- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Olive Garden & Fine Dining To Drive Darden's (DRI) Q3 Earnings

Darden Restaurants, Inc. (NYSE:DRI) is scheduled to report third-quarter fiscal 2020 results on Mar 19. In the last reported quarter, the company delivered a positive earnings surprise of 4.7%. Notably, the company has a trailing four-quarter positive earnings surprise of 2.7%, on average.

Estimate Revision

The Zacks Consensus Estimate for fiscal third-quarter earnings is pegged at $1.87, down by a penny in the past seven days. This indicates an improvement of 3.9% from $1.80 per share in the year-ago quarter. The consensus mark for revenues is pegged at $2,322 million, suggesting growth of 3.4% from the prior-year quarter.

Factors to Note

Robust performance of Darden’s Olive Garden, Fine Dining, LongHorn Steakhouse and Other business is likely to get reflected in the fiscal third-quarter results. The Zacks Consensus Estimate for sales at Olive Garden, Fine Dining and LongHorn Steakhouse is pegged at $1,156 million, $190 million and $507 million, indicating growth of 2.3%, 8.9% and 4.9% year over year, respectively. Moreover, the same for Other segment stands at $479 million, suggesting growth of 4.4% from the prior-year quarter.

Olive Garden’s second-quarter fiscal 2020 marked 21st consecutive quarter of positive comps and the trend is likely to have continued in the to-be-reported quarter. The company’s focus on strengthening its in-restaurant execution through investments in quality and simplification of operations is likely to have driven the fiscal third-quarter performance.

However, high labor costs are likely to have weighed on the company’s margin in the quarter to be reported. Further, the non-franchised model makes it susceptible to increased expenses.

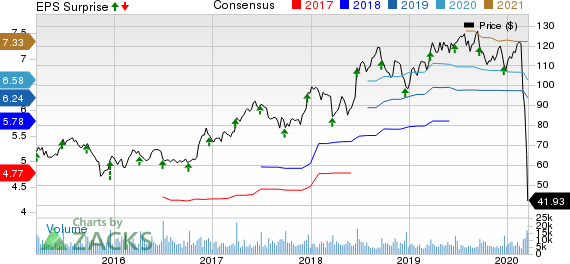

Darden Restaurants, Inc. Price, Consensus and EPS Surprise

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Darden Restaurants this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

The company has an Earnings ESP of -0.17% and a Zacks Rank #4 (Sell). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Peer Releases

Chipotle Mexican Grill, Inc. (NYSE:CMG) reported fourth-quarter 2019 results, wherein both earnings and revenues surpassed the respective Zacks Consensus Estimate. The company’s adjusted earnings of $2.86 per share beat the Zacks Consensus Estimate of $2.74. The bottom line also improved 66.3% from the year-ago quarter, driven by increased revenues and strong operating margins. Quarterly revenues of $1.4 billion outpaced the consensus mark by 2.7% and improved 17.6% year over year.

Starbucks Corp. (NASDAQ:SBUX) reported mixed first-quarter fiscal 2020 results, wherein the bottom line surpassed the Zacks Consensus Estimate but the top line missed the same. In the quarter under review, adjusted earnings of 79 cents per share beat the consensus mark of 76 cents and improved 5.3% on a year-over-year basis. Total revenues came in at $7,097.1 million, marginally missing the Zacks Consensus Estimate of $7,100 million.

McDonald's Corp. (NYSE:MCD) reported fourth-quarter 2019 results, wherein both earnings and revenues surpassed the Zacks Consensus Estimate after missing the same in the preceding quarter. Adjusted earnings came in at $1.97 per share, which beat the consensus mark by a penny. However, the bottom line was flat with the prior-year quarter figure. In the fourth quarter, revenues of $5,349 million beat the Zacks Consensus Estimate of $5,300 million. Moreover, the figure improved 4% year over year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Starbucks Corporation (SBUX): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Darden Restaurants, Inc. (DRI): Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.