Mark Twain once wrote that "History doesn't repeat itself, but it does rhyme." While this is a statement that is often thrown around by the media, economists and analysts - few of them actually heed the warning. It is even a worse case for investors. Over the past 800 years of history we have watched one bubble after the next develop, and bust, devastating lives, savings and, in some cases, entire countries. Whether it has been a bubble created in emerging market debt, rail roads or tulip bulbs - the end result has always been the inevitable collapse as excesses are drained from the system.

On September 6th, 2008 I gave a presentation discussing the December 2007 recession call we had made (NBER officially stated the recession started in December 2007 a full year later) and the potential for a substantial crisis ahead (the market began its collapse one month later.) During the presentation I showed the following slide discussing history and why this time was "not going to be different."

Each previous bubble was predicated on expansion of credit, lax lending policies, inflation, speculation, unique investment opportunity (tulip bulbs), or leverage which ultimately led to speculative fervor. The speculative fervor occurs as the bubble becomes fully developed and sucks the last of the "buyers" into the market creating a vacuum when sellers emerge.

Since that presentation in 2008 many of the predictions that we had made at the time came horrifically true. Today, we once again have to ask ourselves whether the markets are repeating history or if this time is "truly" different? Unfortunately, the answer is most likely "no."

Over the past couple of months the markets have advanced sharply in anticipation of a third round of Large Scale Asset Purchases (LSAP) by the Fed which has become affectionately known as QE3. The Fed delivered not only the expected QE3 program but expanded it by making it an open-ended program that will last until "employment reaches an acceptable level." This is quite a departure from the previous two programs which were finite in nature and has a lofty goal of boosting the economy to boost employment. The problem is that an artificial intervention program of this magnitude leads us once again into the realm of "unintended consequences."

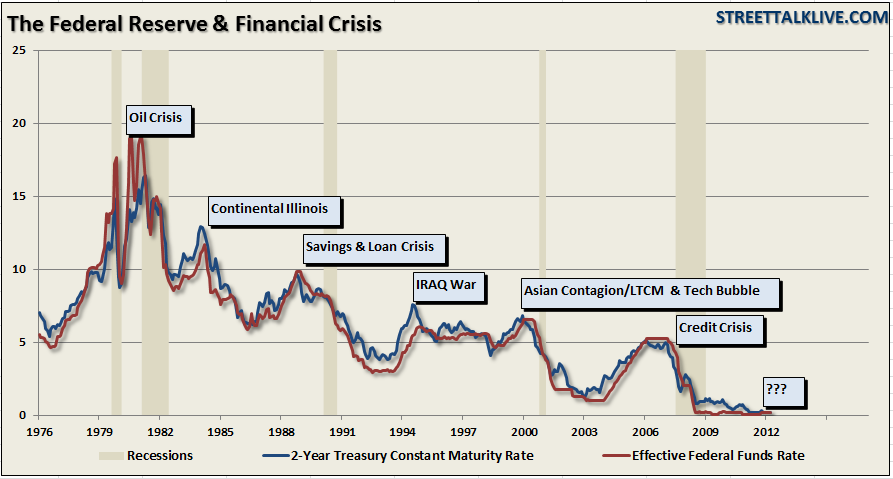

History is replete with examples of interventions that go wrong. The chart below shows the actions by the Federal Reserve in the past and the subsequent "crisis" that those actions bring. What the media misunderstands is that it is the policy of artificially manipulating interest rates that creates the bubble. It is rising interest rates that has historically been the "pin" that popped it.

This is the problem that exists currently. Since the turn of the century the U.S. economy has been subjected to the bursting of the stock market "tech" bubble that was driven by investor fervor followed by the collapse of the real estate bubble created by excessive credit and leverage. Since the end of the last financial crisis the Federal Reserve has remained consistently engaged to try and stabilize the financial system. By injecting trillions of dollars of liquidity into the system the Fed has made a concerted effort to reduce the probability of another financial crisis caused by a freezing of the credit markets. However, in the endeavor to prevent one event they may be creating another.

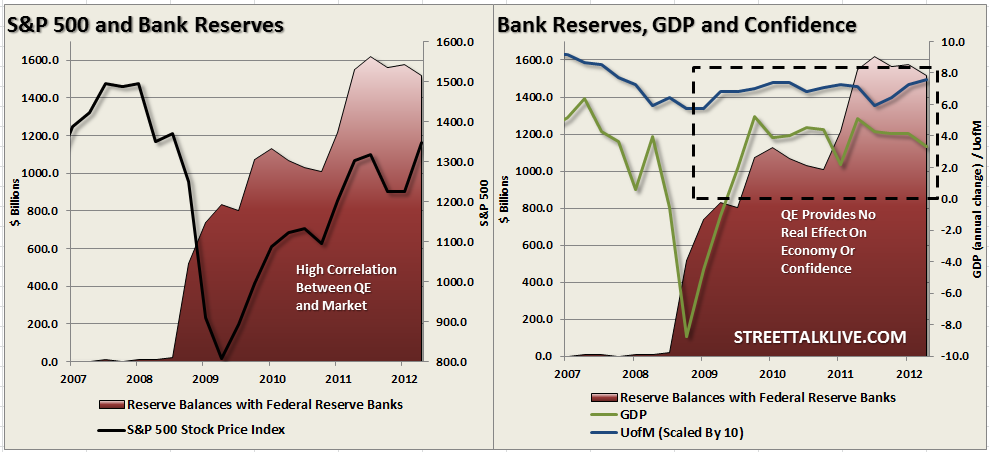

The Federal Reserves goal has been clearly stated that by boosting asset prices consumer confidence will be lifted supporting economic growth. The chart below shows the balance of excess reserves at Federal Reserve banks as compared to the market, consumer confidence and GDP.

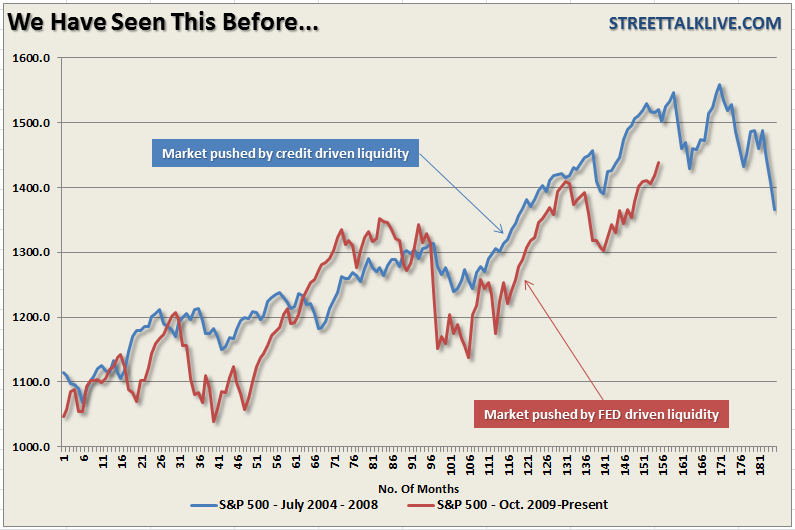

What is evident is that while QE programs have flooded the excess reserve accounts of Federal Reserve banks there is little evidence that it translates to anything other than higher asset prices and a boost to the profitability of the banks through trading activities. These increases to bank liquidity, which is translated into proprietary trading activities that are very profitable for the major banks, is something that we witnessed during the real estate bubble from 2004-2008.

As we stated in our weekly missive: "While no two markets are ever the same – in this case, however, the issuance and repackaging of mortgage debt previously supplied massive liquidity to banks. This liquidity was then funneled into proprietary trading operations which drove markets higher. Today, the Fed is buying the mortgage bonds from the major banks in turn providing excess liquidity which again is funneled to proprietary trading desks. The net result is same." The importance of this is that the Fed was blind to the asset bubble being built in late 2007-2008 just as they will most likely be blinded by a focus on employment to the exclusion of risks building elsewhere in the system.

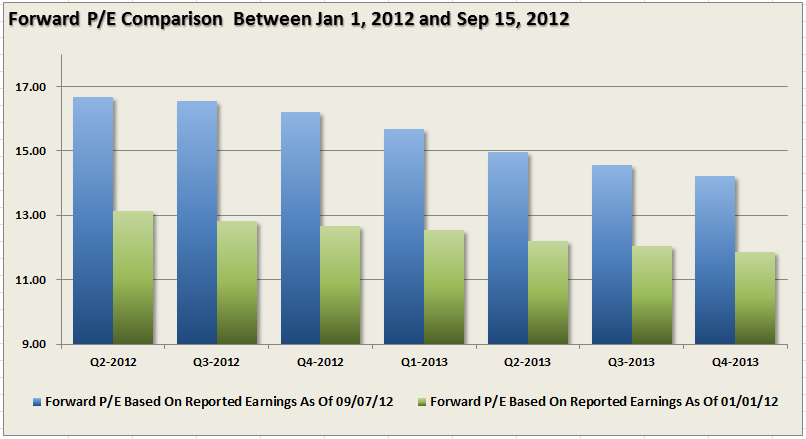

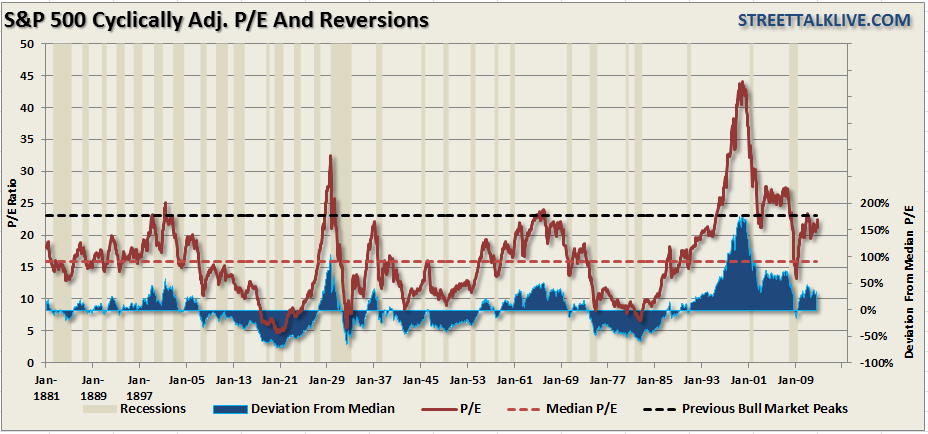

One of the signs of a potentially burgeoning asset bubble in stocks is valuations. As opposed to the previous QE programs where earnings were rising sharply - during the recent market advance leading up to QE3 valuations have risen by more than 2 points as prices advanced in the face of declining earnings. Recent manufacturing and corporate reports are citing the weakness of the continuing recession in the Eurozone now beginning to impact the U.S.

These rising valuations show a clear detachment between price and underlying fundamental and economic realities. The risk to investors is that a liquidity induced stock market rally creates a further disparity between fantasy and reality. It is the disillusionment, as the dream turns into the next nightmare, which devastates market participants.

There has been much commentary about how the market can support higher valuations due to lower interest rates. This is a fallacy of the Greenspan era that has continued to be perpetuated (see full analysis here.) With interest rates artificially suppressed by the actions of the government the theory loses much of its integrity.

The risk that the Fed is running is the creation of another "unrecognized" asset bubble in stocks one again. The chart above shows the Shiller cyclically adjusted P/E based on trailing reported earnings. Historically when P/E's have reached a level of 23x earnings, or greater, it has normally been indicative of the end of a bull market cycle. The major exceptions were the 1929 and 2000 stock bubbles. With valuations currently at 22.5x earnings the stock market, even in a low interest rate environment, are no longer "cheap" by many measures. This puts investors at risk of a sharp decline in equity prices as valuations adjust to the underlying fundamentals.

I am not saying that an asset bubble exists at this particular moment. What I am saying is that Bernanke's folly of thinking that asset purchases that flood Wall Street with liquidity will improve housing, employment or the economy. There is currently no evidence of that. However, there is clear evidence that the continued suppression of interest rates is forcing unwitting investors into chasing yield which can most dangerous to their financial future.

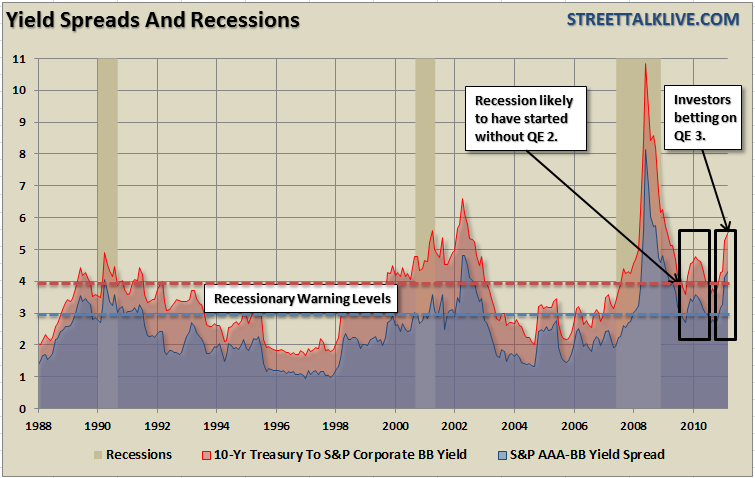

Most likely the markets will push higher in coming months as liquidity floods the system pushing commodity prices and interest rates higher while devaluing the U.S. dollar. This will be great for the major banks trading profits but will impose a harsh tax on the consumer which ultimately impacts aggregate end demand for businesses. It is this degradation of the consumer that will likely push the economy towards the next recessionary drag and is something that yield spreads are already warning of.

While Bernanke has high hopes that QE3 will support the economy long enough for a grid-locked Congress to enact fiscal policy to support the ailing economy. The reality is that we already may be closer to the next asset bubble than we realize.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

QE3 And Bernanke's Folly - Part II

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.