- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

PDL BioPharma (PDLI) Misses On Q4 Earnings, To Dissolve By Year-End

PDL BioPharma, Inc. (NASDAQ:PDLI) reported earnings of 2 cents per share (including the impact of stock-based compensation expense) in the fourth quarter of 2019, missing the Zacks Consensus Estimate of 5 cents. The bottom line was also lower than the year-ago earnings of 10 cents.

The company reported total revenues of a negative $5.8 million in the quarter against the positive $46 million generated in the prior year. The negative revenues were due to a change in the fair value of royalty rights for the type II diabetes products acquired from Assertio Therapeutics (NASDAQ:ASRT) .

Notably, along with the earnings release, PDL announced a plan to dissolve the company by the end of the ongoing year. The monetization of the assets is currently underway and the company targets to file a certificate of dissolution under the Delaware Law by 2020 end.

Shares of PDL were down 2.3% in after-hours trading on Wednesday following the above news. In fact, the stock has lost 12.6% in the past year compared with the industry’s decrease of 12.1%.

Quarter in Detail

Product revenues in the quarter were $21 million, down 19.3% year over year. The same included $12.4 million from the sales of Noden products, namely Tekturna and Tekturna HCT, and another $8.5 million from the sales of LENSAR laser system in the United States.

Notably, revenues from LENSAR laser system increased 19% year over year and also 4.9% sequentially. Per the company, the majority of its top-line growth was owing to revenues recognized from the ex-U.S. markets. Additionally, in the fourth quarter, LENSAR procedure volume surged 41% year over year.

On the conference call, management stated that the branded Tekturna and its authorized generic version captured 73% market share in the United States at the end of the reported quarter, remaining flat sequentially. In March 2019, the authorized generic version of Tekturna (150 mg/300 mg tablets) hit the market in the United States.

During the fourth quarter, PDL recognized negative revenues of $26.8 million from royalty rights against the positive $19.1 million revenues reported in the prior-year period.

As of Dec 31, 2019, PDL had cash, cash equivalents, marketable securities worth $193.5 million compared with $294.3 million as of Sep 30, 2019.

Full-Year Results

PDL generated revenues of $54.8 in 2019, plunging 72.3% year over year.

Liquidation Updates

We remind investors that in December 2019, PDL completed the strategic review process, which was initiated in September. The company decided to halt the execution of its growth strategy, cease additional investments and seek value by monetizing the assets as well as returning net proceeds to its shareholders.

Per the company, last month, PDL’s board of directors approved a formal plan of complete liquidation and passed a resolution to seek stockholder approval at its next annual stockholders' meeting to dissolve the company under the Delaware state law.

Moreover, PDL engaged financial advisors to evaluate the sale of its holdings in Evofem Biosciences, Inc. (NASDAQ:EVFM) common stock, its portfolio of royalty assets plus its Noden and LENSAR subsidiaries.

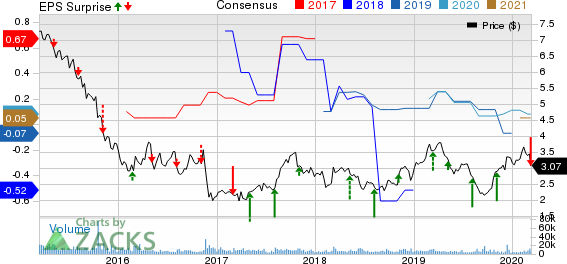

PDL BioPharma, Inc. Price, Consensus and EPS Surprise

Zacks Rank & Key Pick

PDL currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the biotech sector is Aduro Biotech, Inc. (NASDAQ:ADRO) , which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Aduro’s loss per share estimates have been narrowed 16.3% for 2020 over the past 60 days.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

PDL BioPharma, Inc. (PDLI): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Neothetics, Inc. (EVFM): Free Stock Analysis Report

ASSERTIO THERAPEUTICS, INC (ASRT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.