- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

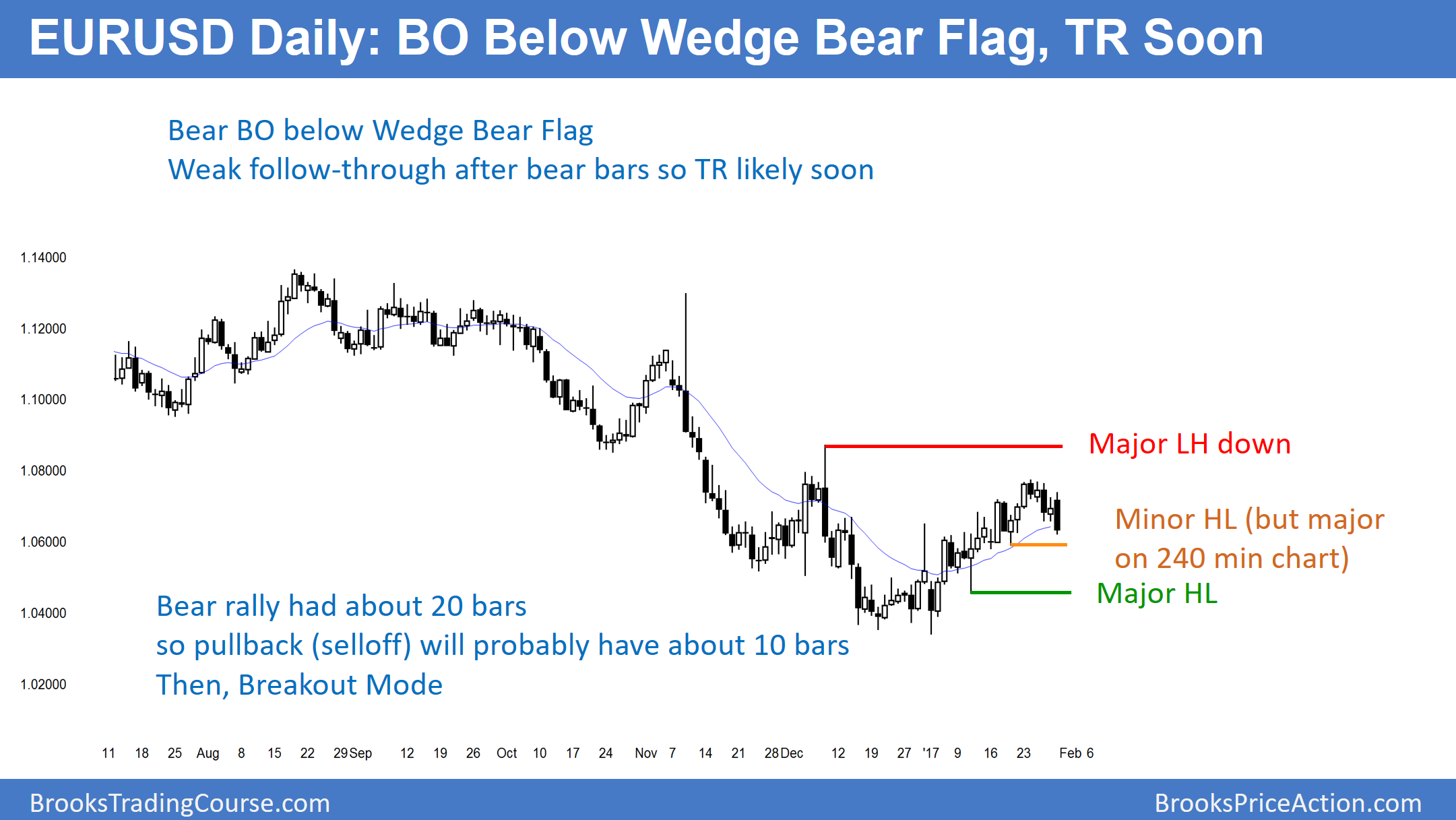

EUR/USD: Wedge Bear Flag

The daily EUR/USD Forex chart has been in a trading range for 3 months. While it has sold off for 5 days below a wedge bear channel, each of the 3 bear bars led to a bull bar. Targets are the higher lows below.

The EUR/USD daily chart failed to break above the December 8 major low high. It has sold off below the wedge bear flag for the past 5 days. Traders therefore expect a test of support. Hence, the January 19 higher low of 1.0588 is the next target.

Since wedge bear channels usually correct down in about half as many bars as they rallied, this selloff will probably last about 2 weeks. Furthermore, wedge channels usually evolve into trading ranges. Therefore, the odds are that the selloff will bounce at a major higher low, like the January 11 low of 1.0453. In addition, a wedge rally has 2 sided trading. It the selloff therefore usually leads to a trading range. Hence, the daily EUR/USD daily chart is probably in a bear leg of what will become a trading range over the next month.

Wednesday’s FOMC Announcement

Wednesday’s FOMC announcement has the potential to be a big surprise. This is because there is a consensus that the Fed will raise rates slowly, and this is probably wrong. Since the monthly bond market has a clear major top, interest rates will probably rise for the next 20 years. Yet, no one talks about this. Once traders discover this, and they will at some point in the next year or two, the dollar will strengthen. Therefore, the EURUSD will probably get down to par (1.0000), and possibly lower.

Because of Wednesday’s uncertainty, the EUR/USD will probably enter a narrow range until the announcement. This is consistent with what the chart appears to be doing.

Overnight EUR/USD

The EUR/USD Forex market sold off more than 100 pips overnight. Because the month long rally had bar follow-through buying on the way up and this selloff on the daily chart lacked strong follow-through selling on the way down, the odds are that this is a bear leg in what will be a trading range for the next month. Yet, the overnight selling was strong enough so that the best the bulls will probably get today is a trading range.

Because this selloff is probably part of a trading range on the 240-minute and daily charts, traders will buy breakouts below prior lows. Hence, there will be some buying here below Thursday’s low. Yet, the momentum down overnight was strong. Therefore the buying will probably halt the overnight selling, but not reverse the market into a bull trend.

Related Articles

The Canadian dollar is calm in the European session, trading at 1.4438, up 0.02% on the day. Later today, Canada releases GDP and the US publishes the Core PCE Price...

USD/CAD recoups drop below EMAs as March tariffs become reality Technical indicators suggest quick rebound is fragile; focus on 1.4470 USD/CAD made a strong comeback just when...

In response to criticism of tariff 'confusion', President Trump stepped in emphatically yesterday to announce that tariffs would be going ahead on Canada, Mexico, and China next...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.