- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

One Big, Potential Catalyst For Gold In 2018

The rebound in the precious metals sector continues. Friday, gold pushed to another new high, near $1340/oz. Gold stocks led by the HUI Gold Bugs Index and VanEck Vectors Gold Miners (NYSE:GDX) also made a new high with juniors and silver right behind. The greatest traders say the move comes first and then the reason later. When it comes to gold we are always analyzing the reason behind the moves so we can distinguish between reactions and reflex moves and those moves that are part of a real bull market. The market may be starting to sniff out a potential big catalyst for gold that could drive its breakout in 2018.

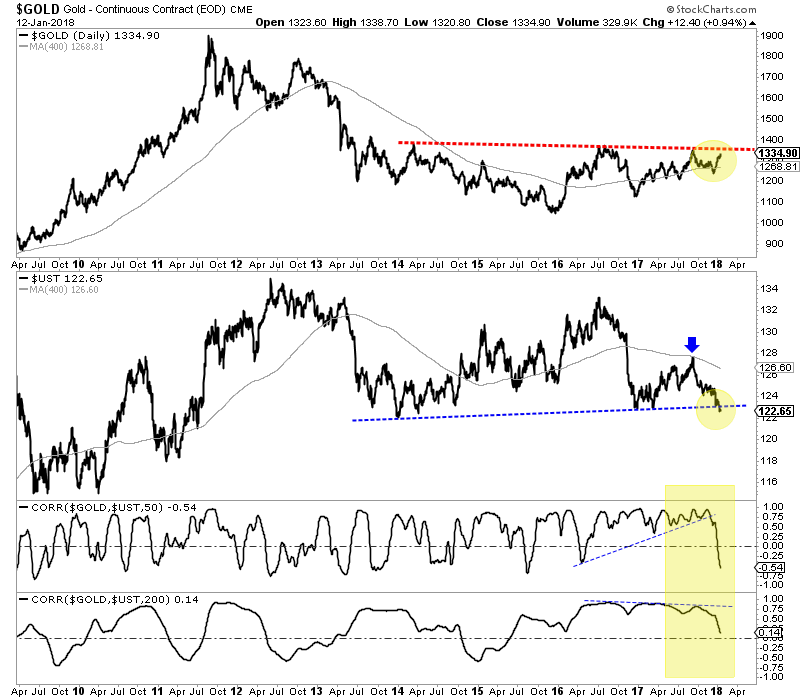

With respect to gold and bonds an important change has taken place in recent months. The two asset classes had been positively correlated. When rates declined, gold moved higher. When rates rebounded, gold struggled. That is what happens when inflation is low and not trending. However, now we see long-term bonds (specifically the 10-year bond) moving towards a breakdown while gold is not far from a breakout. Look at the rolling 50-day and 200-day correlations at the bottom of the chart.

As we’ve written in the past, higher long-term yields are bullish when they rise faster than short-term yields. That is a steepening of the yield curve and indication of inflation.

At present, higher long-term rates could help bid gold in a few different ways. First, for those who are seeking income they enhance the appeal of bonds relative to stocks. Second and more importantly, higher long-term rates will hurt what is an over-indebted economy and government at some point. Debt payments rise. Credit growth can slow. The threshold of that remains to be seen. Perhaps it could be 3.00% on the 10-year yield.

It is counterintuitive but upward pressure on long-term rates can be very bullish for gold (in the present environment) as it necessitates the need for lower or stable long-term rates (amid an inflationary environment). It all comes back to debt. At some point rising rates negatively impact the economy and the government’s balance sheet. If that creates the need for central bank intervention and monetization while inflation is running then that is what can push gold to $2000-$3000/oz in the next several years.

The looming, potential breakdown in long-term bonds could be a major catalyst for the breakout in precious metals. Don’t wait too long, as gold stocks remain historically and incredibly cheap. Select junior miners and explorers have the chance to be 5-10 baggers if gold breaks resistance and trends towards its 2011 high. We seek the juniors that are trading at reasonable values but have fundamental and technical catalysts that will drive increased buying.

Related Articles

The silver market is forecast to record a fifth straight market deficit in 2025, with demand once again outstripping supply, and the majority of the existing above ground silver...

Trumping Brent Oil Futures. Oil got Trumped and dumped. While many people feared that President Trump aggressive trade negotiations would raise the price of oil, so far oil has...

Upon analysis of the wobbly moves since Tuesday, when the natural gas futures tested the two-year high at $4.55, Thursday might be a cozy one, as the inventory announcements after...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.