- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Progressive (PGR) Q4 Earnings Surpass, Premiums Grow Y/Y

The Progressive Corp.’s (NYSE:PGR) fourth-quarter 2017 operating earnings per share of 99 cents beat the Zacks Consensus Estimate of 77 cents. The bottom line improved 55% year over year.

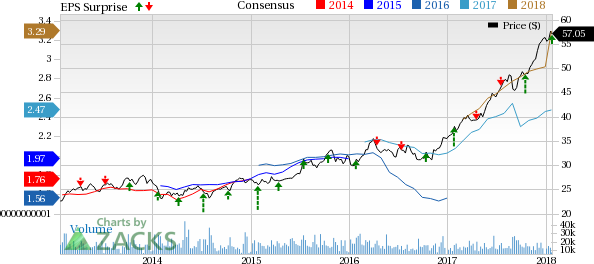

Progressive Corporation (The) Price, Consensus and EPS Surprise

Including net realized losses, net income per share was 98 cents, up 48% year over year.

Behind the Headlines

Progressive recorded net premiums written of $6.8 billion in the quarter under review, up 22% from $5.6 billion in the year-ago quarter. Also, net premiums earned grew 17% year over year to $6.8 billion from $5.9 billion

Net realized loss on securities was $9.7 million, comparing unfavorably with a gain of $22.1 million in the year-ago quarter. Combined ratio — percentage of premiums paid out as claims and expenses — improved 130 basis points (bps) from the prior-year quarter to 91.4%.

Numbers in December 2017

Operating revenues improved 18% year over year to $1.97 billion. This top-line growth was driven by a 40% surge in service revenues, 16% higher fees and other revenues and 17% increase in both premiums and investment income.

Total expense increased 19.6% to nearly $2 billion. This rise in expenses can be primarily attributed to 19.8% higher loss and loss adjustment expenses, 16.5% increase in policy acquisition costs and 22% higher other underwriting expenses.

In December 2017, policies in force were impressive at the Personal Auto segment, improving 13% from December 2016 to 11.7 million. Special Lines inched up 2% from the prior-year month to 4.4 million.

In Progressive’s Personal Auto segment, Direct Auto grew 13% year over year to 6 million while Agency Auto ascended 12% year over year to 5.7 million.

Progressive’s Commercial Auto segment grew 6% year over year to 0.6 million. The Property business had about 1.5 million policies in force in the reported month, up 22% year over year.

Progressive’s book value per share was $15.96 as of Dec 31, 2017, up 16.3% from $13.72 as of Dec 31, 2016.

Return-on-equity on a trailing 12-month basis was 21.7%, having expanded 680 bps from 14.9% in December 2016. Debt-to-total capital ratio contracted 200 bps year over year to 26.3% as of Dec 31, 2017.

Zacks Rank and Performance of Insurer

Progressive carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The bottom line at Brown & Brown, Inc. (NYSE:BRO) , MGIC Investment Corporation (NYSE:MTG) and The Travelers Companies, Inc. (NYSE:TRV) surpassed their respective Zacks Consensus Estimate in the fourth quarter.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

MGIC Investment Corporation (MTG): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.