- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Pioneer Natural (PXD) Q4 Earnings Beat, Reserves Increase

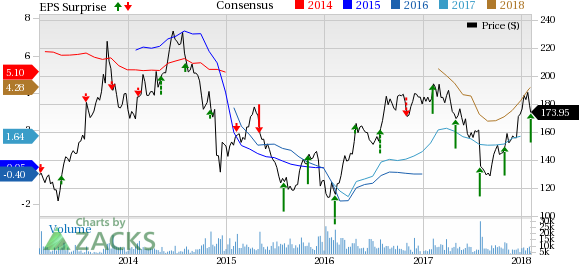

Pioneer Natural Resources Company (NYSE:PXD) reported fourth-quarter 2017 earnings, excluding one-time items, of $1.22 per share. The bottom line beat the Zacks Consensus Estimate of 76 cents. Notably, the company posted adjusted earnings of 49 cents per share in the year-earlier quarter.

Revenues and other income in the quarter improved 30.6% year over year to $1,526 million from $1,168 million. However, the top line lagged the Zacks Consensus Estimate of $1,716 million.

Higher oil and liquids price realizations and production along with Spraberry/Wolfcamp horizontal drilling program drove fourth-quarter results.

Dividend

Pioneer Natural raised dividend by 300% to 16 cents per share from 4 cents. The dividend is payable on Apr 12 to stockholders of record at the close of business on Mar 29.

Production

Total production in the reported quarter averaged approximately 305 thousand barrels of oil equivalent per day (MBOE/d), up 26.1% year over year and surpassed the Zacks Consensus Estimate of 298 MBOE/d. The upside can be attributed to the Spraberry/Wolfcamp horizontal drilling program.

Oil production averaged 179.7 thousand barrels per day (MBbl/d), up 25.8% year over year and surpassed the Zacks Consensus Estimate of 176 MBbl/d. Natural gas liquids (NGLs) production jumped 41% year over year to 62.4 MBbl/d and came above the Zacks Consensus Estimate of 60 MBbl/d. Natural gas productions increased to 377.1 million cubic feet per day (MMcf/d) from the year-ago level of 328.5 MMcf/d and beat the Zacks Consensus Estimate of 298 MBOE/d.

Price Realization

On an oil equivalent basis, average realized price was $38.68 per barrel in the reported quarter against $33.84 a year ago and surpassed the Zacks Consensus Estimate of $37.69. The average realized price for oil was $52.81 per barrel compared with $46.13 in fourth-quarter 2016 and higher than the Zacks Consensus Estimate of $51.

Average natural gas price declined 2.3% year over year to $2.53 per thousand cubic feet (Mcf) and lagged the Zacks Consensus Estimate of $2.64. Natural gas liquids were sold at $21.64 per barrel, up from the $16.76 in the year-ago quarter but below the Zacks Consensus Estimate of $22.15.

Cash, Debt and Capex

At the end of the quarter, cash balance was $896 million. Long-term debt was $2,283 million, which represents debt-to-capitalization ratio of 16.8%.

Capital Outlay

For 2018, Pioneer Natural intends to spend $2.9 billion. Of this, the company will allocate $2.65 billion for drilling and completion and $260 million for water infrastructure, vertical integration and field facilities.

An amount of $2.63 billion has been allocated for the Permian Basin and $20 million for other assets.

Guidance

Pioneer Natural expects production between 304 MBOE/d and 314 MBOE/d in the first quarter of 2018. For first quarter, the company expects production costs in the range of $7-$9 per BOE. General and administrative expenses are expected in the range of $80-$85 million.

Proved Reserves

As of Dec 31, 2017, total proved reserves for the company was 985 million barrels of oil equivalent (MMBOE) compared with 726 MMBOE as of Dec 31, 2016.

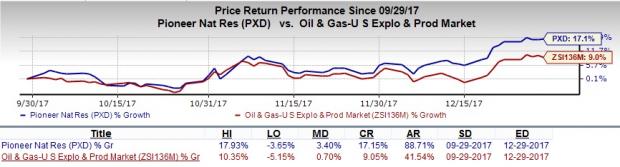

Q4 Share Performance

During the fourth quarter, Pioneer Natural outperformed the industry. The company’s shares gained 17.1% compared with the industry’s rally of 9%.

Zacks Rank & Other Stocks to Consider

Pioneer Natural sports a Zacks Rank #1 (Strong Buy).

A few other top-ranked players in the same sector are EOG Resources (NYSE:EOG) , Statoil (OL:STL) ASA (NYSE:STO) and Devon Energy (NYSE:DVN) . All these stocks flaunt a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Houston, TX-based EOG Resources is a major independent oil and gas exploration and production company. The company delivered an average positive earnings surprise of 40.94% over the preceding four quarters.

Statoil, based in Norway, is a major international integrated oil and gas company. The company delivered an positive earnings surprise of 13.64% in the preceding quarter.

Devon Energy, based in Oklahoma City, is an independent energy company engaged primarily in the exploration, development and production of oil and natural gas. The company delivered a positive earnings surprise of 13.77% in the preceding quarter.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Statoil ASA (STO): Free Stock Analysis Report

Devon Energy Corporation (DVN): Free Stock Analysis Report

Pioneer Natural Resources Company (PXD): Free Stock Analysis Report

EOG Resources, Inc. (EOG): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.