PPG Industries’ (NYSE:PPG) said that it is seeing sustained growth for its chrome-free corrosion-inhibiting aerospace sealant. Aircraft makers and maintenance, repair and overhaul shops reported that the product surpassed their process and performance expectations.

PRC PR-2870 sealant has set a new standard by which other corrosion-inhibiting sealants are measured. According to customers, PR-2870 sealant provides superior corrosion protection in a chrome-free formulation that complies with European Union REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation.

PR-2870 sealant classes can combat corrosion faster. This enables customers to seal parts faster and move them through the process quickly. Lighter weight sealants also improve operating efficiencies of aircraft.

The sealant is available in three classes. Classes A and B weigh 30% less by volume. The Class C sealant PR-2870 comes with roller application and is now available with 48-hour application and assembly time for large, complex aircraft structures.

PR-2870 Class C sealant combats corrosion 70% faster than conventional interfay sealants at ambient conditions. This reduces the cycle time to offer aircraft manufacturers and maintainers the potential for cost savings. The sealant also provides the long work life and the assembly time required for structural assembly.

PR-2870 sealant uses PPG-patented technologies to prevent corrosion on metal in aerodynamic smoothing, structural surface sealing, fay sealing and pressure fuselage sealing aircraft applications.

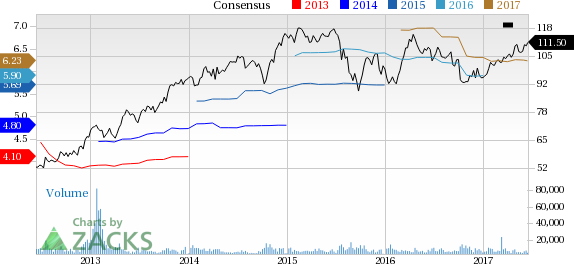

PPG Industries has outperformed the Zacks categorized Chemicals-Diversified industry over the past three months. The company’s shares have moved up around 7.6% over this period, compared with roughly 3.8% gain recorded by the industry.

The company has a diversified business, both in terms of products offered and geographical presence. The company’s strong presence in emerging regions has enabled it to deliver growth to shareholders by tapping opportunities there. PPG Industries is also taking initiatives to expand its business through acquisitions.

PPG Industries has announced certain restructuring measures to lower its cost structure globally. Special emphasis will be put on regions and end-use markets with the weakest business. The restructuring actions are expected to deliver $120–$130 million in annual savings, with $40–$50 million of savings expected to be realized in 2017.

PPG Industries is however, exposed to unfavorable currency exchange translation. The company also continues to face macroeconomic challenges. The company’s operating results are also exposed to the cost of raw materials and energy.

PPG Industries, Inc. Price and Consensus

Zacks Rank & Key Picks

PPG Industries currently carries a Zacks Rank #3 (Hold).

Some top-ranked companies in the chemical space include BASF SE (OTC:BASFY) , The Chemours Company (NYSE:CC) and Kronos Worldwide Inc (NYSE:KRO) . All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BASF has expected long-term growth of 8.6%.

Chemours has expected long-term growth of 15.5%.

Kronos has expected long-term growth of 5%.

3 Stocks to Ride a 588% Revenue Explosion

At Zacks, we're mostly focused on short-term profit cycles, but the hottest of all technology mega-trends is starting to take hold...

By last year, it was already generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. See Zacks' Top 3 Stocks to Ride This Space >>

PPG Industries, Inc. (PPG): Free Stock Analysis Report

BASF SE (BASFY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

Zacks Investment Research