PPG Industries Inc. (NYSE:PPG) was downgraded by equities research analysts at Goldman Sachs Group (NYSE:GS). from a "buy" rating to a "neutral" rating in a report issued on Thursday, The Fly reports.

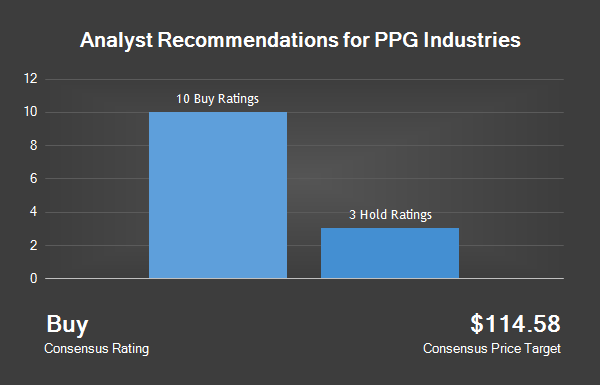

Other research analysts have also recently issued research reports about the stock. Jefferies Group reaffirmed a "buy" rating on shares of PPG Industries in a research report on Wednesday, July 6th. Longbow Research raised shares of PPG Industries from a "neutral" rating to a "buy" rating and set a $130.00 target price on the stock in a research report on Thursday, June 23rd. Credit Suisse (SIX:CSGN) reaffirmed a "buy" rating and issued a $115.00 target price on shares of PPG Industries in a research report on Tuesday, September 13th. Seaport Global Securities raised shares of PPG Industries from an "accumulate" rating to a "buy" rating and upped their target price for the company from $125.00 to $130.00 in a research report on Tuesday, July 26th. Finally, Citigroup (NYSE:C). decreased their target price on shares of PPG Industries from $131.00 to $112.00 and set a "buy" rating on the stock in a research report on Tuesday, October 11th. Five equities research analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company's stock. The company has a consensus rating of "Buy" and an average price target of $115.46.

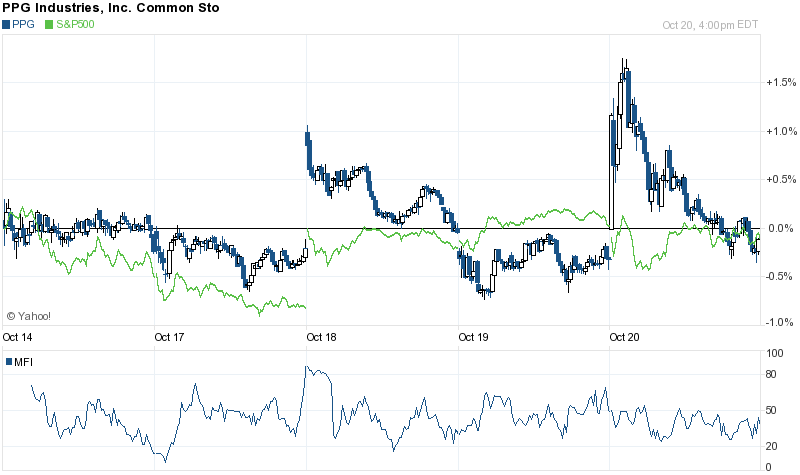

Shares of PPG Industries traded up 0.11% on Thursday, hitting $92.66. 2,411,418 shares of the stock were exchanged. The stock has a market cap of $24.67 billion, a PE ratio of 17.12 and a beta of 1.47. PPG Industries has a 52-week low of $88.37 and a 52-week high of $117.00. The company's 50 day moving average is $100.03 and its 200-day moving average is $105.87.

PPG Industries last announced its quarterly earnings data on Thursday, October 20th. The company reported $1.56 earnings per share (EPS) for the quarter, missing the Zacks' consensus estimate of $1.71 by $0.15. PPG Industries had a net margin of 9.57% and a return on equity of 30.94%. The firm earned $3.80 billion during the quarter, compared to analysts' expectations of $3.83 billion. During the same period in the prior year, the company posted $1.61 EPS. The company's revenue for the quarter was up 1.7% compared to the same quarter last year. Analysts predict that PPG Industries will post $6.17 EPS for the current fiscal year.

The business also recently declared a quarterly dividend, which will be paid on Monday, December 12th. Shareholders of record on Thursday, November 10th will be paid a $0.40 dividend. This represents a $1.60 annualized dividend and a yield of 1.73%. PPG Industries's dividend payout ratio is currently 29.57%.

In other PPG Industries news, insider Viktoras R. Sekmakas sold 40,950 shares of the stock in a transaction that occurred on Tuesday, July 26th. The shares were sold at an average price of $106.64, for a total value of $4,366,908.00. Following the transaction, the insider now directly owns 69,044 shares in the company, valued at $7,362,852.16. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, VP Timothy M. Knavish sold 9,300 shares of the stock in a transaction that occurred on Thursday, August 4th. The shares were sold at an average price of $104.08, for a total transaction of $967,944.00. Following the completion of the transaction, the vice president now owns 11,806 shares in the company, valued at $1,228,768.48. The disclosure for this sale can be found here. 0.68% of the stock is currently owned by company insiders.

A number of institutional investors have recently made changes to their positions in PPG. Vanguard Group Inc. raised its position in shares of PPG Industries by 1.8% in the second quarter. Vanguard Group Inc. now owns 18,091,048 shares of the company's stock valued at $1,884,182,000 after buying an additional 328,358 shares in the last quarter. FMR LLC raised its position in shares of PPG Industries by 2.5% in the second quarter. FMR LLC now owns 16,985,838 shares of the company's stock valued at $1,769,075,000 after buying an additional 409,325 shares in the last quarter. Massachusetts Financial Services Co. MA raised its position in shares of PPG Industries by 0.9% in the second quarter. Massachusetts Financial Services Co. MA now owns 15,989,847 shares of the company's stock valued at $1,665,343,000 after buying an additional 139,886 shares in the last quarter. State Street Corp (NYSE:STT) raised its position in shares of PPG Industries by 3.3% in the first quarter. State Street Corp now owns 11,616,213 shares of the company's stock valued at $1,295,100,000 after buying an additional 368,260 shares in the last quarter. Finally, BlackRock Institutional Trust Company N.A. raised its position in shares of PPG Industries by 1.9% in the second quarter. BlackRock Institutional Trust Company N.A. now owns 6,977,963 shares of the company's stock valued at $726,755,000 after buying an additional 132,813 shares in the last quarter. Institutional investors own 73.01% of the company's stock.

PPG Industries Company Profile

PPG Industries, Inc (PPG) manufactures and distributes a range of coatings, specialty materials and glass products. PPG operates through three business segments: Performance Coatings, Industrial Coatings and Glass. The Performance Coatings segment consists of the refinish, aerospace, protective and marine, architectural-Americas and Asia Pacific, and architectural-EMEA coatings businesses.