimate for fiscal 2018 has increased by two cents in the last seven days. Moreover, Ralph Lauren’s performance over the trailing four quarters, excluding the quarter under review, remains encouraging with an average beat of 11.6%.

Revenues: Ralph Lauren’s net revenues dropped 4.2% to $1,641.8 million and also missed the Zacks Consensus Estimate of $1,648 million. On a currency neutral basis, revenues fell 6%. Revenue decline was attributable to the exit of brand, promotional activity and soft consumer demand.

Outlook: The company continues to project currency neutral net revenues to decline 8–9% in fiscal 2018. For fourth-quarter fiscal 2018, management envisions currency neutral net revenue to decrease 8-10%. Foreign currency is estimated to favorably impact the top line growth by nearly 330 basis points (bps) and 100 bps in the fourth quarter and the fiscal, respectively.

Zacks Rank: Currently, Ralph Lauren carries a Zacks Rank #3 (Hold), which is subject to change following the earnings announcement. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stock Movement: Ralph Lauren’s shares are down nearly 7.3% during pre-market trading hours following the earnings release.

Check back later for our full write up on Ralph Lauren’s earnings report!

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Ralph Lauren Corporation (RL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.